In a post-COVID world we have seen dramatic changes in the way customers pay, from the further shift towards a cashless society to a digital revolution in e-commerce payments. As we look forward, we see these trends accelerating and new payments rails emerging, says Accenture, in a company’s blog.

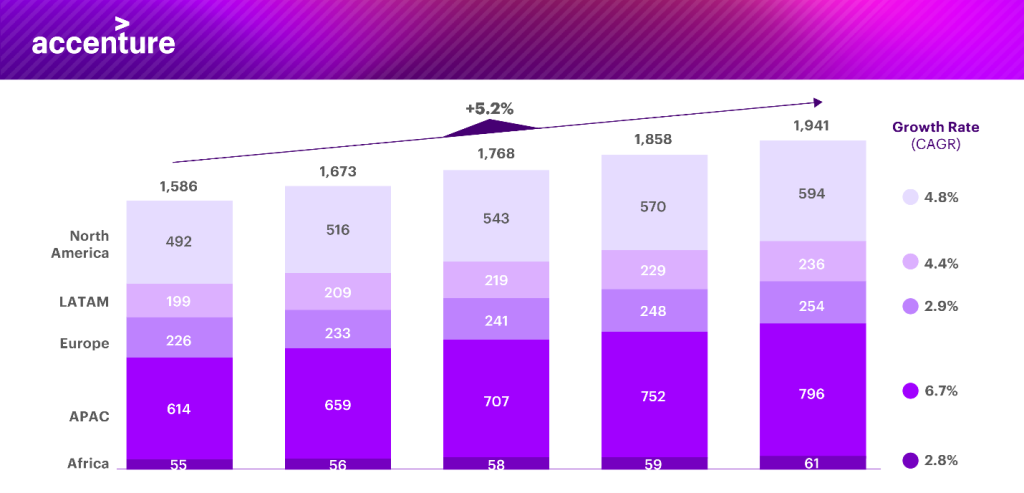

Based on Accenture’s proprietary Global Payments Revenue forecasts, APAC is expected to see the strongest payment growth at 6.7% year over year, whilst the global average is only 5.2%. This is to be expected as APAC moves to cashless payments; however, the countries in the region are also pressing ahead with innovations the rest of the world has yet to adopt. For example, WeChat and AliPay have exploded in popularity by bundling social media, marketplaces, and financial services in digitally mature markets.

Global Payments Revenue Forecast (USD Bn)

Competition from the new and innovative payments players is getting stronger in all the markets. Banks can feel the heat from the payments scale-ups due to the migration of some of the traditional payments customers.

Accenture analysis suggests that digital players such as PayPal and Square have outperformed UK banks in terms of total return to shareholders (TRS) by an impressive 12 times since 2016. Payment processors such as Visa and Mastercard, for comparison, achieved 2.6 times the TRS of UK banks over the same period. Even the processor business model is under threat as faster payments rails mount a credible challenge to the dominance of cards.

The future of the payments landscape is hard to predict. Will account-to-account payments replace traditional card rails? Will central bank digital currencies (CBDCs) replace the role of payment intermediaries? What new use cases will this unlock for merchants? Only time will tell how far these innovations go, but the cost of inaction is likely to increase due to the simple fact that if payment providers don’t innovate, new global fintechs will.

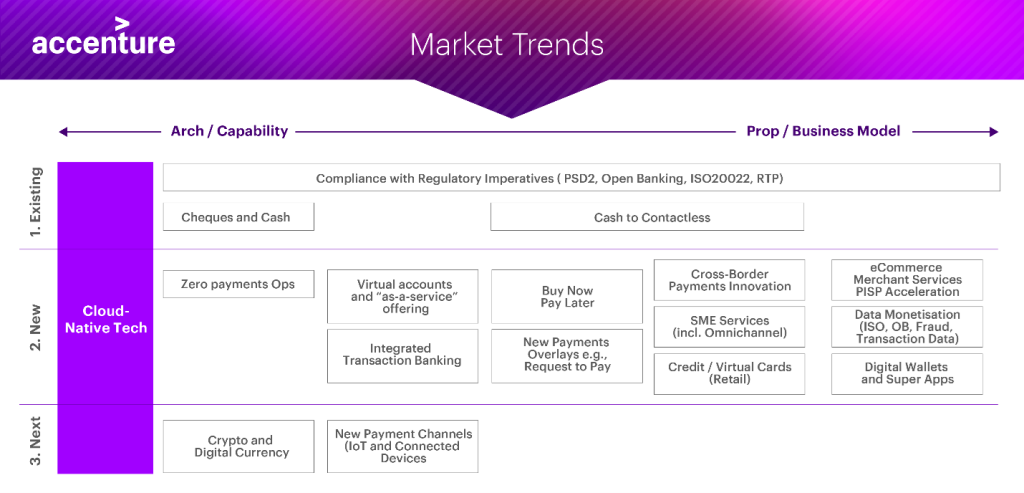

You can think of relevant payments disruption in three waves: ‘existing’, ‘new’ and ‘next’. While we’re about to take a closer look at each of them, it’s important to remember that these phases cannot be viewed independently. For instance, if payment providers do not address existing regulatory imperatives, there will be no license to operate when addressing new value levers. Likewise, if customer acquisition is not increased through payments innovations that address customer needs, payment providers won’t have a seat at the table to test new use cases that enable the next wave of growth.

Payment Themes: Existing, New and Next

1. Existing

PSD2 in Europe is over two years old now. User journeys have improved in that time and some of the players have invested millions to solve for the new pain points. While the scale of Open Banking has increased, payments remains a fraction of total Open Banking volumes. In July of this year, for instance, 840 million successful API calls were made using open banking in the UK, but only two million of them were payments related. That’s less than 0.5%.

Over the next few years, we expect to see payments growing as a share of this total, driven by more embedded payments. What customers increasingly want is for payments to be part of a seamless end-to-end journey, rather than a separate process or afterthought. Merchants, meanwhile, want to understand the best payment terms to offer customers, provide seamless checkout, request payment, and offer financing such as buy now pay later (BNPL), all in one place. On the consumer side, PayPal, Revolut and others are launching “super apps” that combine payments, savings, bill pay, crypto, shopping and more. Thinking about the end-to-end customer experience will unlock new opportunities for Open Banking payments. The latest to make this move is Klarna, who debuted an in-app online store that helps transform the company from a BNPL payments provider to a shopping and loyalty hub.

This requires a step change in how banks currently address ecosystem plays. Previously, banks have developed new apps in technology silos, leaving a fragmented array of different services. Examples include BBVA’s ‘Simple’ personal finance app which closed in May. We are seeing the end of this service unbundling as banks, fintechs and e-commerce players need to work together in one joined up ecosystem underpinned by a shared technology stack.

Payment providers are also currently adapting to regulatory imperatives such as ISO 20022, the emerging global standard for payments. Some 90% of the world’s financial transactions are projected to use ISO 20022 by 2023. Widespread adoption of the standard could have significant benefits for the financial system by enriching the data carried in payments messages, improving compatibility across technology platforms, and creating opportunities for collaboration and innovation.

To respond to shifting customer behaviour like the move away from cash towards contactless payments, as well as regulatory imperatives, a more flexible and responsive payments architecture is necessary. Nimbleness will enable moving to a common set of payments processor microservices, cloud-based infrastructure and improved data strategy to serve the new use cases mentioned above.

2. New

COVID has accelerated many trends that were already underway before its outbreak. Cards and digital wallets are obvious winners in an e-commerce market that is set to grow at 6% year-over-year between 2021 and 2025, reaching $4.2 trillion at the end of the period, according to Statista. In the last 12 months, BNPL and account-to-account (A2A) transfers have also exploded in popularity, with A2A transfers in Europe accounting for around 13% of checkouts.

This has profound strategic implications for incumbents who rely on the traditional four-party model and benefit from mark-ups on interchange fees and merchant service charges. With these fees at risk, banks and payments companies need to reassess their go-to-market propositions and payment mixes. As companies undergo this shift, addressing legacy cost bases will come into focus. Back-office operations are burdened with high costs, low efficiency, and outdated infrastructure. Zero-based operations can help automate manual back-office activities and lead to reduced cost and improved customer experiences. Efficiency gains of up to 50% are very typical.

In addition to consumer-facing innovations, B2B offerings have also taken off in a big way. We are seeing a proliferation of smaller payments players that may not have the scale to efficiently build or run their own architectures and therefore seek as-a-service offerings. Incumbent payment providers who have modernised their cores and payments architectures may decide to offer these to other players to gain new income streams.

3. Next

As we look to the future, boundaries will blur between banks, fintech players and big tech as payments become more embedded in marketplaces and across industry use cases. Beyond smartphones, consumers’ other internet-connected devices are becoming a new frontier for commerce. Almost anything a consumer wears (e.g., watches, wristbands, and rings) can become a contactless payment device. According to research by Mercator Advisory Group in 2019, the IoT segment already amounts to $5.76 billion in payments and is estimated to grow to $7.56 billion by 2024.

We will see regulators and central banks working more closely with big tech and payment leaders to ensure consumers are protected and payment sovereignty isn’t compromised. This is especially true in the case of CBDCs, which are gathering momentum. The Bank of England and HM Treasury announced a joint task force in April 2021 as they explore the potential of such a currency. This is being backed up by a CBDC Technology Forum, with members drawn from financial institutions, academia, fintech, infrastructure providers and technology firms to provide input on all aspects of CBDCs.

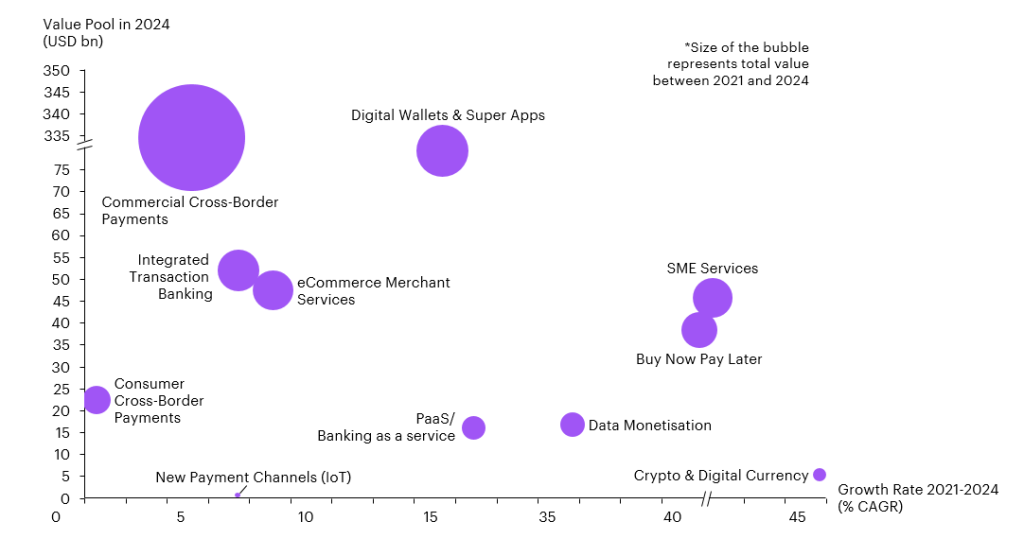

Revenue pools vary significantly by region, based on existing payments infrastructures and customer preferences. The figure below illustrates the revenue pools for the most common emerging use cases in global payments. (Due to the pace of change we are seeing, these forecasts are subject to change as business models evolve).

Emerging Payment Revenue Pools for Payment Providers (2021-2024)

By 2024, we project that the largest revenue pools will be those that have established use cases and clear existing markets. Smaller revenue pools that are very fast growing include data monetisation, BNPL, SME services and digital currencies. These revenue pools are not mutually exclusive, and the combination of different value levers could realistically multiply the value seen above. As mentioned elsewhere, payments will become more deeply embedded in wider financial propositions and customer journeys. The winners will be those that solve for this end-to-end integrated payments experience.

For more details download the report here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: