ING Survey: nearly half of phone owners in Europe now managing their finances through their handsets

If you don’t already bank, shop or make payments using your mobile device, there’s a good chance that you’ll start within the coming year. At least, that’s what the results of the ING International Survey on Mobile Banking 2016 tell us. The survey asked nearly 15,000 people in 15 countries questions about banking, shopping and paying with their mobile devices.

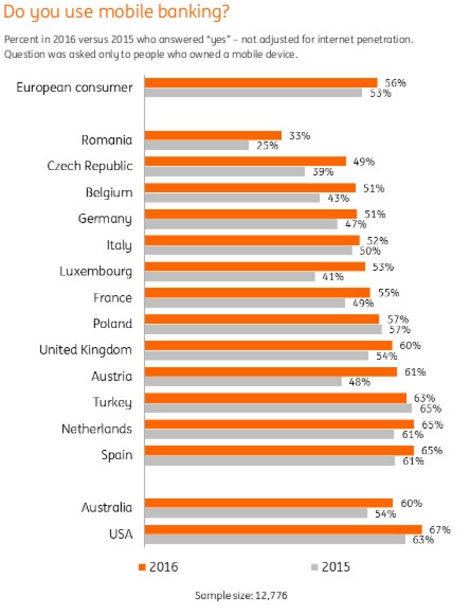

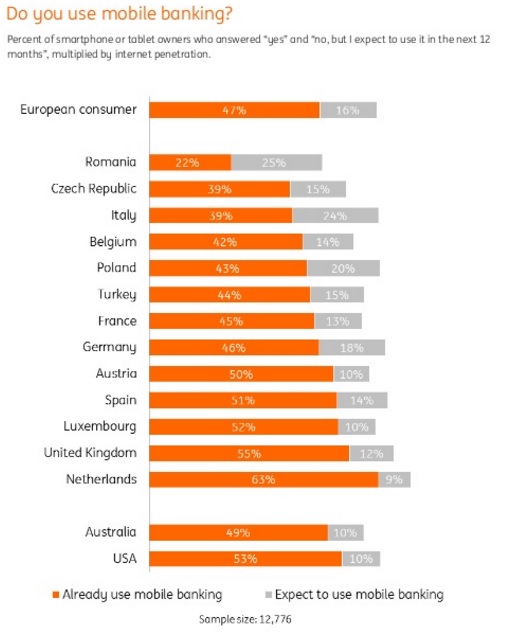

Results show that the share of smartphone or tablet users in Europe who use their device for banking has swelled to 47% – up from 41% in 2015 – with another 16% expected to start within the next 12 months.

“Mobile devices seem to be everywhere, and many people can’t live without their smartphone,” said Ian Bright, senior economist at ING. “People don’t only want to use their mobile phone in their everyday life to manage their money—many also reckon it helps them manage their money better.”

More than 70% (71%) of those who use mobile banking in the 13 European countries in the survey indicated that they managed their finances better as a result of mobile banking. Outside of Europe, the figure was slightly higher in the US (78%) and in Australia slightly lower (61%).

The survey’s findings are in line with ING’s strategy to become a next generation digital bank. ING recognises the importance of increasing innovation to keep up with changing customer needs. Banking “anytime, anywhere” is one of our customer promises. The bank is constantly finding new ways to make this easier for customers, for example with fingerprint authentication for our mobile banking apps in many countries where we have retail banking operations, such as the Netherlands and Belgium, and the digital savings coach (personal money manager) at ING France.

Mobile payments

Pure banking isn’t the only thing Europeans are doing more of on their mobile devices.

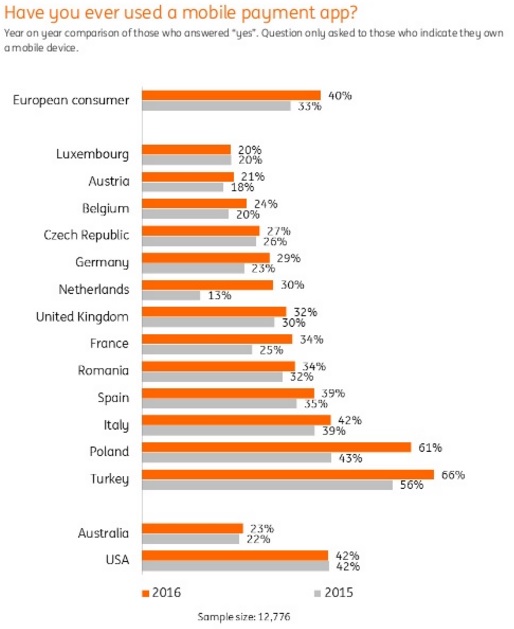

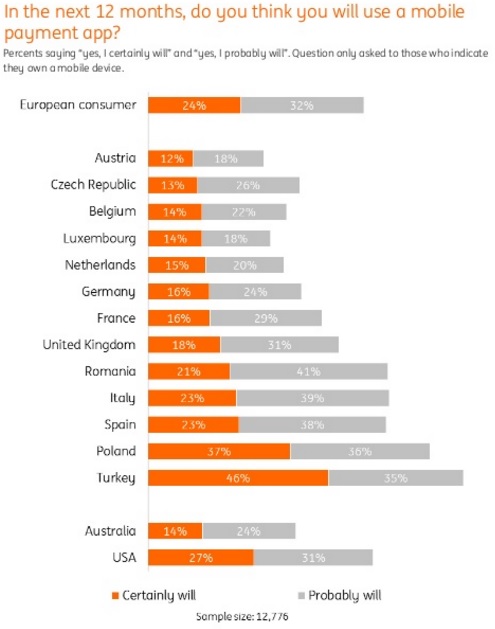

More people are also paying by mobile, with 40% in Europe saying they’ve used an app to pay on the go in 2016, up from 33% in 2015. And 56% of mobile device owners say they expect they will “certainly” or “probably” use a mobile payment app in the next 12 months.

If this trend continues, Europe could overtake the US, where adoption rates have remained static in the last 12 months at 42%, according to the data. ING’s apps such as Twyp and Payconiq may help keep the trend going, as they allow customers (and non-customers) to easily make payments with their mobile devices.

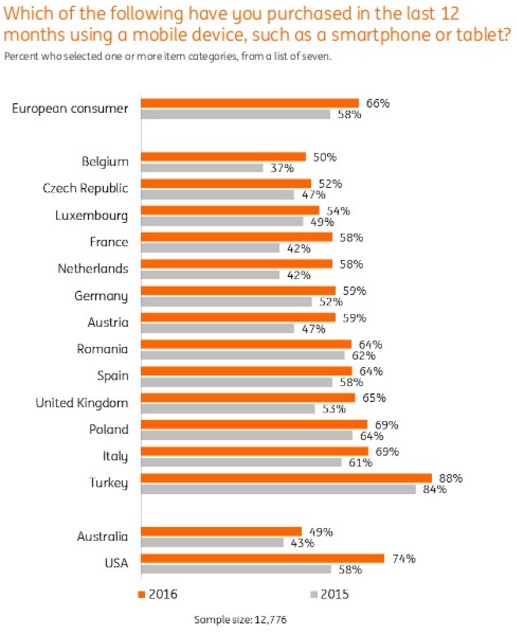

Shopping by smartphone or tablet has also made notable gains in 2016, the report reveals, with 66% in Europe saying they do so, up from 58% in 2015.

How about Romania – see the charts below

For more details follow the link: Mobile banking and shopping set to surge

The International Survey is produced three times a year by eZonomics, which looks at money and life—combining ideas around financial education, personal finance and behavioural economics to produce regular and practical information about the way people manage their money, and how this can affect consumers’ lives.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: