India’s card payments market is set to grow by 23.6% to reach INR26.9 trillion ($361.6 billion) in 2023, driven by rising consumer spending, says GlobalData, a leading data and analytics company.

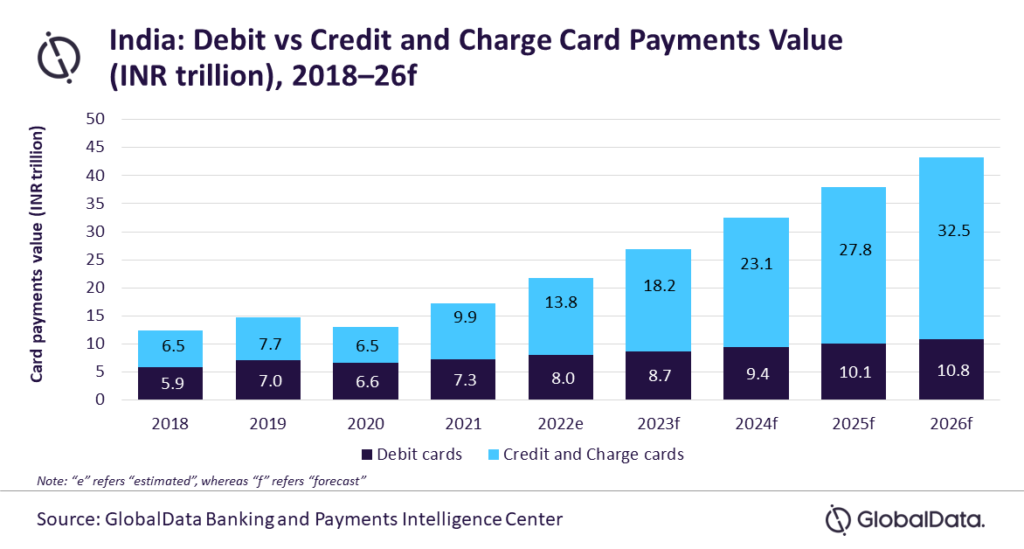

GlobalData’s Payment Cards Analytics reveals that card payments value in India registered a strong growth of 26.7% in 2022, supported by improving economic conditions. This trend is expected to continue in 2023 and India’s card payments market is set to grow at a compound annual growth rate (CAGR) of 18.7% between 2022 and 2026 to reach INR43.3 trillion ($581.1 billion) in 2026.

Kartik Challa, Senior Banking and Payments Analyst at GlobalData, comments: “India, which is primarily a cash-driven economy, made robust progress in the adoption and usage of card payments supported by consumers’ increasing preference for electronic payments, improvement in payment infrastructure, and constant efforts by financial authorities to increase financial inclusion and boost cashless payments.”

The introduction of low-cost banking services under Pradhan Mantri Jan Dhan Yojana (PMJDY) program, the appointment of banking correspondents to serve the remote population, the launch of payments banks, and the reduction of merchant fees on card-based payments are some of the initiatives from the government and the central bank that led to rise in card payments in the past few years.

The post-pandemic recovery in card payments is mainly driven by credit and charge cards, with this card category growing by 39.2% in 2022, as consumer spending increased on travel, accommodation, restaurants, and transportation. Regular benefits such as loyalty programs, discounts, and availability of instalment facilities are also aiding the rise in credit and charge card usage.

Debit card payments are also on the rise albeit at a slightly slower rate of 9.7% in 2022, supported by the migration of low-value cash transactions to debit cards.

Kartik adds: “The same trend is expected to continue in 2023, with credit and charge card payments expected to drive total card payments growth.”

The card payments market, however, is witnessing some hiccups due to rising inflation rate as the country’s central bank is on an interest rate hike path to control inflation. The repo rate was increased in phases to 6.50% in February 2023 from 4.40% in May 2022, making credit costlier for consumers.

Challa concludes: “Card payments in India have been driven by a strong revival in the economy, the opening-up of businesses, and a post-pandemic rise in consumer spending. Although inflation and rising interest rates pose some challenges in the short run, they are unlikely to disrupt the overall growth trajectory of India’s card payments market.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: