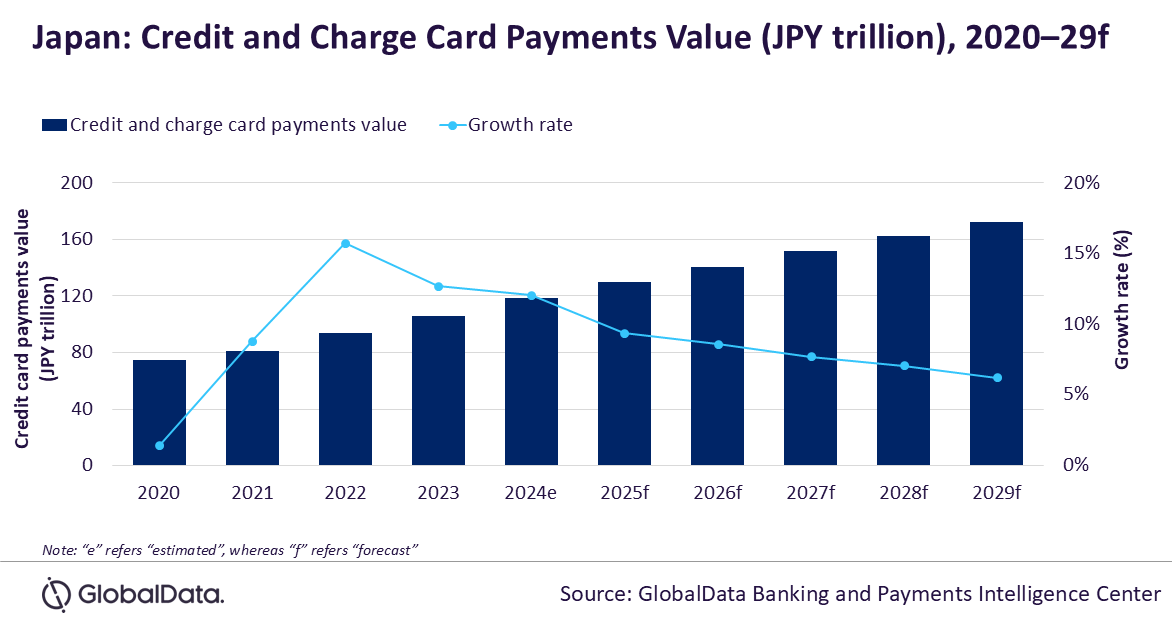

Japan’s credit and charge card payments market is projected to grow by 9.4% in 2025 to reach JPY129.6 trillion ($857.3 billion), driven by the rising consumer preference for non-cash transactions and wider acceptance of credit cards among merchants, according to GlobalData, a leading data and analytics company.

GlobalData’s Payment Cards Analytics reveals that Japan saw a growth of 12.7% in credit and charge card payments value in 2023, and continued its growth trajectory with 12.1% growth to reach JPY118.5 trillion ($783.8 billion) in 2024.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “Japan’s payment landscape is predominantly cash-based. However, payment cards usage has grown in recent years, mainly driven by the higher adoption of credit and charge cards with frequency of credit and charge payments per card at 70.7 times in 2024e. This is mainly due to the associated reward programs, which are considered far more beneficial than those offered with debit and prepaid cards. Another important factor driving this usage is the wider acceptance of credit cards among merchants, with credit cards now accepted across all types of merchants.”

Credit and charge cards dominates the overall card payments market, accounting for 96.2% share of the overall card payment value in 2024. Japanese consumers are increasingly opting for credit and charge cards when making payments, with the frequency of payments per card standing at 70.7 times in 2024 compared to 2.4 times for debit cards. This is mainly due to the value-added benefits associated with these cards, such as flexible payment options and reward programs.

The Ministry of Economy, Trade and Industry (METI) unveiled a cashless vision document in April 2018 outlining strategies to achieve a cashless payment ratio of at least 40% by 2025, with a long-term goal of reaching 80%.

To support these objectives, the government implemented measures such as the implementation of point reward programs to encourage the adoption of cashless payments by consumers, encouraging cashless transactions at self-service kiosks, and developing comprehensive cashless payment statistics.

Notably, credit and charge cards are the primary method of payment for e-commerce transactions in Japan, accounting for over half of total transaction value in 2024. This can be attributed to the benefits offered with credit and charge cards for online payments.

The growing usage of contactless payments for public transport payments is also contributing to this. For instance, in September 2024, Keikyu Line stations launched contactless ticket payment system enabling credit card holders to make payments at the automated ticket gates.

Sharma concludes: “Looking ahead, Japan’s credit and charge card payments market is poised for continued expansion. The ongoing shift from cash to electronic payments, availability of pricing benefits on credit and charge cards and rising adoption of contactless payments, are expected to further boost credit and charge card usage. The credit and charge card market is expected to grow at a CAGR of 7.4% between 2025 and 2029 to reach JPY172.3 trillion ($1.1 trillion) in 2029.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: