a blog written by Panagiotis Kriaris, Head of Business & Corporate Development at Unzer.

The implications are huge. Europe is contemplating to abandon its open finance plans. Here is why.

First, two important clarifications:

– Open Finance (OF) is the evolution of Open Banking (OB). It translates into unifying more complex use cases – savings, lending, investments, insurance, etc – under one digital dashboard with hyper-customized services behind.

– Both OB and OF are built out of two main building blocks: data and distribution rails, which we call APIs.

The transition from OB to OF is a global trend, which despite the different approaches followed, is based on one common principle: data (the other element, APIs, has become so widespread that is taken for granted).

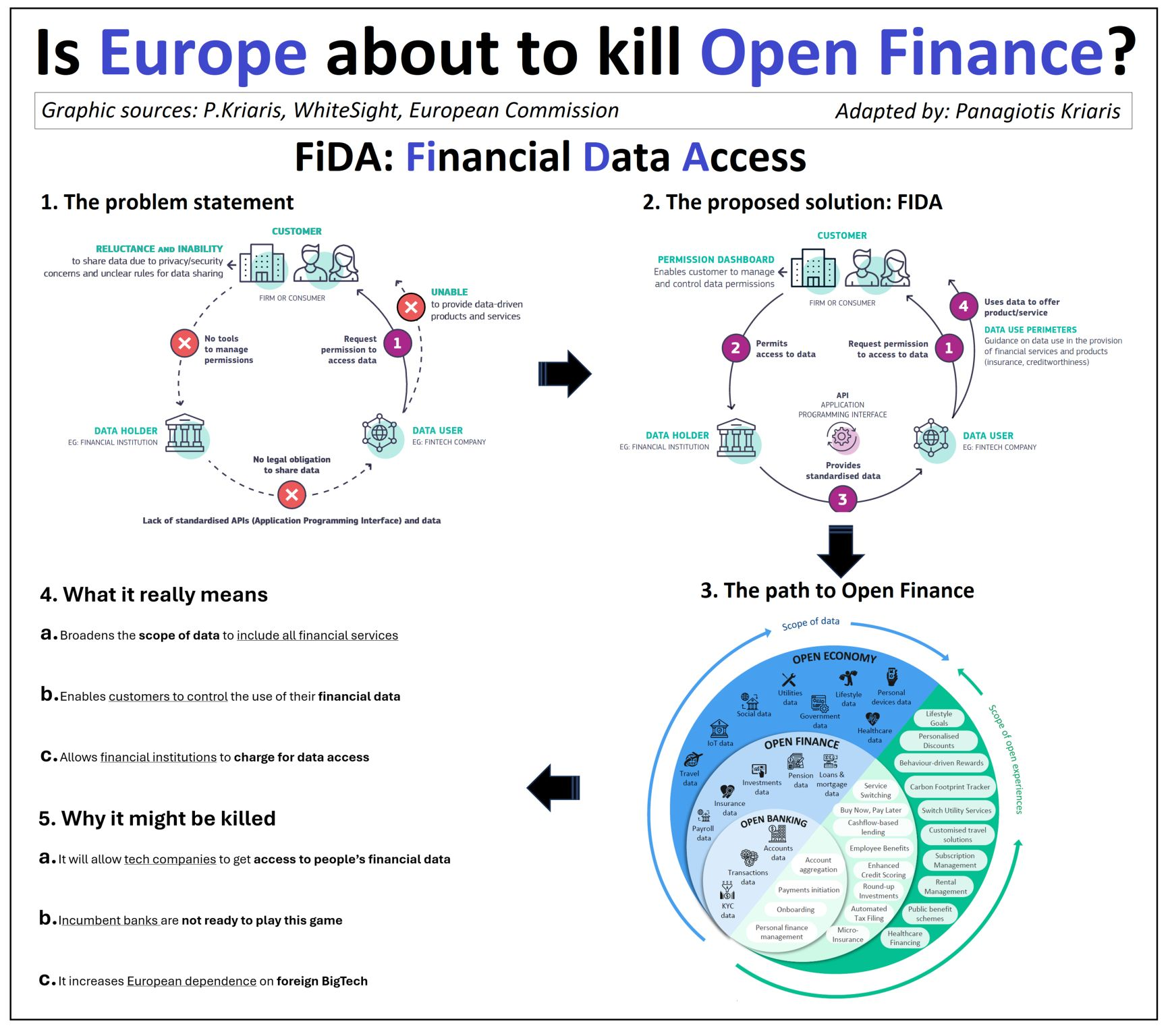

In June 2023 the EU Commission proposed an innovative regulation building on the concept of data around OB. Called FiDA (Financial Data Access), the idea was to take advancements made by PSD2 and plans announced by PSD3 (and its sibling PSR) to the next level.

FiDA would be a game changer because of three reasons:

1. It broadened the scope of data to include all financial services (not only banks).

2. It wanted to enable customers to control the use of their financial data.

3. It allowed financial institutions to charge other service providers for data access granted by customers, which was always a big point missing from PSD2 and one of the main disincentives of banks to invest in OB.

In short: FiDA wanted to impose functioning data sharing rules that would increase competition, provide incentivization and benefit consumers on pricing and personalization.

So, what happened?

Industry representatives have been pushing back for months now. On December 9th the Association for Financial Markets in Europe (AFME), the European Association of Co-operative Banks (EACB), the European Banking Federation (EBF), the European Fund and Asset Management Association (EFAMA), the European Savings and Retail Banking Group (ESBG), and Insurance Europe issued a joint statement calling to postpone FiDA ‘‘before a thorough assessment of its impact across the entire value chain is completed.’’

The main arguments had to do with costs and market proof-of-concept, but reading behind the lines the main issue is different:

– FiDA would allow tech companies to get access to people’s financial data, which is a huge advantage for personalizing and bundling with other offerings. Incumbent banks are not ready to play this game.

– None of these tech firms is of European origin. Which feeds into the ongoing debate of European dependency on US (and other) bigtechs.

An official announcement is still pending but rumours and leaked documents suggest that regulation will be withdrawn within six months.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: