An ING spinout that helps international clients manage multiple bank accounts has raised €10 million in its first external funding round. Alongside ING Ventures as main shareholder, Cobase has welcomed Nordic bank Nordea and the French Crédit Agricole CIB as new investors and strategic partners. „The funding will support Cobase in developing its platform and expanding its network of banks.”, according to the press release.

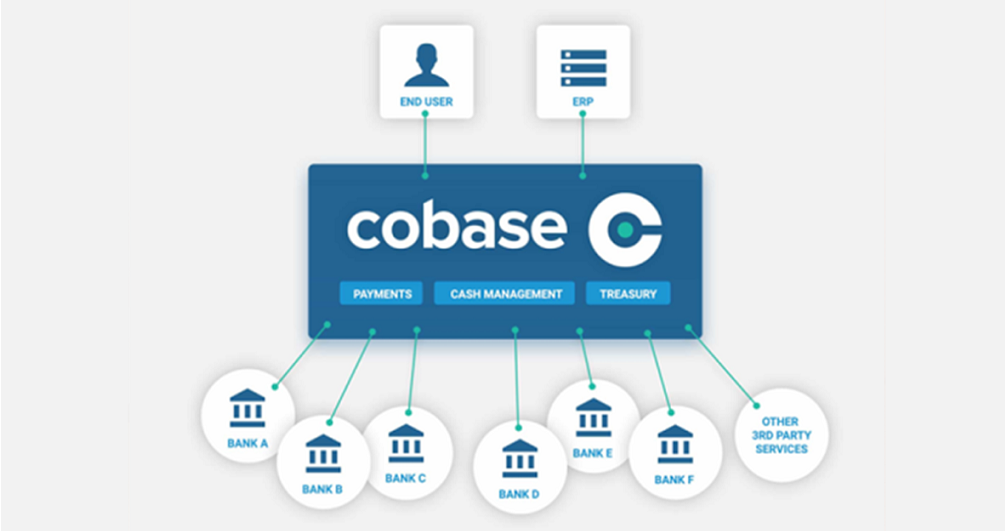

The fintech’s multi-banking platform allows users to view all their balances and transactions in one place, initiate payments, and perform actions related to cash management or corporate treasury.

„Currently, our clients are large corporates, mainly from Western Europe. Our strategy is to make Cobase a leading pan-European player in the coming years and then continue to roll out globally. We are already connected with more than one hundred banks from all over the world,” said Jorge Schafraad, founder and CEO of Cobase.

“Our platform helps them to manage their bank accounts efficiently, and we will continue to enhance its capabilities. Besides that, banks can choose to embed our technology into their systems and offer our solution to clients under their brand. It is a win-win situation.”

ING Ventures invested €7.5 million in Cobase after the fintech completed the bank’s accelerator programme, in which the concept was tested through prototyping, customer interviews and market research.

“Cobase has all the makings of a fintech success story. They are a great example of how we innovate at ING and help the companies we invest in to become successful. Their multi-bank platform is a great concept. Cobase is now entering its scale-up phase. We very much welcome our new banking partners to accelerate together the promising growth of Cobase,” said Benoît Legrand, chief innovation officer and CEO of ING Ventures at ING”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: