IFC survey: Fintechs should target women customers in emerging markets. They are more loyal, less risky, and more or equally valuable relative to men.

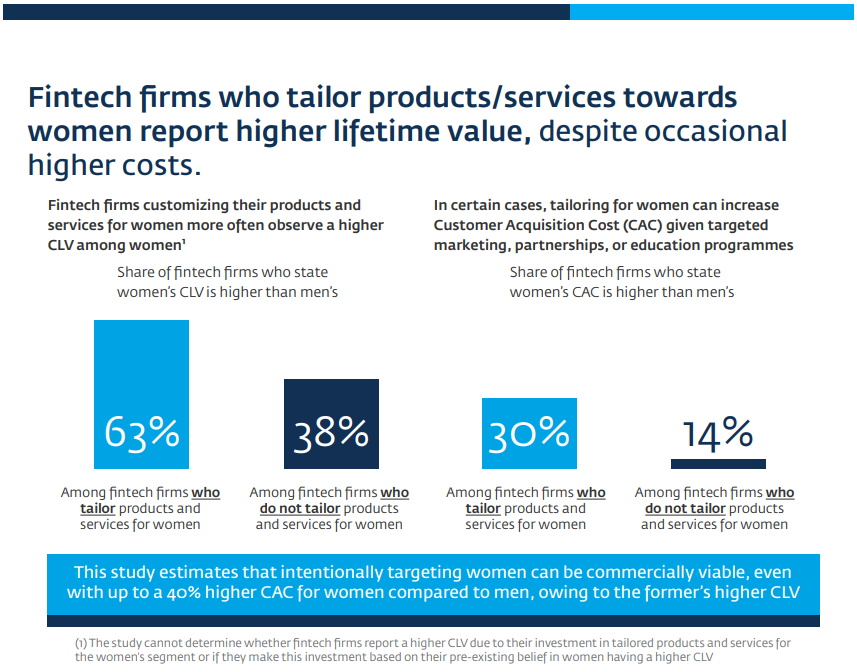

Strong behavioral gender differences, as well as barriers, call for fintech firms to offer differentiated solutions for women. Fintech firms that tailor products/services toward women report higher lifetime value, despite sometimes incurring higher costs.

Fintech firms could do more to intentionally target women customers in emerging markets. According to a new IFC report, by using business strategies informed by analyzing sex-disaggregated data, fintech firms could capitalize on the women’s market while contributing to greater financial inclusion for women.

Fintech and digital financial services have been considered a game-changer for women’s financial inclusion and economic empowerment. Until now, there has been limited research that quantifies the degree to which fintech firms are actively addressing women’s financial inclusion and the specific strategies that are showing success.

To fill this gap, IFC conducted a survey of 114 fintech firms in emerging markets around the globe. The report, Her Fintech Edge: Market Insights for Inclusive Growth, provides insights from fintech firms about their own perceptions and practices to deliver services to women’s customer segments.

„What is clear from this study is that strong behavioral gender differences, as well as barriers, call for fintech firms to offer differentiated solutions for women, said Emmanuel Nyirinkindi – Vice President of Cross-Cutting Solutions, IFC. „In doing so, fintech firms can unlock the full potential of the women’s market – a valuable customer segment that exhibits greater loyalty, lower default rates, and strong revenue generation.”

The survey findings show that women still make up a minority of fintech portfolios, with 63% of the lending-focused fintech firms reporting that women-owned small and medium sized enterprises (SMEs) make up less than a quarter of their portfolio.

Nevertheless, the report highlights that there is a strong business case for fintech firms to serve women customers. The majority of fintech firms consider women to be more loyal, less risky, and more or equally valuable customers than men. The survey found that 69% of lending focused fintech firms believe women’s loyalty is greater than or equal to that of men.

The presence of leaders who have internalized the social or commercial value of serving women is the strongest internal driver for firms intentionally targeting women. The survey found that 58% of firms attribute their strategic focus on women to leaders’ belief in the importance of women’s financial inclusion.

To target women intentionally, the report explains that fintech firms need knowledge, research, financial support, and technical assistance to fully capture the women’s market.

Read the full report here.

__________

IFC’s Banking on Women business provides finance, advisory expertise, and actionable data to financial institutions in emerging markets. The research in the report was funded by the Women Entrepreneurs Finance Initiative (We-Fi), with the specific aim of advancing economic and financial opportunities for women entrepreneurs.

IFC — a member of the World Bank Group — is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2023, IFC committed a record $43.7 billion to private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity as economies grapple with the impacts of global compounding crises.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: