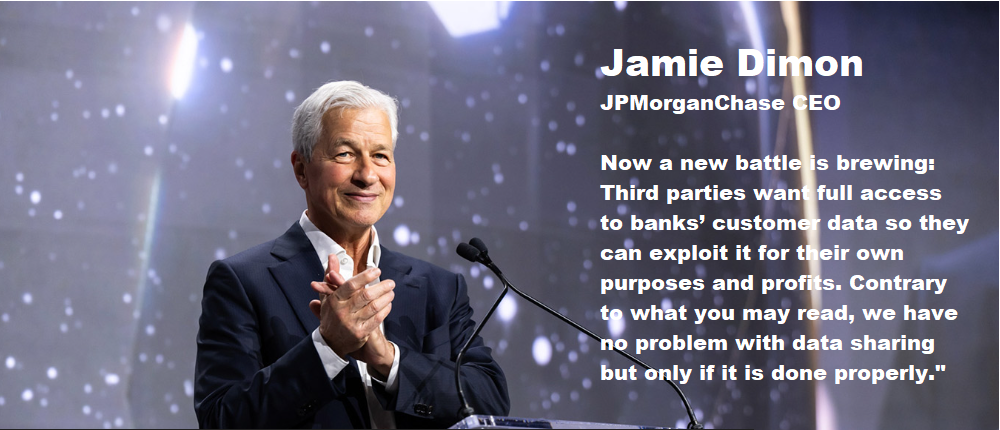

„We have no problem with data sharing but only if it is done properly.” – says Jamie Dimon, JPMorganChase CEO, in his annual letter to sharholders.

In the chapter entitled Consumer payments have become a new battleground, Dimon states the following:

There is a lot of misunderstanding about the value and cost of a consumer checking account. Our consumer bank serves nearly 44 million customers and just over 60 million accounts. It costs approximately $225 for us to maintain an account, of which roughly $150 is a fixed expense.

Included among these costs are all the branch expenses, the people expenses and the cost of onboarding accounts (including verifying customers’ identity and meeting Know Your Customer and anti-money laundering requirements). They do not include certain litigation costs or the cost of capital, which would add another $1.5 billion or essentially $25 per account.

Our consumer accounts also come with an extraordinary number of services, generally free checking, free direct deposit, superior fraud protection, 24/7 access to call centers, access to cash from branches and ATMs nationwide, free investment accounts, free wealth planning, and free and safe payments, including debit cards, Zelle and more.

Consumers “pay” for these accounts by the bank retaining net interest on deposits, which has averaged around 2.25% or approximately $275 a year per account. However, for accounts with lower balances, which make up the majority of accounts, this is generally around $25 a year.

Banks also receive certain fees, such as monthly account fees, overdraft fees and debit card fees, which on these accounts is usually around $100 a year. For these lower balance accounts, our costs to maintain and operate them are far greater than what we make from them.

Debit revenue, which is paid by the third party receiving the payment rather than the consumer, was cut in half due to the ill-conceived Durbin Amendment (the average revenues from debit went from approximately $130 to $60 – this had been a large share of the revenues from smaller accounts). In setting the pricing for debit cards, the government looked only at the cost of the debit card swipe, which is illogical as that assumes a debit card is a separate and distinct product from its underlying checking account.

Debit cards are a feature of the checking account that enable consumers to access their funds to pay merchants. Therefore, the true cost of providing debit cards should also include the costs associated with operating checking accounts (e.g., the costs of branches, bankers and so on). Predictably, to make up for their lost revenue, banks had to increase their fee schedules, causing approximately 1 million more individuals to become unbanked. The Durbin Amendment is the only case I can think of where the government determined the pricing between two big industries, in this case banks and retailers.

Retailers now pay banks like ours that are subject to this government-mandated pricing 47 basis points (0.47%), on average, for debit card transactions. This is far cheaper for retailers than debit card alternatives, such as cash and checks, while debit cards also provide retailers immediate guaranteed money and are preferred by consumers.

All retailers bear a high cost of processing cash (including defalcation, cash sorting, delivery of cash to a bank, counterfeit funds and higher insurance because of robberies). The cost of processing cash, even for the largest retailers, is probably more than 4% of the payment. It is unfortunate that retailers and banks have been in a battle for years over who should bear the cost of processing money – and that retailers continue to use “lawfare” to get their way. This also makes it ironic that retailers are now adding “buy now-pay later” features as another payment option for their customers, which usually cost the retailer considerably more than processing a debit or even credit card transaction.

Our Consumer Bank lost $500 million from fraud last year – $300 million from losses as a result of customer fraud committed on us (for example, counterfeit deposited checks) and $200 million from reimbursements to customers who were victims of fraud (it is our policy to reimburse 100% of valid fraud claims).

Unfortunately, we must also process thousands of scam claims where customers authorized transactions but should not have done so (for example, buying nonexistent products or sending money to fake websites), often because they were misled by bad actors. The loss rate to scams for our customers is amongst the lowest in the industry, and lower than nonbank payment providers. That is because we have made significant investments in fraud and scam detection, as well as prevention capabilities, and believe that our efforts have prevented Chase customers from losing $12 billion. Fraud and scams are a societal problem, and we need law enforcement, retailers, social media, telecom companies and others to work together to stop these crimes at the source.

Now a new battle is brewing: Third parties want full access to banks’ customer data so they can exploit it for their own purposes and profits. Contrary to what you may read, we have no problem with data sharing but only if it is done properly: It must be authorized by the customer – the customer should know exactly what data is shared and when and how it is used; third parties should pay for accessing the banking system and payment rails; third parties should be restricted from using the customers’ data for purposes beyond what the customer authorized, and they should be liable for the risks they create when accessing and using that data. When banks utilize third party data, they will be, and in most cases already are, subject to these same obligations.

Banks provide fantastic services, and it’s time to defend ourselves – in the public realm or in court if need be.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: