In 10 years, banking will look like a sci-fi film

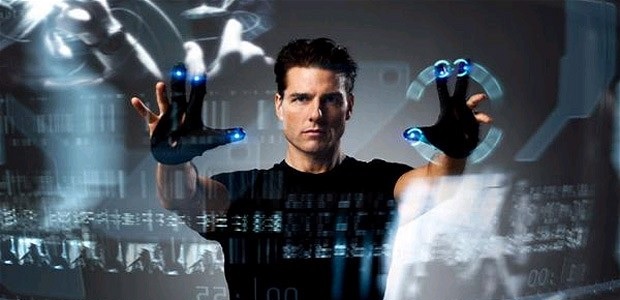

Future technologies could lead to personalised shopping assistance, highly specific help building your business, and the type of financial advice currently only available to billionaires. Scenes from the film Minority Report (photo) could be closer than you think, as banks use data to send customers highly personalised adverts and offers, writes The Telegraph.

In the 2002 film Minority Report, Tom Cruise’s character is confronted by personalised adverts on billboards which recognise his face, speaking to him by name to offer a car he might like, or a beer which could tempt him.

When customers carry smartphones everywhere and pay for everything on plastic card or online, their bank can know where they are and what they are doing. If you walk into a shop in 2025, your bank could update you with alternative shops or websites where you could buy the same products more cheaply. It could suggest which account to use for a transaction based on how much money you have.

Or it could even point out that it is a week until payday, and you will run into your overdraft if you buy those shoes because your utilities bill comes out of the account tomorrow.

Currently the bank is using so-called beacon technology which can alert staff when a disabled customer enters the branch, so staff know more about their specific needs immediately. Analysts expects that in future all customers will be able to choose to have this beacon capability, meaning staff will be alerted to their exact financial situation so they can provide a more tailored service more akin to the private banking scene than the mass-market service usually provided on the high street.

RBS has rolled out fingerprint identification for customers with iPhones, and 80pc of those who can use the technology already do so, indicating the enthusiasm for high-tech biometrics.

Carrying phones and watches is not just a means of contacting your bank or proving your identity – it could replace debit and credit cards altogether. As unlikely as it seems right now, at a time when millions of Britons pay for everyday items with the new contactless payments system, some in the industry predict the demise of plastic altogether.

“As smartphone security increases, credit and debit card information will merely be stored on the device, making the actual cards themselves redundant,” Nationwide’s Nick Middleton said in a report for Vocalink, the bank-owned company behind much of the UK’s payments infrastructure. “Beyond this, the potential of facial recognition technology for reducing the friction of paying is huge.”

„If digital innovation is going to change life for shoppers and businesses, it could also come into your home. The balance between convenience and surveillance could be put to the test most dramatically when your own white goods start spending on the credit card.

“Imagine when all devices, from your fridge, to your car, to your washing machine will have a SIM in it, or another form of networked connectivity,” said Anne Boden, chief executive of startup mobile-only bank Starling.

“Could your car insurance be paid for by the mile driven on a daily basis direct from your bank account? A part failed on your washing machine – the part is ordered, the engineer booked and the payment takes place, without the customer having any direct contact with the bank. With smart metering, would your energy bill be on a daily basis, with advice on keeping costs down, and daily billing?”

None of this is to say that traditional banking will disappear entirely in a decade. There will still be thousands of bank branches, and customers will be able to meet bank staff face to face when they want to carry out a complex transaction or take financial advice.

But those branches will be fewer in number and as banks’ focus turns to flashier technology in the years ahead, those who do not want to bank on their mobile will risk missing out on some of the personal attention they want.

Source: The Telegraph

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: