January 2025 euro area bank lending survey

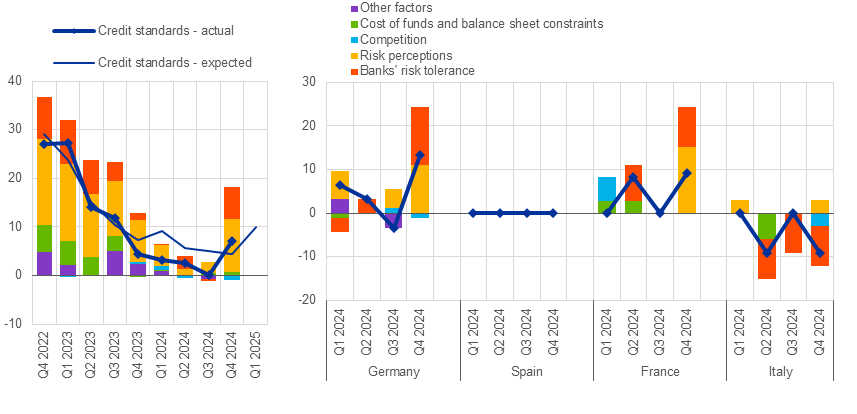

According to the January 2025 bank lending survey (BLS), euro area banks reported a renewed net tightening of credit standards – banks’ internal guidelines or loan approval criteria – for loans or credit lines to enterprises in the fourth quarter of 2024 (net percentage of banks of 7%; Chart 1). Banks also reported broadly unchanged credit standards for loans to households for house purchase (net percentage of 1%), whereas credit standards for consumer credit and other lending to households tightened further (net percentage of 6%). For firms, the net tightening followed the unchanged credit standards seen in the third quarter and was higher than banks had expected in the previous survey round. It was driven by higher perceived risks related to the economic outlook, the industry-and-firm-specific situation and banks’ lower risk tolerance. For loans to households for house purchase, the stability of credit standards, after three quarters of easing, was in contrast to the strong net easing that banks had expected in the previous quarter. Credit standards tightened further for consumer credit, mainly owing to higher perceived risks. For the first quarter of 2025, banks expect a further net tightening of credit standards for loans to firms and consumer credit, and a small net tightening for loans to households for house purchase.

Banks’ overall terms and conditions – the actual terms and conditions agreed in loan contracts – remained broadly unchanged for loans to firms and consumer credit, but eased strongly for housing loans. For loans to firms, the contribution to easing from lower lending rates and narrower margins on average loans was broadly offset by stricter collateral requirements and other terms and conditions, such as loan covenants, to compensate for the higher perceived risks. For housing loans, lower lending rates and margins on average loans were the main drivers of the net easing. For consumer credit, lending rates had an easing impact, offset by widening loan margins.

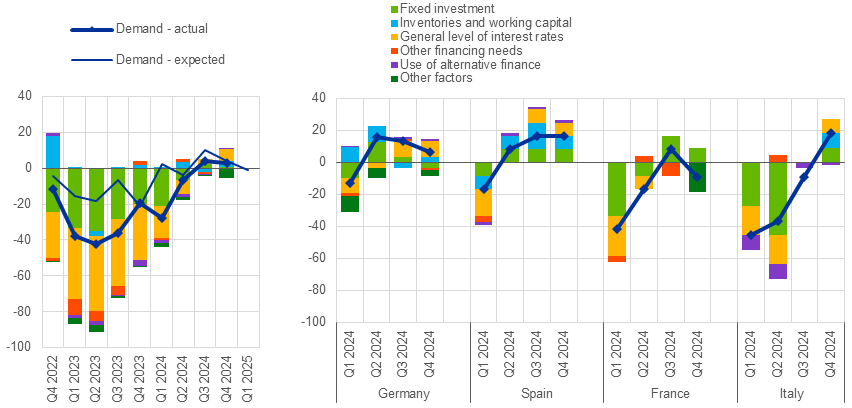

In the fourth quarter of 2024, demand from firms for loans or the drawing of credit lines increased slightly (Chart 2), while remaining weak overall. Loan demand from firms was supported mainly by declining interest rates, with fixed investment having a still-muted impact after its small positive contribution in the previous quarter. Net demand for housing loans continued to increase strongly, driven mainly by declining interest rates, substantiating still further the signs of a rebound from the strong declines seen in housing loan demand over previous years. Demand for consumer credit and other lending to households increased slightly, supported by declining interest rates, whereas spending on durable goods and consumer confidence, among other factors, dampened demand for consumer credit. In the first quarter of 2025, banks expect loan demand to remain broadly unchanged for firms and to increase further for households, especially for housing loans.

Euro area banks’ access to funding worsened somewhat for retail funding, money markets and debt securities in the fourth quarter of 2024. In the first quarter of 2025, banks expect access to funding to remain broadly unchanged across all market segments.

In response to the new regulatory or supervisory requirements in 2024, euro area banks reported a net increase in their required capital as well as increases in their liquid and risk-weighted assets. Banks also reported a net tightening impact on credit standards stemming from the requirements, especially for loans to firms, with further net tightening expected in 2025.

Euro area banks reported that non-performing loan ratios and other indicators of credit quality had a net tightening impact on their credit standards for loans to firms and consumer credit in the second half of 2024, the largest since the height of the pandemic and the period of balance sheet clean-up in 2014-17. By contrast, for housing loans credit quality had a neutral impact on bank lending conditions. Banks expect these developments to continue in the first half of 2025.

Banks’ credit standards tightened further in all main economic sectors in the second half of 2024, especially in commercial real estate (CRE), wholesale and retail trade, construction and energy-intensive manufacturing. Banks also reported a net decrease in loan demand in CRE, construction and energy-intensive manufacturing. For the first half of 2025, banks expect a further net tightening of credit standards in most economic sectors, except for services. They expect muted loan demand in all sectors but residential real estate, for which they expect a moderate increase.

Banks reported that the changes in excess liquidity held with the Eurosystem had a neutral impact on bank lending conditions in the second half of 2024. They expect similar effects in the first half of 2025.

The quarterly BLS was developed by the Eurosystem to improve its understanding of bank lending behaviour in the euro area. The results reported in the January 2025 survey relate to changes observed in the fourth quarter of 2024 and changes expected in the first quarter of 2025, unless otherwise indicated. The January 2025 survey round was conducted between 10 December 2024 and 7 January 2025. A total of 155 banks were surveyed in this round, with a response rate of 99%.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: