Payments don’t just transfer money; they move people, businesses, and entire economies. And in a

globalized world, when payments stop at borders, progress stops too. Integrating payment systems is not just a matter of improving efficiency; it is a way to improve lives. And for many, especially the most vulnerable, the impact can be profound.

Selections of the keynote speech by Mr Fabio Panetta, Governor of the Bank of Italy, at the Asian Development Bank 58th Annual Meeting, Milan, 6 May 2025.

Technological progress has greatly improved the efficiency of domestic payment infrastructures, reducing transaction costs and speeding up execution. However, these gains have scarcely materialized for cross-border payments, which remain slow, expensive and opaque. The reason is that technology alone is not enough: harmonized rules and procedures are essential on this front, and making progress on these aspects is more complex.

The stakes are high. In 2024, the global cross-border payments market was estimated at over $190 trillion1 – nearly twice the size of global GDP – and it is projected to surpass $300 trillion within the next 5 to 10 years.

The decline of correspondent banking: limited access and rising costs

Cross-border payments have always predominantly relied on a ‘correspondent banking’ model. Relying on a chain of intermediaries to complete a transaction inevitably makes payments slower, more expensive and less efficient.

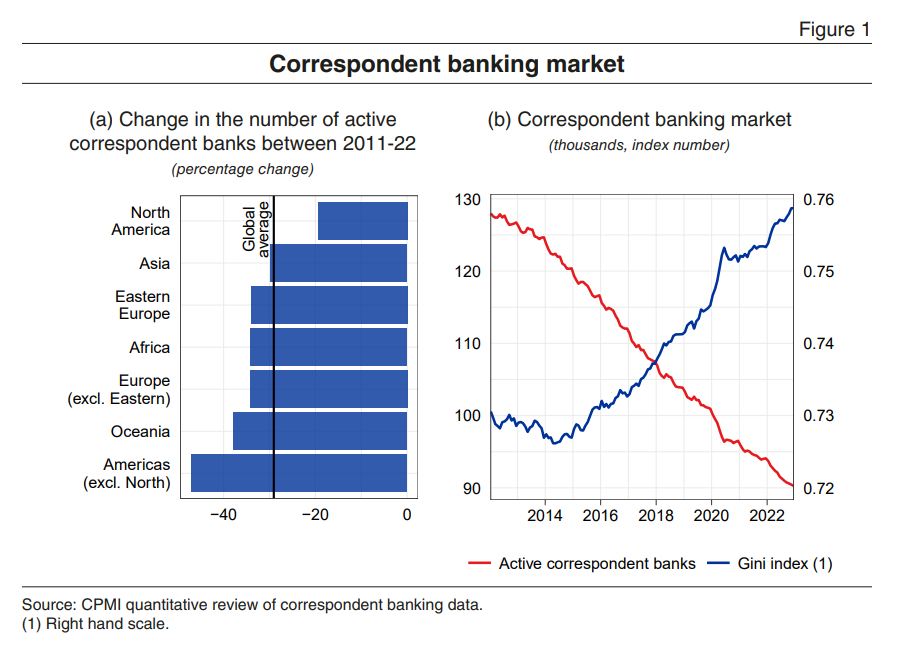

To make things worse, the tighter prudential standards and stricter AML/CFT4 regulations introduced after the Financial Crisis led to a decline in correspondent banking relationships. Between 2011 and 2022 the number of active correspondent banks fell by 30 per cent globally, with some regions experiencing reductions of nearly 50 per cent (Figure 1.a). As a result, the network has become increasingly concentrated and less competitive (Figure 1.b), which contributes to persistently high costs and, in extreme cases, limits firms’ access to international trade.

The emergence of alternative solutions

These inefficiencies have triggered the rise of new technologies – such as distributed ledgers – and new products – such as crypto-assets – in order to provide a better solution to people’s payment needs. But it is a promise that needs to be taken with a large pinch of salt.

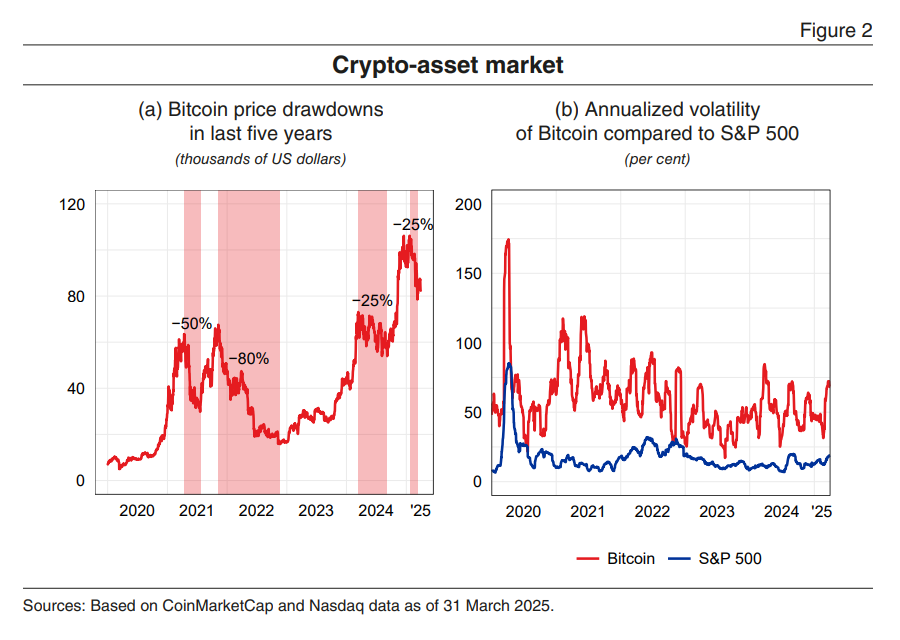

Unbacked crypto-assets pose significant risks, including the potential for substantial losses for end users (Figure 2.a). More importantly, they do not fulfil payment functions as they are highly volatile (Figure 2.b), lack intrinsic value and are often under-regulated or entirely unregulated.

If properly designed and regulated, so-called stablecoins could instead perform some payment functions. However, the proliferation of stablecoins running on non-interoperable blockchains risks fragmenting the payments landscape and undermining overall efficiency. In addition, regulatory frameworks vary significantly across jurisdictions, and the lack of coordination, particularly between Europe and the United States, makes future outcomes difficult to predict.

Finally, while stablecoins face the risk of a ‘run’ like banks, they typically lack some critical safeguards such as access to central bank facilities, deposit insurance, and resolution frameworks. Prohibition is not the answer though. The only effective response to the emergence of riskier alternatives is to provide retail payment solutions that are equally efficient, but safer and more reliable.

The social impact

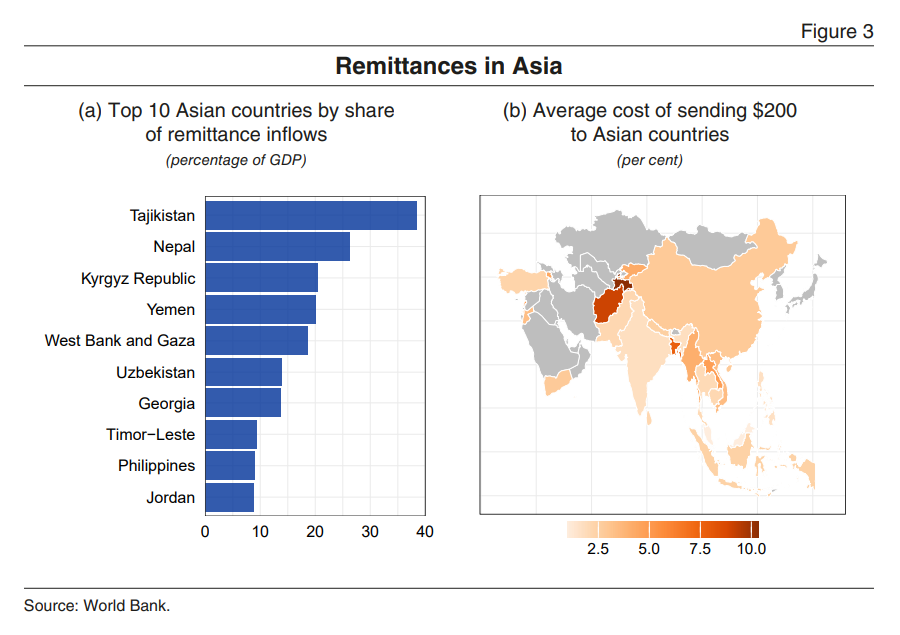

Inefficiencies in cross-border payments impose significant social costs on the most vulnerable segments of the population. Remittances often represent the main source of income for many low-income households, and while they may appear modest in the context of total cross-border payments, they are vital for certain economies, where they represent a large share of GDP (Figure 3.a).

Low-value remittances may incur disproportionately high fees relative to the amount sent (Figure 3.b). However, high costs are only part of the problem. Many unbanked individuals and people living in less developed economies lack access to payment services altogether, forcing them to rely on informal, unsecured channels for cross-border payments.

In principle, high remittance costs – which effectively resemble a tax on labour income earned abroad – could even discourage workers from relocating and hinder international labour mobility. The Asia-Pacific region is particularly significant in this context, as it is the largest recipient of international remittances worldwide. In 2023, it accounted for 38 per cent of global remittance inflows, amounting to $328 billion. In 2022, remittances to low- and middle-income countries in the region matched the volume of foreign direct investment, highlighting their role as a vital financial lifeline for developing economies.

Addressing inefficiencies in cross-border payments is an increasingly urgent matter. In a world marked by growing interconnectedness, expanding e-commerce, and rising international travel and migration, the social costs associated with them are likely to increase over time.

More details here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: