Italy is the leading country in the euro area for real-time digital payments via smartphone

Jiffy, the service developed by SIA to send and receive money in real time from a smartphone using the cellphone number, has topped 4.2 million users.

A significant increase that makes Jiffy the leading “Person to Person” (P2P) digital payment service in the euro area and the second largest in Europe after Swish (5 million), active in Sweden, and ahead of Paym (3.5 million), present in the UK.

According to the latest figures on payments made with Jiffy, the average value of a single transaction is about 50 euro, while transfers under 25 euro represent 40% of the total.

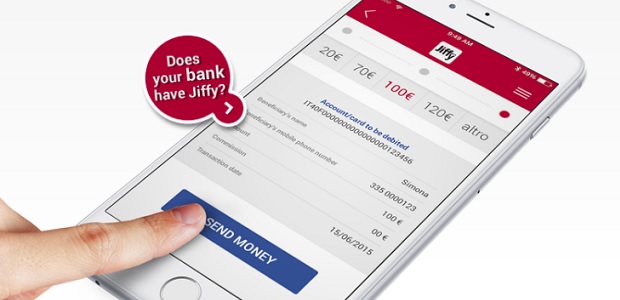

How Jiffy works

To transfer cash via smartphone, users simply select the receiver from the personal contacts list available on the banking app, enter the amount, a message if desired and with a click the money is immediately sent and can instantly be used by the beneficiary.

If the beneficiary is the holder of a current account at a bank subscribing to Jiffy, the debit and credit of funds will be immediate. Otherwise, the payment will be put on hold, but through the app it will be possible to send a message to report its presence and the steps necessary to receive it.

Which banks offer the service?

At present, 23 bank groups have joined the SIA “Person to Person” (P2P) payments service since it was launched on the Italian market.

Jiffy is currently available to the current account holders of BNL, Banca Nuova (Gruppo BPVI), Banca Popolare di Milano, Cariparma, Carispezia, Cassa Centrale Banca, Che Banca!, Friuladria, Gruppo Carige, Hello bank!, Inbank, Intesa Sanpaolo, Banca Mediolanum, Monte dei Paschi di Siena, Banca Popolare di Vicenza, Raiffeisen,

UBI Banca, UniCredit, Veneto Banca, Webank and Widiba.

Soon, Jiffy will also be available to Banca Popolare di Sondrio, Sparkasse and Volksbank Banca Popolare. Once all of these banks have signed up, the service will be available to over 32 million Italian current accounts, equal to more than 80% of the total.

Jiffy is already set up to send and receive money in Europe

Based on SEPA money transfer, Jiffy is open to all banks operating in the Single Euro Payments Area, potentially usable by over 400 million European current account holders.

Compliant with the standards of the European Retail Payment Board (ERPB), it is already set up to be integrated with the pan-European instant payments infrastructure, which will be completed by EBA Clearing by 2017.

SIA’s Jiffy service was developed in collaboration with GFT, global provider of information technology solutions for financial services.

Source: SIA

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: