Since January 2022, the SEPA Instant Credit Transfer (SCT Inst) scheme has been in use in Slovakia, where three payment service providers (PSPs) have joined the scheme to date.

European Payments Council interviewed Milena Koreňová, CEO of the Slovak Banking Association, to share the lessons her community has learned while implementing the scheme.

In 2019, in close cooperation with the National Bank of Slovakia, the Ministry of Finance of the Slovak Republic and the State Treasury, the National Plan for the implementation of SCT Inst in Slovakia was agreed and published, with a starting date of instant payments set for February 1, 2022. Payment service providers adhere to the National Plan on a voluntary basis.

Three banks declared their interest in implementing SEPA instant payments by the set date. The announced adherence of at least three banks with significant share in the total number of credit transfers in Slovakia in the previous calendar year fulfilled the fundamental requirement for introduction of instant payments from February 1, 2022 in the Slovak market.

„These three major banks have a share of more than fifty percent in payments, and at the same time the total number of open accounts in these banks exceeds fifty percent. This means that instant payments can already be used by the majority of the country’s population,” said Milena Koreňová.

„Instant payments were also very well received by clients. In the first week of February alone, Slovaks sent hundreds of thousands of instant payments,” she added.

In terms of developments related to the SCT Inst scheme, the CEO of the Slovak Banking Association believes that instant payments will become a new common standard in payments.

„We therefore expect gradual involvement of other Slovak banks. Another important milestone will be achieved when the State Treasury joins the scheme, and we will be able to take advantage of instant payments also for paying administrative fees or taxes.” – Korenova concluded.

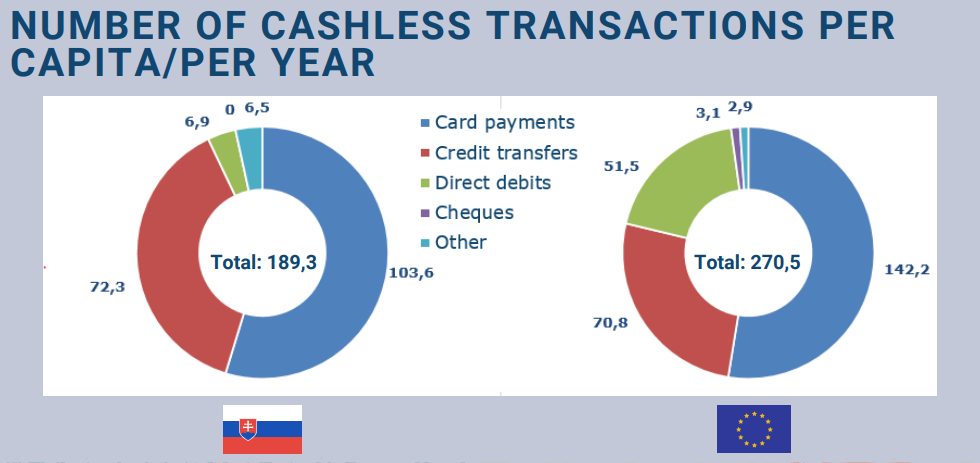

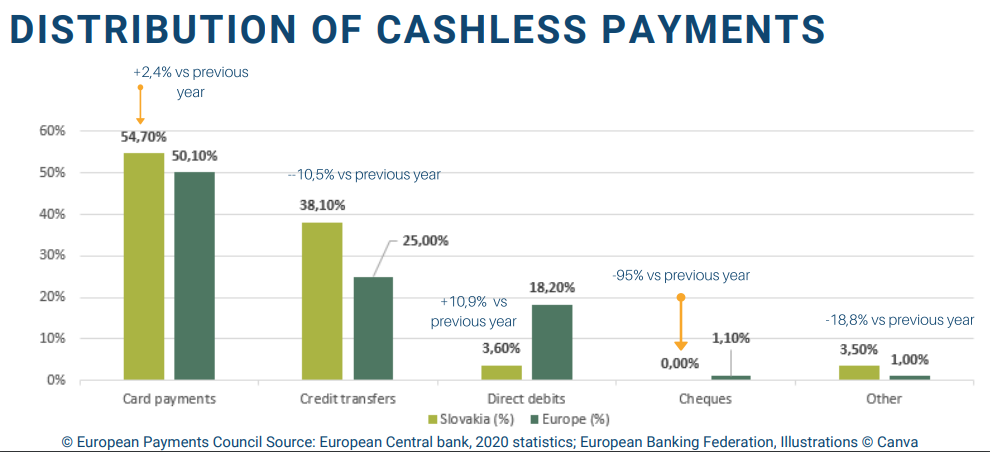

Also, the payment behaviour of Slovaks has been significantly affected by the COVID-19 pandemic. The growth in the volume of non-cash payments made at point-of-sale (POS) terminals in the last year increased by a double-digit number. The use of mobile cashless payments has also been growing significantly. In 2021, the number of mobile payments increased by more than 100% and for the first time exceeded the number of cash withdrawals from ATMs.

The Slovak Banking Association supports member banks by providing a platform for the creation and development of various standards in the field of payment services. In 2020, in cooperation with its members, the Association created a payment link standard and based Payme service on it, allowing clients to easily share payment information in an electronic environment via a web link.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: