Many ‘decade ahead’ predictions prove unreliable. And Deutsche Bank admits this special edition of Konzept cannot be a perfect crystal ball. Regardless, the bank presents 24 contrarian ideas for how the 2020s may evolve because they believe it is best to be prepared for the unexpected themes that may arise over the coming decade. „After all, if the 2010s have taught us anything it is that the trends of the prior decade are no guide for the decade to come.”, the researcher analysts of Deutsche Bank said.

The end of fiat money? The forces that hold the fiat money system together look fragile, particularly decades of low labour costs. Over the next decade, some of these forces could begin to unravel and demand for alternative currencies, from gold to crypto, could take off.

The end of plastic cards – Many predict the end of cash but there are several reasons why notes and coins will still be around in 2030. Conversely, plastic cards could die out as smartphones and other electronic devices make physical cards obsolete.

The big risk to cards comes from mobile payments. In 2004, mobile payments emerged in China with Alipay. Our survey shows that, today digital wallets are the first method of payment in China. Three main reasons explain mobile payments popularity.

First, the Chinese government has been playing an active role in building a world-class infrastructure to support digitisation. By 2013, China was the world’s largest market for smartphones, e-commerce, and online games with more than six hundred million Internet users.

Against this backdrop, Chinese customers quickly moved from cash to mobile payments, considering it as secure, convenient and reliable. In turn, retailers have embraced mobile payments. In fact, some stores began to accept only mobile payments and refused cash. This led the Chinese central bank to issue a formal notice in 2018 clarifying that renminbi cash is legal tender in China and should not be refused. Elsewhere in Asia, people are skipping cards completely and going straight from cash to mobile payments.

In Europe, mobile payment technology is more recent, with Apple Pay commencing in 2014, while Google Pay and Samsung Pay began in 2015. So far, only eight per cent of people use smartphones to pay but this is primed to take-off over the next five years for two main reasons.

First, the main reasons consumer give for using mobile payments are convenience, speed and the absence of fees. Indeed, a third of people are planning to use mobile payments more in the next six months. Second, retailers are taking note. They cite the primary reason for installing a mobile payment app as being “to fit customer desire”. The key issue is the lack of friction, such as typing in a PIN or handing over cash, which removes a psychological barrier.

Therefore, it is only a matter of time before smartphones make plastic cards an obsolete tool. Those in advanced countries are taking gradual steps towards adoption based on their country’s infrastructure. Meanwhile, Fintech companies and smartphones are resulting in new banking innovations and a fully-fledged new integrated ecosystem is possible. Whether it is through the eager adoption by millennials or the increased digitalisation of countries’ infrastructure, the plastic card could be on its way out over the next decade while people will still be paying with humble notes and coins.

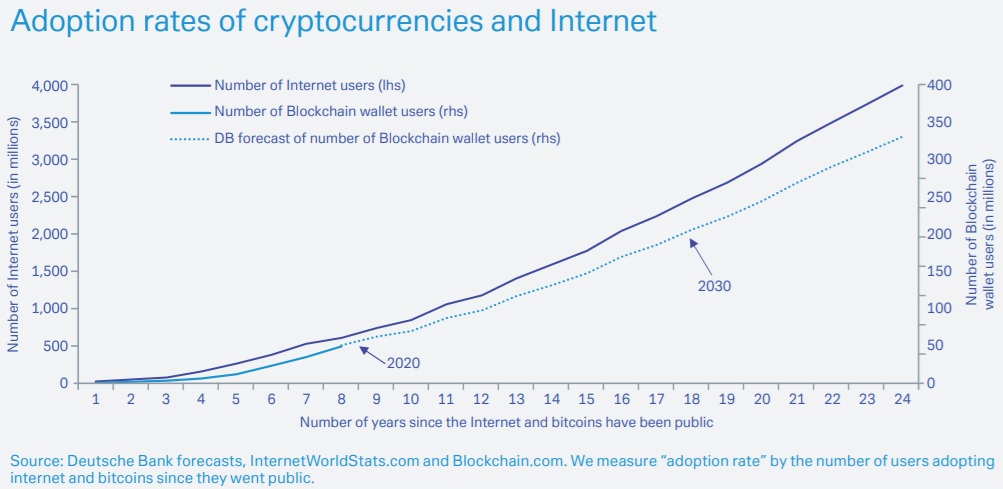

Cryptocurrencies: the 21st century cash – Until now, cryptocurrencies have been additions, rather than substitutes, to the global inventory of money. Over the next decade, this may change. Overcoming regulatory hurdles will broaden their appeal and raise the potential to eventually replace cash.

Cryptocurrencies need to overcome three main hurdles to become widespread. First, they must become legitimate in the eyes of governments and regulators. That means bringing stability to the price and bringing advantages to both merchants and consumers. They must also allow for global reach in the payment market. To do this, alliances must be forged with key stakeholders – mobile apps such as Apple Pay, Google Pay, card providers such as Visa and Mastercard, and retailers, such as Amazon and Walmart. If these challenges can be overcome, the eventual future of cash is at risk.

As we look to the decade ahead, it would not be surprising if a new and mainstream cryptocurrency were to unexpectedly emerge. Some countries with historically-strong banking industries are trialling cryptocurrencies. Separately, cryptocurrencies may constitute the best tool for a digital war. The question is which country will take advantage of being the first to obtain licenses and build alliances. As that occurs, the line between cryptocurrencies, financial institutions, and public & private sectors may become blurred.

How Europe can fix its banks – Over the coming decade, there are five things Europe must do to set its banking system on the correct course so it can support the real economy. It is vital that investors, regulators, and policymakers take note. If not, Europe will likely experience the same economic pain as has Japan over the last two decades. Europe can ill afford to replicate this experience given its current economic situation.

1. Consolidation is necessary but not sufficient – Europe’s banking system is far more fragmented than those in other developed markets, including the US, and the competitive position of banks suffers as a result. If we look at the US, the five largest banks share between them half the assets of all US banks. In contrast, the five largest European banks share less than onequarter of banking assets. This is a key reason why banks should be allowed to merge. This fragmentation leads to structurally lower returns which, in turn, hurts the real economy.

Just one example is the provision of cross-border loans. Just one per cent of European households have a loan through a bank outside their home country and just nine per cent of non financial corporates do. Meanwhile just eight per cent of cross-border deposits in the euro-area come from corporates while almost none are from households. Such a low rate of cross-border financing makes no sense given Europe is supposed to benefit from its single market.

Consolidation will help. That is because banking returns are generally correlated with market concentration.

2. Policymakers need to break down barriers – Consolidation by itself is not sufficient. Policymakers need to break down barriers to create the right structure. They need to take steps to break down the barriers of non-private sector banks to encourage more consolidation both within the sector as well as with private sector banks. These institutions exist with different motivations. They typically have lower market discipline, weaker incentives to prioritise profitability, more limited sources of external capital and, thus, potentially perpetuate the ’bank-sovereign doom loop’.

3. Break the sovereign debt doom loop – If Europe’s banks are to have a productive future, it is essential that any hidden surprises be brought out into the open. In this regard, regulators must reform the rules around sovereign debt, to which European banks are worryingly exposed and prevent the economy from falling into a doom loop. Indeed, the average European bank has sovereign debt exposure equal to 170 per cent of its core tier one capital. That is more than triple the exposure of US banks.

4. Complete the banking union – Without a banking union, the prospects for cross-border consolidation and an integrated banking system are slim. A closer banking union will help break down some of the barriers that currently inhibit consolidation. For example, current European regulations mandate liquidity requirements be met at the subsidiary level in each country rather than at the parent domicile level. The key stumbling block remains the creation of a fully-fledged European Deposit Insurance Scheme. This should be a priority for the coming decade.

5. Europe needs a much more ambitious capital markets union The size of Europe’s banking system introduces a frightening level of risk into the continent’s economy. Indeed, the banking market is 2.7 times larger than the entire eurozone economy, a vivid contrast with the US where the banking market is slightly smaller than the economy. A capital markets union can help mitigate the risks. Indeed, the urgency in developing a better capital markets union becomes all the greater following Brexit given the historical dependence on London as the financial hub of the EU.

There are three ways Europe can create a more ambitious capital markets union. First, create deeper cross-border markets to help reduce ’home bias’. Next, reduce the reliance on the banking system by encouraging alternative market-based sources of finance notably for small and medium enterprises, infrastructure projects, or long term financing. Finally, revive securitisation markets as a source of funding and risk sharing.

For more details download the full Deutsche Bank research report: „Imagine 2030 – The decade ahead”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: