Increased interest in cryptoassets among UK customers – 2.3 million adults now hold cryptoassets (4,4%). About half of crypto users plan to buy more.

Consumers are now less likely to cite cryptocurrency as a gamble when considering their reasons for purchase (agreement down 9 points to 38%) and are more likely to see them as an alternative or complement to mainstream investments. Consumers who are persuaded by adverts are much more likely to regret their purchase.

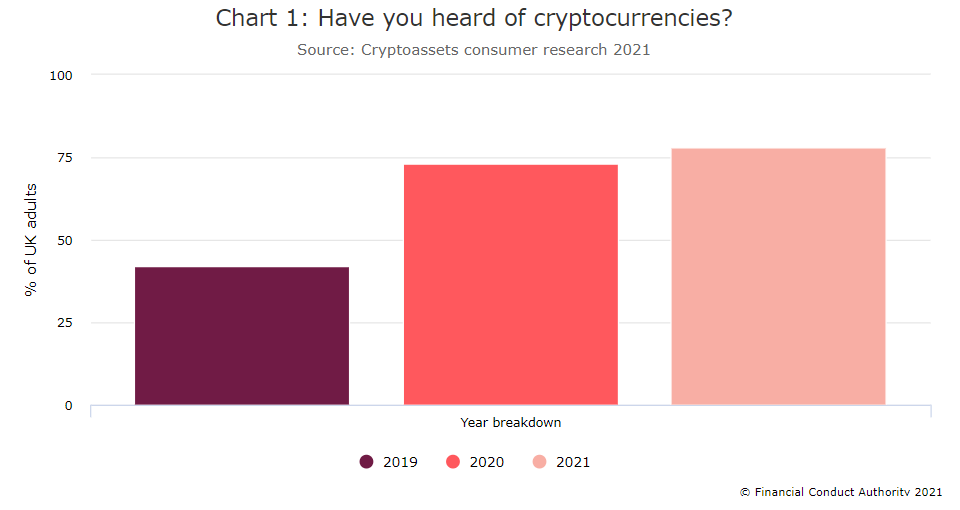

Research published by the Financial Conduct Authority (FCA) estimates that 2.3 million adults now hold cryptoassets (up from 1.9 million last year). 78% of adults have now heard of cryptoassets, up from 73% in a year. For this year’s study the UK population was taken to be approximately 52 million, while in 2020 it was taken to be around 50 million.

Two thirds (66%) of crypto users hold Bitcoin, up 3pp. The next most popular currencies showed little change, including Ethereum (35%), Litecoin (21%), XRP/Ripple (18%), and Bitcoin Cash (15%).

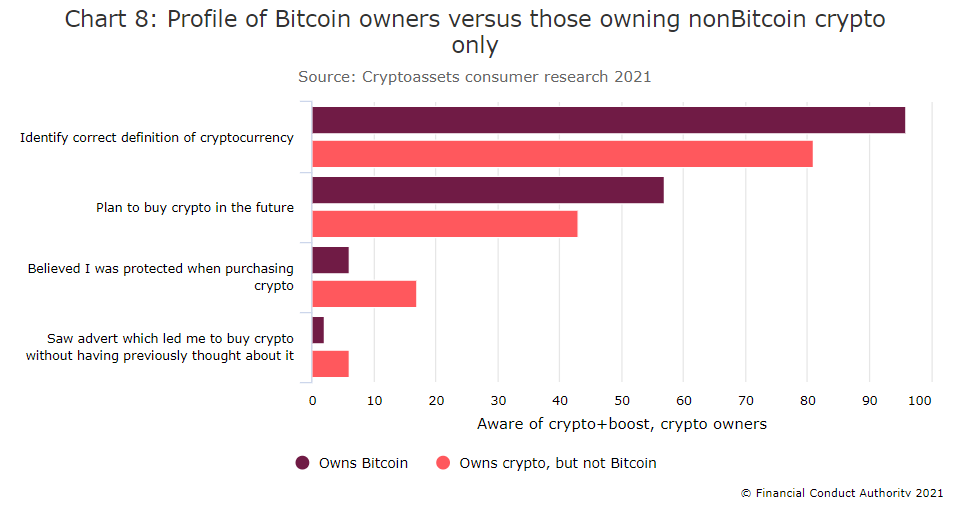

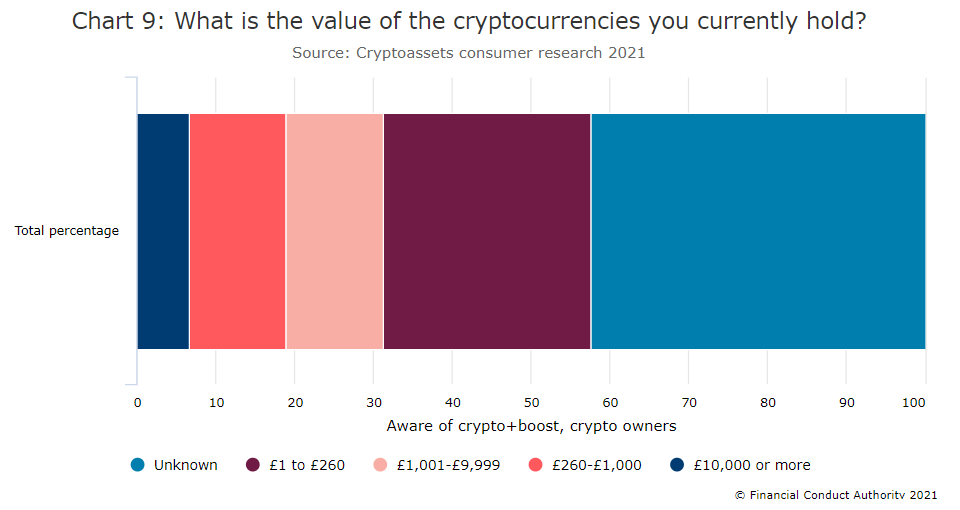

The level of understanding of cryptocurrencies is declining, suggesting that some crypto users may not fully understand what they are buying. Median holdings have risen (up from £260 to £300) in a strong period of price increases, but the profile of cryptocurrency owners has not changed substantially – the population remains largely male (78%), with 70% over 35 and 47% are within the AB social grade

However, the consumer research shows that attitudes have shifted, as cryptocurrencies appear to have become more normalised – fewer crypto users regard them as a gamble (38%, down from 47%) and more see them as an alternative or complement to mainstream investments, with half of crypto users saying they intend to invest more.

By contrast, the level of overall understanding of cryptocurrencies is declining, suggesting that some people who have heard of crypto may not fully understand, with only 71% correctly identified the definition of cryptocurrency from a list of statements.

Enthusiasm for cryptoassets is growing with over half of crypto users saying they have had a positive experience so far and are likely to buy more (rising from 41% to 53%). Fewer people also regret having bought cryptocurrencies, down from 15% to 11%.

Most consumers continue to use an exchange to purchase their cryptocurrency and use their own disposable income to pay for it. More consumers are checking their balances every day (up from 13% to 29%).

About half of crypto users plan to buy more; a similar proportion say they ‘know they’ll make money at some point’. There are limited signs of enthusiasm or understanding for stablecoins as 46% of crypto users are unclear on their benefits.

1 in 10 who had heard of cryptocurrency said they are aware of consumer warnings on the FCA website. Of these, 43% said they were discouraged from buying crypto. Most consumers recognise that crypto investments are not protected, although 12% of crypto users believe otherwise.

Sheldon Mills, FCA’s Executive Director, Consumers and Competition said: ‘The research highlights increased interest in cryptoassets among UK customers. The market has continued to grow, and some investors have benefitted as prices have risen. However it is important for customers to understand that because these products are largely unregulated that if something goes wrong they are unlikely to have access to the FSCS or the Financial Ombudsman Service. If consumers invest in these types of products, they should be prepared to lose all their money.’

Over the last decade, cryptocurrencies such as Bitcoin and Ethereum have provided high, if volatile, returns. In a low interest-rate environment, many consumers have realised substantial gains.

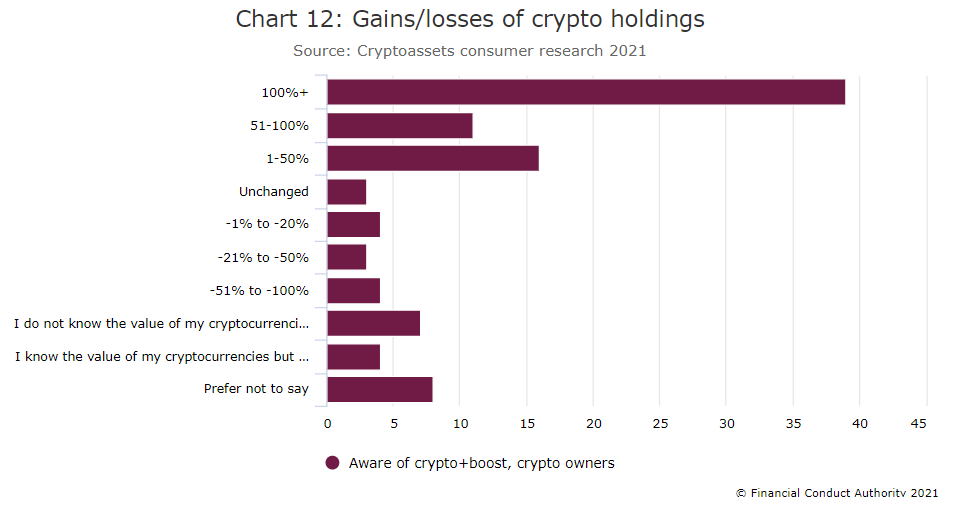

In chart 12 we see 2 in 3 (66%) of crypto owners report a positive return on their crypto investment and only 11% report a loss.

______________

The research is the FCA’s fourth consumer research publication on cryptoassets ownership. It is part of the FCA’s strategy to develop its thinking on the potential harms and benefits to consumers from cryptoassets and help better understand consumers’ attitudes and patterns of use.

During that period the FCA issued further consumer warnings, stating that investing in cryptoassets is high risk and that investors should be prepared to lose all their money.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: