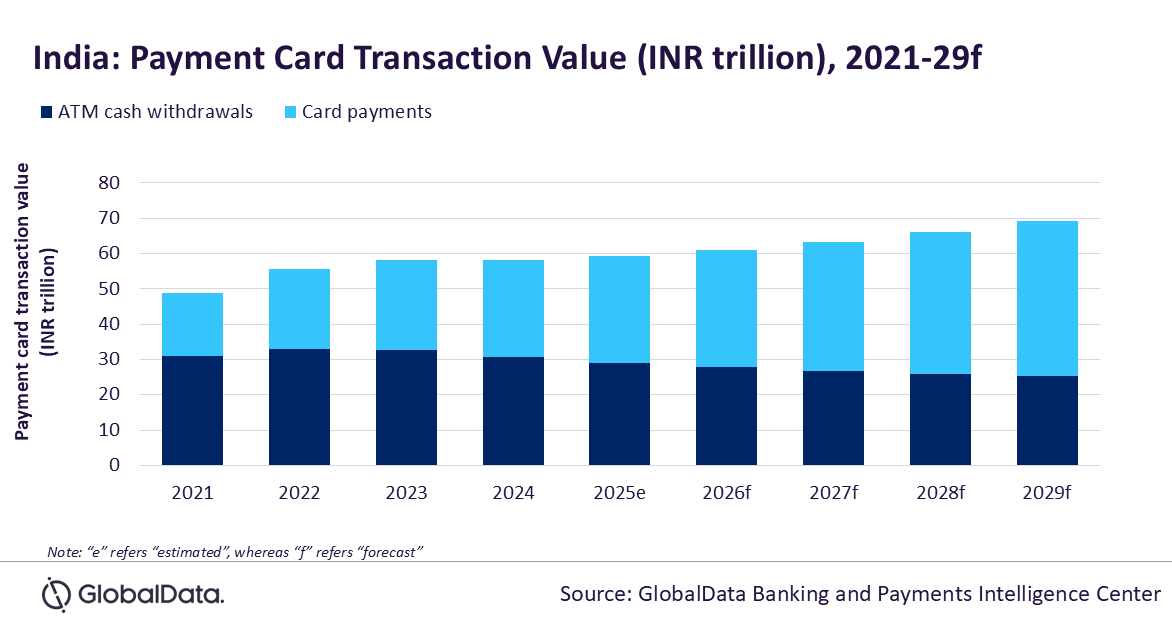

India’s payment card transaction value (including point-of-sale (POS) payments and ATM cash withdrawals) is estimated to reach INR59.2 trillion ($704.4 billion) in 2025, supported by growing preference for electronic payments and rise in consumer spending, reveals GlobalData, a leading data and analytics company.

GlobalData’s Payment Card Analytics reveals that card payments value (including payments at POS and initiated remotely) in India registered a growth rate of 7.8% in 2024 to reach INR27.5 trillion ($328.9 billion). Amid the rising consumer spending, decreasing interest rates and inflation, card payments value is estimated to reach INR30.1 trillion ($358 billion) in 2025 registering a higher growth rate of 9.4%. Conversely, the usage of cards for ATM cash withdrawals is on decline with the total ATM cash withdrawals value set to decline by 4.9% in 2025e.

Yasaswini Pujitha, Banking and Payments Analyst at GlobalData, comments: “While digital wallets and cash remain widely used for payments in India, payment cards are also gradually gaining popularity. This trend is driven by a growing banking population, rising awareness of the benefits of payment cards and associated benefits such as reward programs and installment facility. The Reserve Bank of India (RBI) initiatives such as reducing merchant service fees coupled with continued expansion of payment infrastructure has encouraged wider acceptance of payment cards among merchants as well.”

Card payments represent 50.8% of the total payment card transaction value, slightly outpacing ATM cash withdrawals in 2025e. The RBI announcment to increase ATM withdrawal fees from INR21 ($0.25) to INR23 ($0.27) for transactions exceeding the monthly limit of five free withdrawals, from May 2025, is expected to further discourage cash withdrawals.

In an effort to encourage card payments, the government eliminated merchant service charges on RuPay cards. Alongside this, aggressive marketing strategies by Indian banks such as discounts, cashback offers, reward points and flexiable payment options on credit cards, coupled with the growing number of merchants accepting card payments are also expected to increase the payment card usage in the country.

In addition, the Indian government decreased the goods and services tax (GST) rate on daily essentials, electronics, automobiles and health care effective from 22 September 2025, effectively reducing their prices.This move is likely stimilate the consumer spending, which in turn is likely to drive card usage.

Another important factor contributing to this uptrend is the availability of installment facilities. Most of the country’s major banks offer installment payment facilities, enabling consumers to convert large-ticket purchases into monthly payments. For example, Axis Bank allows credit card holders to convert purchases into six, nine, 12, 18, or 24 installments. Similarly, HDFC Bank offers a Smart EMI option, allowing its credit card holders to convert purchases across six to 48 monthly installments.

Despite growth in card payments, the overall card payment frequency remains at lower at 6.9 transactions per card in 2025e. This is mainly due to comparatively lower card penetration, limited merchant acceptance among merchants especially in rural and remote areas as well high preference for UPI-based mobile payments among consumers and merchants.

With all digital wallets integrated into UPI platform, offering real-time, cost-free financial transactions, Indian consumers and merchants are opting for this payment method, which in turn is restricting the wider adoption and usage of cards.

Pujitha concludes: “India’s card payment landscape is expected to record sustained growth in the next five years, supported by the digitalisation of financial services, consumer preference for electronic transactions, RBI regulations, and improving payment acceptance infrastructure.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: