Artificial intelligence (AI) is an extraordinary and groundbreaking technology, and is inextricably linked with cloud-based systems, whether public or private, and digital capabilities, JPMorgan Chase & Co CEO Jamie Dimon wrote in a letter to shareholders on Tuesday. „Will be critical to our company’s future success” he says.

Find below what he believes about AI, data and IM Morgan’s journey to the cloud.

„AI and the raw material that feeds it, data, will be critical to our company’s future success — the importance of implementing new technologies simply cannot be overstated. We already have more than 300 AI use cases in production today for risk, prospecting, marketing, customer experience and fraud prevention, and AI runs throughout our payments processing and money movement systems across the globe.

AI has already added significant value to our company. For example, in the last few years, AI has helped us to significantly decrease risk in our retail business (by reducing fraud and illicit activity) and improve trading optimization and portfolio construction (by providing optimal execution strategies, automating forecasting and analytics, and improving client intelligence).

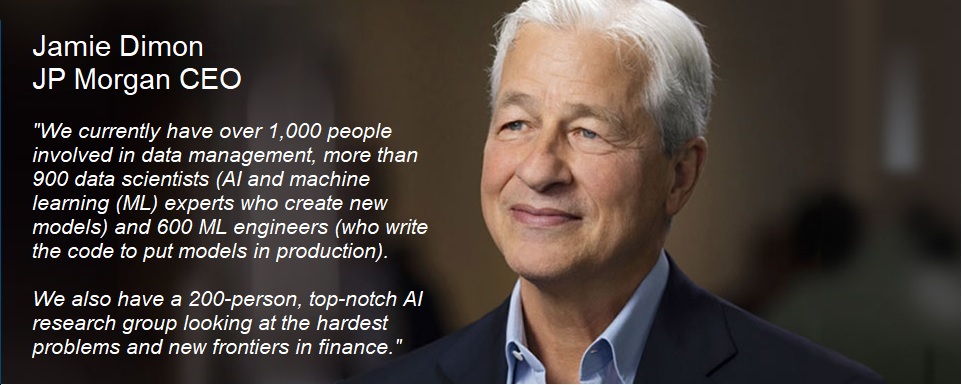

We currently have over 1,000 people involved in data management, more than 900 data scientists (AI and machine learning (ML) experts who create new models) and 600 ML engineers (who write the code to put models in production). This group is focused on AI and ML across natural language processing, time series analysis and reinforcement learning to name a few. We’re imagining new ways to augment and empower employees with AI through human-centered collaborative tools and workflow, leveraging tools like large language models, including ChatGPT.

We also have a 200-person, top-notch AI research group looking at the hardest problems and new frontiers in finance. We were recently ranked #1 on the Evident AI Index, the first public benchmark of major banks on their AI maturity. We take the responsible use of AI very seriously and have an interdisciplinary team of ethicists helping us prevent unintended misuse, anticipate regulation, and promote trust with our clients, customers and communities. AI and data use is complex; it must be done following the laws of the land. But it is an absolute necessity that we do it both for the benefits I just described and, equally, for the protection of the company and the financial system – because you can be certain that the bad guys will be using it, too.

All of our technology groups firmwide work together in a flywheel of innovation and deliver state-of-the-art improvements. We are proud that our AI teams have contributed top-quality novel research and compelling solutions that are transforming more and more business cases every day.

AI is inextricably linked with cloud-based systems, whether public or private, and digital capabilities. Our company needs the cloud for its on-demand compute capacity, flexibility, extensibility and speed. Native cloud-based approaches will ultimately be faster, cheaper and aligned with the newest AI techniques, and they will give us easy access to constantly evolving developer tools.

We have spent over $2 billion building new, cloud-based data centers and are working to modernize a significant portion of our applications (and their related databases) to run in both our public and private cloud environments. To date, we have migrated approximately 38% of our applications to the cloud, meaning over 50% of our application portfolio (this includes third-party, cloud-based applications) is running on modern environments.

This journey to the cloud is hard work but necessary. Unlocking the full potential of the cloud and nearly 550 petabytes of data will require replatforming (putting data in a cloud-eligible format) and refactoring (i.e., rewriting) approximately 4,000 applications. This effort will involve not just the 57,000 employees we have in technology but the dedicated time of firmwide management teams to help in the process.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: