The consumer lending market in India is expected to grow by 4.9% to reach $724.2 billion in 2025 supported by robust economic growth, urbanization and growing consumer demand for housing, vehicles, and consumer durables. Despite global headwinds, India’s growing middle class, improving disposable incomes, and supportive monetary policies continue to propel credit demand, solidifying the country’s position as a key growth engine in the Asia-Pacific (APAC), says GlobalData, a leading data and analytics company.

GlobalData’s Global Retail Banking Analytics reveals that the consumer loan value in the India registered a growth of 27.6% in 2023, driven by rise in consumer income and evolving consumption patterns. Despite facing turbulent conditions over the past five years, India remains one of the world’s most rapidly expanding major economies. The value registered an estimated growth of 8.3% in 2024 to reach $690.5 billion.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “India’s strong economic growth, fuelled by government investment in infrastructure and rising household investments in real estate, is contributing to the overall demand for consumer lending. Increased disposable incomes are allowing consumers to spend more on discretionary items and services, further stimulating demand for various consumer loans.”

However, global economic uncertainties, exacerbated by the recently announced US tariffs could dampen the consumer sentiment. This is likely to result in slowdown in the growth of new loan originations for most loan products.

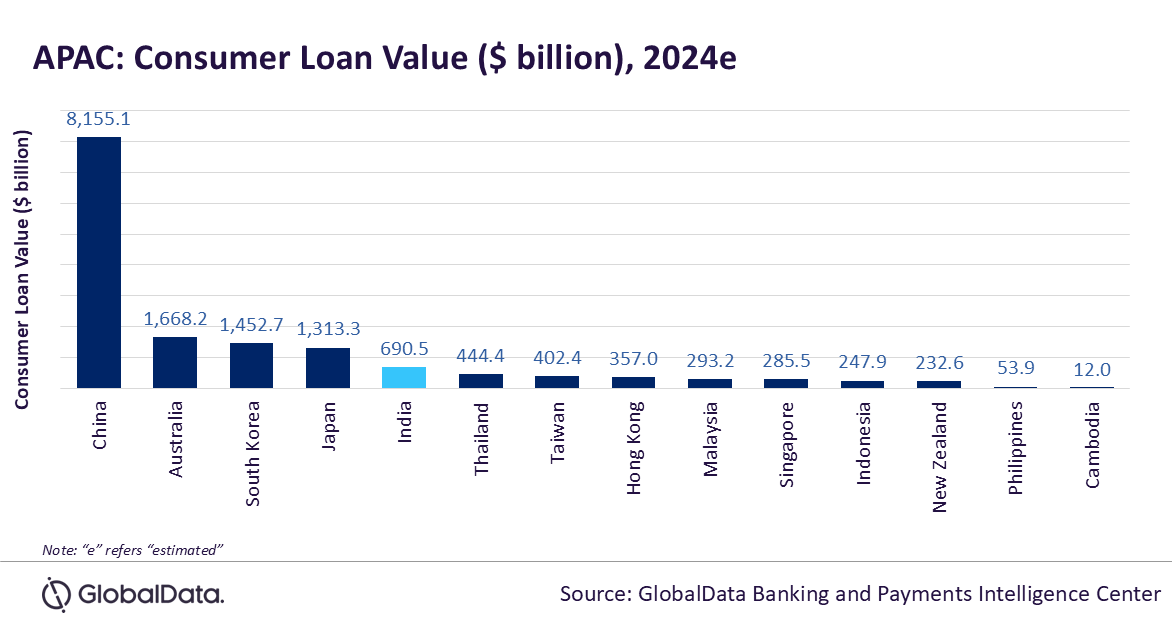

The Indian consumer loan market stood at $690.5 billion in 2024—much lower than regional counterpart China, which accounted for $8.2 trillion. Overall, the APAC consumer lending market is dominated by China. It is distantly followed by Australia with value of $1.7 trillion, South Korea with $1.5 trillion, and Japan with $1.3 trillion in 2024.

Mortgage loans accounted for the largest share of consumer loans in India with 49.1% share in 2024. The segment witnessed a strong growth of 17.4% between 2020 and 2024. Affordable housing prices, an increase in the supply of residential property, and government initiatives for affordable housing, including the Pradhan Mantri Awas Yojana have contributed to the growth of the mortgage loan market in recent years. Nevertheless, this segment is expected to register growth rate of 5.9% amid unexpected global economic scenario.

The personal loan market (including personal, car and all other personal loans) in India represents the second-largest segment, accounting for 45.8% share in total consumer loan in 2024. The market is expected to register a marginal growth of 3.8% in 2025 due to reduced consumer demand amid global uncertainty.

To boost consumer spending, the Reserve Bank of India (RBI) reduced repo rates from 6.25% to 6% in April 2025. This is the second reduction in 2025, with the previous cut also being 25 bps in February 2025. This is anticipated to decrease equated monthly instalments (EMIs) for borrowers and make new loans cheaper.

Credit card balances outstanding in India accounted for only 5% of total consumer loan value in 2024. The segment witnessed a strong compound annual growth rate (CAGR) of 21.9% between 2020 and 2024. The rise in credit card usage can be attributed to the improving POS infrastructure and growing e-commerce sector. Banks also offer cashback, discounts, and rewards incentivizing consumers to spend using credit cards. However, it is expected to grow at comparatively slower growth of 4.3% in 2025.

Sharma concludes: “Looking ahead, consumer lending in India is expected to continue its upward trajectory, supported by stable economic indicators at country level, expanding middle-class population, increasing urbanisation, a new generation of buyers, and rising demand for consumer credit, although global geo-political situation will pose challenge for faster growth. Overall, the consumer loan value is expected to register a compound annual growth rate (CAGR) of 7.2% between 2025 to 2029 to reach $956.7 billion in 2029.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: