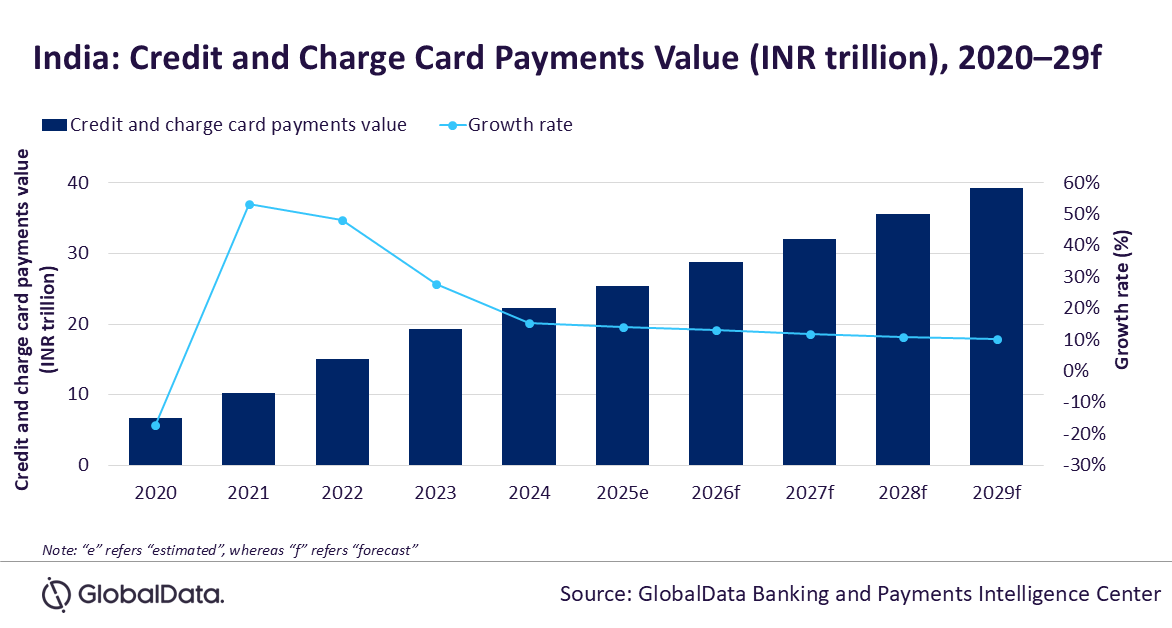

India’s credit and charge card payments market is projected to grow by 14% in 2025 to reach INR25.4 trillion ($303.9 billion), driven by rising consumer preference for non-cash transactions, according to GlobalData, a leading data and analytics company.

GlobalData’s Payment Cards Analytics reveals that India saw a growth of 27.9% in credit and charge card payments value in 2023, and continued its growth trajectory with 15.3% growth to reach INR22.3 trillion ($266.5 billion) in 2024. The market is expected to register upward trajectory despite the current global uncertainty because of latest US tariffs, with the overall credit and charge card payments value growing by 14% in 2025.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “Despite lower penetration than debit cards, credit and charge cards are highly preferred for payments. Payment frequency for these cards stood at 54.2 times a year in 2025e—much higher than for debit cards. With the expansion of the middle-class workforce, increasing incomes, and heightened awareness of credit card benefits—fueled by banks’ promotional campaigns—the adoption and utilization of credit cards are on the rise.”

Credit and charge cards dominate in terms of payment card transaction value, accounting for 81% of the total in 2024. This can be attributed to the value-added benefits that are provided to incentivize credit and charge card payments, such as discounts and cashback.

Another important factor contributing to this uptrend in India is the availability of installment facilities. Most of the country’s major banks offer installment payment facilities, enabling consumers to convert large-ticket purchases into monthly payments. For example, Axis Bank allows credit card holders to convert purchases into six, nine, 12, 18, or 24 installments. Similarly, HDFC Bank offers a Smart EMI option, allowing its credit card holders to convert purchases across six to 48 monthly installments.

Notably, rising e-commerce payments in the country also contributed to the overall growth in credit and charge cards, accounting for 11.2% of total e-commerce transaction value in 2024. This can be attributed to the benefits offered with credit and charge cards for online payments.

In June 2025, the RBI reduced the key policy rate by 50 basis points to 5.50%. This reduction is anticipated to potentially decrease loan interest rates, encompassing those for credit cards. Robust economic expansion, in conjunction with a decline in inflation and interest rates, is likely to incentivize consumers to acquire new credit, thus fostering growth in the credit and charge card market.

Sharma concludes: “Looking ahead, India’s credit and charge card payments market is poised for continued expansion. The ongoing shift from cash to electronic payments, availability of pricing benefits on credit and charge cards and increasing merchant acceptance are expected to further boost credit and charge card usage. The credit and charge card market are expected to grow at a CAGR of 11.5% between 2025 and 2029 to reach INR39.3 trillion ($470.1 billion) in 2029.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: