Idea Bank launches Webdepo, an online savings platform for any EU bank customer

Idea Bank, part of the Polish finance group Getin Holding, launches an online savings platform through which any novel, even if it is not a customer of the bank, can make a deposit by a simple bank transfer from a current account open to all EU banks.

Idea Bank’s WebDepo savings platform enables any banked customer, whether he has a current account on Idea Bank or not, to place his money online at prices above the market group.

The client determines the amount he / she wants to pay in the deposit and due date.

The customer can open online payment from home, any time, with no need to go to the bank, as long as he has an account with any bank, thus identified, under the NBR rules, by a financial institution. He / she only needs this step of the Identity Act.

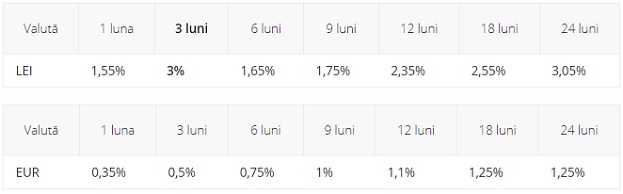

In order to make the deposit, the customer must transfer the money to Idea WebDepo from all running accounts opened with another EU bank. In the first three months, it will generate one 3% interest rate per year. Thereafter, the interest rate on other maturities is as follows*:

* Preferential interest rates apply to the first set-up by Idea :: WebDepo, the default (standard) interest applies at renewal.

* Preferential interest rates apply to the first set-up by Idea :: WebDepo, the default (standard) interest applies at renewal.

In addition, the bank states that it will not charge a commission to set up, administer or withdraw money from the deposit.

„Diversification of online distribution channels is a key strategy for the development of the Idea Bank. The webdepo platform, alongside the Desired Counter are such online channels for exclusive distribution (unconditional of the earlier opening of an online account) of the two categories of basic banking products offered to individuals: deposits and loans. The new WebDepo platform is an important step in opening to individuals, Romanian citizens, with a running account at a bank in the EU. Convenience, advantageous interest and zero commissions are the main benefits which turns WebDepo into a unique offer on the Romanian banking market, „said Alin Daniel Fodoroiu, vice president.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: