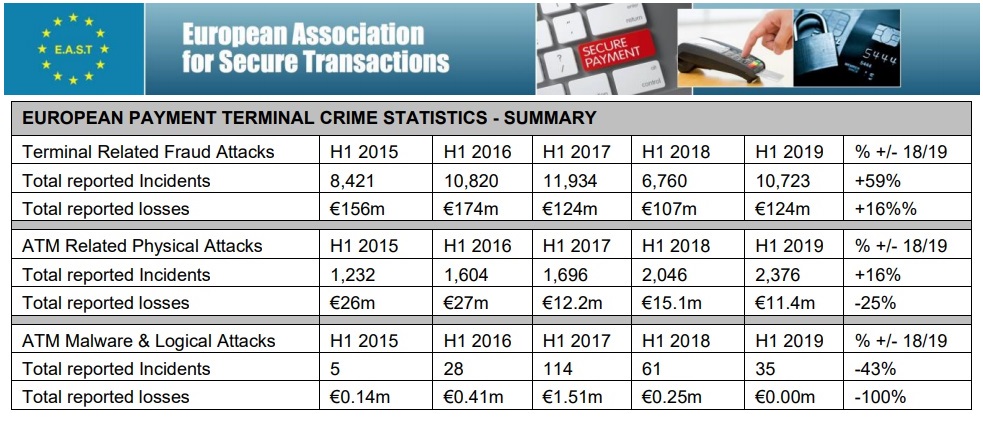

ATM malware and logical attacks fall in Europe The European Association for Secure Transactions (EAST) has just published a European Payment Terminal Crime Report covering the first six months of 2019 which reports that ATM malware and logical attacks continue to trend downwards.

ATM malware and logical attacks against ATMs were down 43% (from 61 to 35) and all bar one of the reported ‘jackpotting’ attacks are believed to have been unsuccessful. Malware was used for 3 of the attack attempts and the remainder were ‘black box’ attacks. Related losses were down 100% (from €0.25 million to €0.00 million), although a small loss (less than €1,000) was reported in one case.

EAST Executive Director Lachlan Gunn said, „This fall in logical and malware attacks is very good news and reflects the work that has been put into preventing such attacks by the industry and law enforcement. In January 2019, supported by our Expert Group on All Terminal Fraud (EGAF), Europol updated their ‘Guidance & recommendations regarding logical attacks on ATMs’, which was first published in 2015. These Guidelines, which have been widely shared with ATM deployers and law enforcement agencies, reinforce the recommendations made by the ATM vendors.”

Terminal related fraud attacks were up 59% (from 6,760 to 10,723 incidents). This increase was primarily due to an increase in transaction reversal fraud attacks (up from 2,292 to 5,649 incidents), while card skimming incidents fell to an all time low (down from 985 to 731 incidents). This downward trend reflects the success of EMV and that measures to counter skimming at terminals, along with geo-blocking, are working well in Europe.

Total losses of €124 million were reported, up 16% from the €107 million reported during the same period in 2018. This increase is primarily due to a rise in international losses due to card skimming (up from €87 million to €100 million), which indicates that EMV implementation is not yet complete globally with resultant risks for European cardholders.

Losses due to transaction reversal fraud were up 135% (from €1.36 million to €3.2 million).

ATM related physical attacks were up 16% (from 2,046 to 2,376 incidents). Attacks due to ram raids and ATM burglary were up 3% (from 590 to 610 incidents) and ATM explosive attacks (including explosive gas and solid explosive attacks) were up 3% (from 490 to 503 incidents). Losses due to ATM related physical attacks were €11.4 million, a 25% decrease from the €15.1 million reported during the same period in 2018.

The average cash loss for a robbery is estimated at €15,140 per incident, the average cash loss per explosive or gas attack is €10,161 and the average cash loss for a ram raid or burglary attack is €9,632. These figures do not take into account collateral damage to equipment or buildings, which can be significant and often exceeds the value of the cash lost in successful attacks.

A summary of the report statistics under the main headings is in the table above.

EUROPEAN PAYMENT TERMINAL CRIME REPORT – Period: January to June 2019

The above release is based on a report prepared twice-yearly by EAST to provide an overview of the European payment terminal crime situation for law enforcement officers and EAST members, using statistics provided from 22 European states.

The following countries, with an estimated total installed base of 348,128 ATMs, supplied full or partial information for this report: Austria; Belgium; Cyprus; Czech Republic; Denmark; Finland; France; Germany; Greece; Ireland; Italy; Liechtenstein; Luxembourg; Netherlands; Norway; Portugal; Romania; Slovakia; Spain; Sweden; Switzerland; United Kingdom.

EAST intends to obtain such information from all 28 European Union states as well as from Iceland, Liechtenstein, Norway, and Switzerland.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: