Ingenico, the global leader in seamless payment, reported „disappointing performance of Banks & Acquirers” – the group is reviewing its strategic options

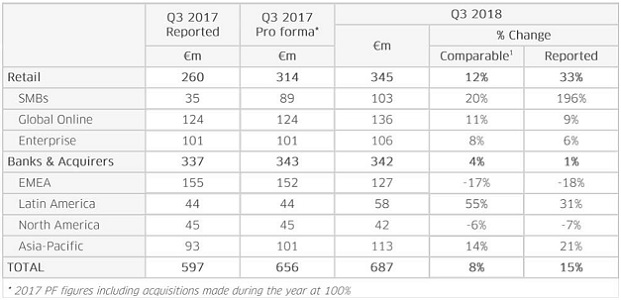

In the third quarter of 2018, revenue totalled €687 million, representing an increase of 15% on a reported basis. On a comparable basis, revenue was 8% higher than in the third quarter of 2017, according to the Ingenico’s press release.

The Retail business unit revenues reached €345 million, up 33% on a reported basis. On a comparable basis, revenue grew by 12% in the third quarter of 2018. „The Bambora integration is perfectly on track with our initial expectations, especially with its model deployment in Germany which has been promising during the quarter.”, the company said.

Third quarter key highlights

Outstanding performance of SMB (+20%) driven by the successful Bambora integration and German deployment

Global Online back to double digit level of growth (+11%) supported by new features and product developments

Strong performance of Enterprise (+8%) driven by both North America and the European in-store services

4%1 growth for Banks & Acquirers

Small & Medium Businesses (up 20%): The strong quarterly performance illustrates the success of Bambora’s integration, which is delivering in line with our expectations. In the course of the past quarter, more than 4,000 new merchants per month have joined the SMB community of clients, showing the relevance of the offer. On top of the existing positioning of Bambora in the Nordics, the performance has been driven by the acquiring volumes that continue to increase, with more than 30% growth during the quarter, and the German entity that is finalizing its transformation with a rejuvenated organization and commercial dynamic. In parallel, the third quarter has been marked by the signing of a partnership with Payworks in order to launch new innovative payment solutions to the integrated segments.

Global Online (up 11%): As expected, the division is back to double-digit growth. The churn rate remains at a very low level and the activity has benefited from the roll out of new features and more efficient on-boarding of clients. Its leaner organization enabled the group to provide new products more easily and rapidly than before, such as the Trustly payment method, and new versions of the payment gateway to comply with the latest versions of the e-commerce platforms. The deployment of the Chatbot tools with emblematic customers is gaining traction, as those solutions provide an exceptional conversion ratio. During the quarter, numerous clients have been on-boarded within the platform such as Iberostar, Trip.com, Elevate Financial or TickMill among others.

Enterprise (up 8%): As mentioned during the publication of the results for the first half-year, the division has benefited this quarter from a significant contract of a US based retailer. Therefore, the North American performance has shown a very strong dynamic throughout the quarter and will continue to be driven by the early EMV renewals coming from Retail as well as by a strong traction of our Mobile solutions. In parallel, the European dynamic remains contrasted, Turkey being strongly impacted by the ongoing macroeconomic development, whereas in-store gateway processing remains strong. The business unit has gained significant commercial successes in Germany within the Healthcare sector and has benefited from the Deutsche Post contract deployment.

The Banks & Acquirers business unit totalled revenues of €342 million, up 1% on a reported basis, impacted by a negative foreign exchange of €13 million. On a comparable basis, revenue increased by 4% compared to the third quarter of 2017. The Banks & Acquirers dynamic has continued to improve during the quarter, driven by the good performance of some of our big clients in Asia-Pacific and in Latin America, while Europe was weak due to some quarterly seasonal effects and the phasing out of the Iranian market.

Europe, Middle-East & Africa (down 17%): Despite a strong performance in France driven by the continued success of the Telium Tetra deployment, the region’s performance has been encumbered by the overstock of POS from our main Northern clients following the PCI migration. This impact will last for the next couple of quarters as clients reduce stock levels. As expected, the Iranian situation did not improve and has therefore impacted the overall activity trend. The quarter was still under pressure due to the consolidation that is taking place in Germany and seasonality effects in regions such as Iberia. Those effects should dissipate by the end of the year. Eastern Europe continues to face the high comparison basis coming from Russia. In parallel, the Axium launch is in line with the product plan.

Asia-Pacific (up 14%): The overall trends are improving significantly in the region, with India back to positive growth after two quarters impacted by the comparison basis resulting from the demonetization process. Australia is accelerating thanks to the gain of new contracts, while Japan is ramping up with new certifications related to the ongoing EMV migration. The South East Asian market remains dynamic, driven by Indonesia that is back to a normal level of business. China is as expected stable compared to last year, with the APOS continuing with very good momentum (c. 460k units shipped during the quarter).

Latin America (up 55%): The quarterly performance illustrates the strong Brazilian recovery. The country dynamic has been driven by the gaining of numerous contracts with the largest local acquirers thanks to the Telium Tetra success and the Android products deployment. This enabled Ingenico Group to win market shares within the local market. The remaining part of the region was very buoyant, with Mexico rebounding after a slow quarter following the anticipation of the national election, and a strong performance in Argentina.

North America (down 6%): The quarterly dynamic has shown a mixed performance between Canada performing strongly and the United States remaining weak. Unlike the Retail part of the US activity, the B&A’s activity is still lagging from the ISV’s ramp up as well as some certifications that are taking longer than expected. Nevertheless, the quarter saw milestone achievements such as the signing of a partnership with Toshiba, opening up the wide and promising grocery market to Ingenico Group.

Philippe Lazare, Chairman and Chief Executive Officer of Ingenico Group, commented: „This quarterly performance illustrates the year-end revenue acceleration we were expecting for 2018. The Retail performance reaches, for the first time, the double digit growth thanks to an outstanding SMB dynamic and the continuing improvement of the Global Online’s performance as well as the North American activities within Enterprise. The adjustment of our 2018 objectives is exclusively related to the disappointing performance of Banks & Acquirers despite its return to growth. 2018 illustrates the transfer of its center of gravity towards the Retail activities, leading to a profile with more recurring revenues. It confirms both the soundness of the acquisitive and development group strategy as well as the differentiated evolution of its two activities. As indicated during our last communication, Ingenico is reviewing its strategic options for the group as well as for its two divisions in order to improve the group’s value creation profile.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: