Javelin Research: Total identity fraud losses soar to $56 Billion in 2020. 38% of victims closed their accounts because of lack of resolution at the financial institution where their fraud occurred.

The 2021 Identity Fraud Study, released by Javelin Strategy & Research reveals a daunting new threat to consumers and businesses: identity fraud scams. While total combined fraud losses climbed to $56 billion in 2020, identity fraud scams accounted for $43 billion of that cost. Traditional identity fraud losses totaled $13 billion, down 21% from 2019.

With traditional fraud, consumers often have no idea how their identities were stolen. With scams, they can often tell, upon reflection, the exact moment when they interacted with a criminal via email, phone, or text.

“The pandemic inspired a major shift in how criminals approach fraud,” said John Buzzard, Lead Analyst, Fraud & Security, with Javelin Strategy & Research. “Identity fraud has evolved and now reflects the lengths criminals will take to directly target consumers in order to steal their personally identifiable information.”

Criminals exploit shift to online lending, banking

The pandemic compelled companies to make quick adjustments to their business models, such as transitioning from in-person lending to remote interactions with borrowers. Criminals pounced on new vulnerabilities presented by the explosion in remote loan originations and closings.

As financial institutions found their footing despite the obvious challenges, criminals took advantage of this ramp up period and banks felt the blow. Nearly one-third of identity fraud victims say their financial services providers did not satisfactorily resolve their problems, and 38% of victims closed their accounts because of lack of resolution at the financial institution where their fraud occurred.

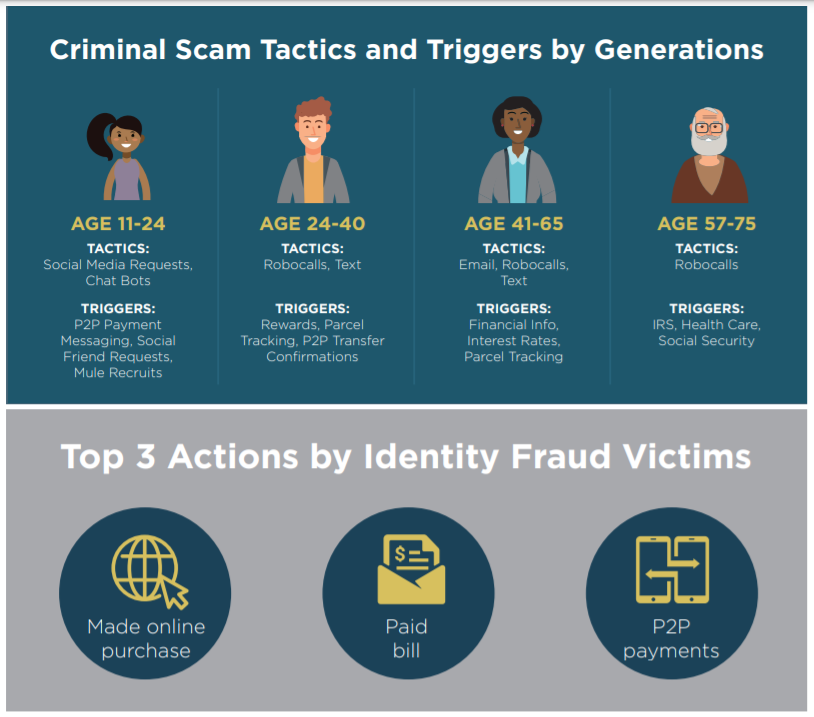

As consumers relied increasingly on digital payment products during 2020, identity fraud scams kept pace with this shift in behavior. Losses related to digital wallets and peer-to-peer (P2P) accounts spiked. This was particularly notable in the case of economic stimulus payment fraud, unemployment benefits fraud, and identity fraud scams.

“The culture of fraud is clearly shifting. The pandemic has created so many more points of vulnerability for families and businesses,” said Paige Schaffer, CEO of Global Identity & Cyber Protection at Generali Global Assistance. “Whether it’s payment products meant to enhance convenience, remote operations, additional logins or even simply more time online, there is more opportunity now than ever for compromise.”

Consumers begin to embrace advanced authentication

Growing acceptance of various digital payment channels presents an opportunity to increase consumer awareness of stronger forms of authentication. Fingerprint scanning and facial recognition, for example, are growing in popularity with consumers.

“Identity verification, throughout the consumer’s digital account engagement, is more vital than ever,” said Cindy White, Chief Marketing Officer at Mitek. “Consumers are willing to do their part to let go of traditional methods and leverage advancements in AI and new biometric technology such as facial scanning. This is good news for them and for their financial institutions.”

As consumers become increasingly savvy online, safe digital transactions will form the foundation of a productive and secure remote financial ecosystem.

“Static forms of consumer authentication must be replaced with a modern, standards-based approach that utilizes biometrics,” said David Henstock, Vice President of Identity Products at Visa. “Businesses benefit from reduced customer friction, lower abandonment rates and fewer chargebacks, while consumers benefit from better fraud prevention and faster payment during checkout.”

____________

The annual Identity Fraud Study, now in its eighteenth year, is the nation’s longest-running comprehensive analysis of identity fraud trends, independently produced by Javelin Strategy & Research.

To find out more information about the report, 2021 Identity Fraud Study: Shifting Angles, visit https://www.javelinstrategy.com/content/Javelin-2021-Identity-Fraud-Study

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: