Idea Bank says turning branches into office space for SMBs has proved too popular

Idea Bank, a Polish lender focussed on small businesses, is boasting that the free office facilities that it provides entrepreneurs have proved so popular that it is being forced to close them to non-customers. With branches becoming increasingly irrelevant in a mobile age, last year the bank began refreshing some of its sites, offering firms free access to co-working space, conference rooms, Wi-Fi, office facilities and beverages.

„Demand for Idea Hubs’ unpaid office facilities and conference rooms is so high that Idea Bank – Poland’s most innovative bank, targeting its services at the small and medium-sized enterprise sector – decided to close them off to non-account holders.”, according to the press release.

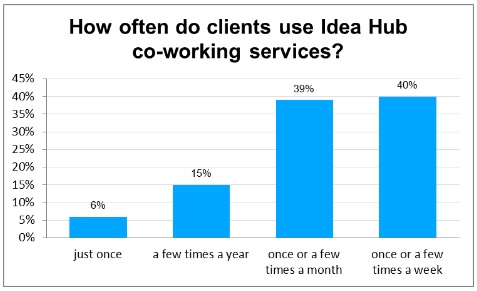

40% of regular visitors use Idea Hubs at least once a week. Only one fifth of all visitors use Idea Hubs the same way they would a typical bank branch. The remaining 81% consider them a place to work, conduct business meetings, attend workshops and training sessions, or engage in various networking activities – shows a survey by Idea Bank. The sample consisted of 230 clients who visited IB’s experimental branches in the first half of 2016.

The pursuit of free office space

59% of the surveyed Idea Bank’s clients visit Idea Hubs to use the unpaid co-working space, conference rooms, Wi-Fi, office facilities and beverages. 27% also pay close attention to the location of a branch. Other important factors include: pleasant ambiance, interesting design or a desire to visit a much talked-about venue.

In the era of emptying bank branches, it is the frequency of visits to Idea Hubs that’s probably the most surprising. 40% of the respondents use IB’s free co-working facilities at least once (22% – a few times) a week. 79% visit them on a minimum monthly basis. Only 6% have used a Hub just once.

Network is growing

The first Hub, located in Warsaw, was opened in January 2015. Currently there are four similar branches available in the capital city of Poland, including one seasonal venue at the Vistula beach. The Hubs have already rolled out to Kraków, Łódź and Katowice; soon another, eighth branch will be opened in Wrocław, followed by an October launch of the Poznań Hub. The branches are equipped with a total of 43 desks and 9 conference rooms.

Idea Hub in numbers: 22,5 thousand visitors, 55,5 thousand cups of coffee consumed, 111 business workshops, 1 000 trained entrepreneurs, 15,7 thousand fans on Facebook.

It’s a little overcrowded…

‘It’s been a year and a half since we opened the first Warsaw Hub. After its initial success we kept on opening other venues, until we’ve reached a point where the demand for our co-working services is greater than we can meet. It’s time for us to verify our hospitality policy’, offers Dominik Fajbusiewicz, Idea Bank board member and the creator of Idea Hubs. Up to now, the bank’s co-working facilities were available to anyone interested. One could simply come in, have a cup of coffee, and take a seat in the co-working zone. Only the free Wi-Fi and conference rooms were reserved for the bank’s clients. ‘That was our strategy back then; we wanted to popularize the Hubs, fill them with entrepreneurs and freelancers, make them visible in the cityscape. But today’s daily agenda is that clients come to Hubs and cannot find a place to sit’, sums up Dominik Fajbusiewicz.

Hence the decision to close off Idea Hubs. ‘We offer a lot at no charge. We want the Hubs to be an added value, our clients’ prerogative’, informs the creator of IB’s innovative branches. Curiously, it was the clients themselves who suggested such a solution. As account-holders, they wanted to feel special. They also pointed out that working in a more controlled environment would affect their sense of security in a positive way.

PLN 1050 saved a month on office space

In September visitors to Idea Hubs will be informed about IB’s new policy. With the beginning of October free office space will become available only to the bank’s clients, though this decision will not impose any costs on non-account holders determined to use the Hubs anyway – the bank has a wide portfolio of unpaid accounts. Entrepreneurs find using IB’s services highly beneficial. A survey carried out by Idea Bank in 2015 amongst 300 sole proprietors showed that 65% of them have no place to conduct business meetings. Moreover, the average amount spent by entrepreneurs on office space is PLN 1050 a month.

Bookings made via Idea Cloud

In October, a new ‘Co-working’ tab will appear in the Idea Cloud e-banking system, featuring a calendar and a desk booking tool. Early reservation will be the only way for an entrepreneur to ensure an unoccupied seat at the Hub. SME owners already use Idea Cloud to book the conference rooms – curiously, their occupancy rate is so high (90%), that Idea Bank considers opening a Hub only equipped with conference-oriented facilities.

Popularity of both the co-working space and conference rooms is highly satisfying, but it would be far too insignificant for the bank to consider the Hubs profitable. The project’s business effects are a lot more important – and they are impressive as well. Idea Hubbers open twice as many bank accounts as visitors to regular branches, and the experimental branches report four times higher sales of Tax Care accounting subscriptions.

Source: Idea Bank Poland

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: