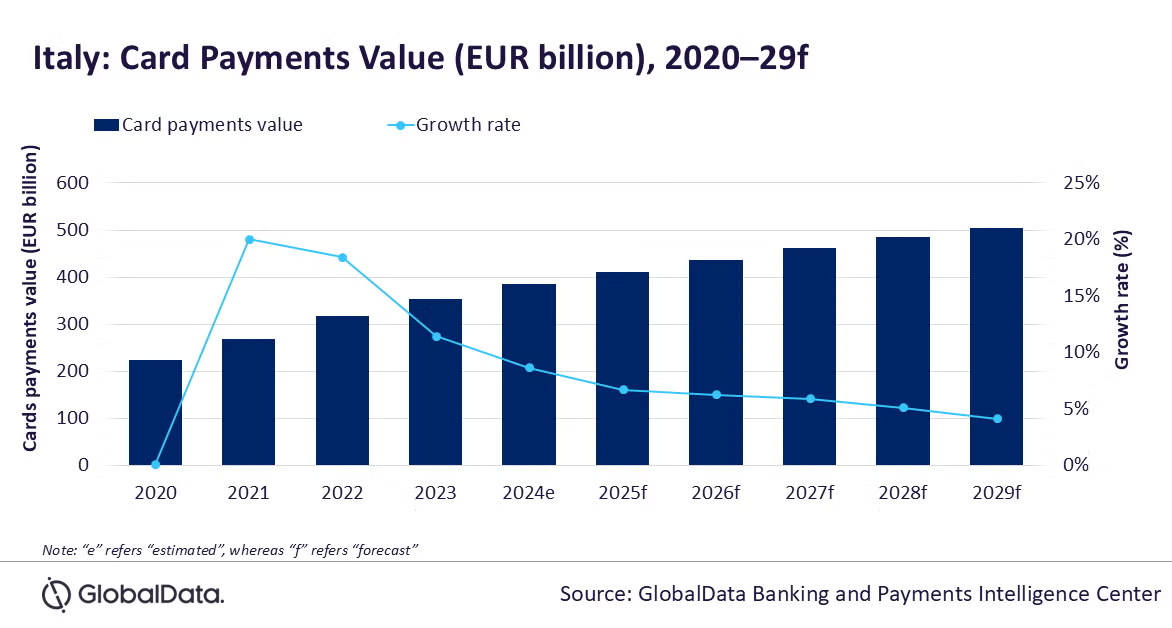

The Italy card payments market is expected to grow by 6.6% to reach EUR410.2 billion ($443.7 billion) in 2025 despite global economic uncertainty, according to GlobalData, a leading data and analytics company.

GlobalData’s Payment Cards Analytics reveals that the card payment value in the Italy registered a growth of 11.4% in 2023, driven by the rise in consumer spending. The value registered an estimated growth of 8.6% in 2024 to reach EUR384.6 billion ($416.1 billion). However, the current global uncertainty because of the latest US tariffs can pose a challenge for the Italy’s overall economic growth, resulting in slowdown in the overall card payments value in 2025.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “The surge in card payments is primarily driven by the government’s initiatives to promote electronic payments, including mandating certain merchant categories to accept card payments and offering tax incentives to those who comply. Additionally, the rising adoption of contactless cards, the proliferation of digital-only banks, and the growth of e-commerce are further propelling the Italian electronic payments landscape, indicating a promising trajectory for the sector.”

Debit cards are mostly preferred due to strong banking penetration and concerted efforts by banks and government bodies to promote financial inclusion. The Italian central bank has implemented various initiatives to enhance electronic payment adoption, including regulations that encourage banks to offer basic accounts with low or no fees.

On the other hand, credit and charge card payments are also witnessing notable growth due to the value-added benefits they offer, such as cashback, discounts, and reward points. The European Central Bank (ECB’s) recent interest rate cuts are expected to further stimulate credit card spending by making borrowing more affordable and enhancing consumer confidence in credit usage.

The adoption of contactless payments is becoming increasingly prevalent in public transport systems across Italy. For instance, in March 2024, the Tuscany Region’s public transport service provider, Autolinee Toscane, implemented a contactless payment system. Similarly, the European Union’s Alternative Fuels Infrastructure Regulation, effective from April 2024, mandates the installation of contactless payment systems at public EV charging stations, further driving the adoption of contactless payments in Italy.

Sharma concludes: “Looking ahead, the total card payments market in Italy is expected to continue its upward trajectory, driven by the ongoing government initiatives, technological advancements, and a cultural shift towards electronic payments. The combination of rising banking penetration, innovative payment solutions, and a favorable regulatory environment will likely position Italy’s card payments market for sustained growth. The card payments value is expected to register a compound annual growth rate (CAGR) of 5.3% between 2025 to 2029 to reach EUR504.7 billion ($546 billion) in 2029.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: