IBM launches cross-border payments system called „Blockchain World Wire”

IBM officially launch their much anticipated Universal Payments System as ‘IBM Blockchain World Wire’. Using blockchain technology and the Stellar protocol, IBM Blockchain World Wire makes it possible for financial institutions to clear and settle cross-border payments in seconds.’

Benefits of ‘Word Wire’ include faster payment processing (simultaneous clearing and settlement), lower costs, increased efficiency and simplified payment and asset type form of transaction. With 97% of the world’s largest banks as clients of IBM there remains little doubt that their new flagship payments system won’t be heavily advertised to their existing customer and client base.

The underlying process of exactly what occurs during these cross-border transactions is explained, and uncovers further exciting revelations. ‘Central bank digital currency’, for example, is suggested as one type of digital asset on the network to be used for these new cross border payments.

How IBM Blockchain World Wire works

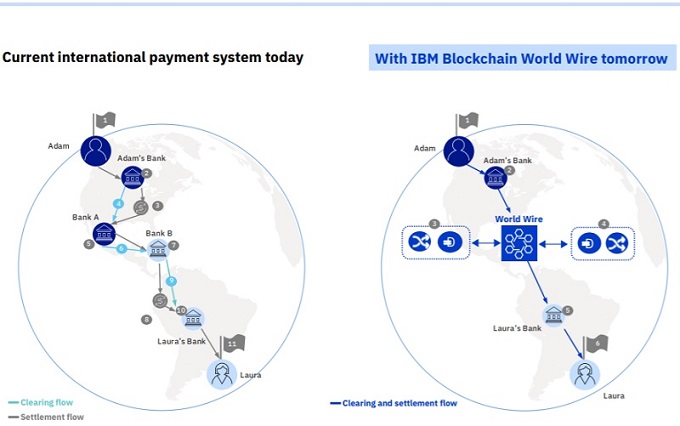

Sending money across borders today requires a series of intermediaries for both clearing and settlement, each adding time and cost to the process. With IBM Blockchain World Wire, clearing and settlement with finality happens in near real-time. The solution uses digital assets to settle transactions — serving as an agreed-upon store of value exchanged between parties — as well as integrating payment instruction messages. It all means funds can now be transferred at a fraction of the cost and time of traditional correspondent banking.

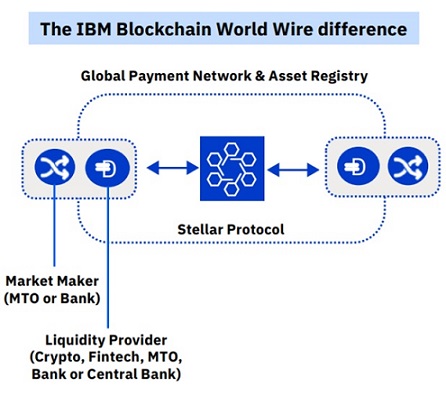

Two financial institutions transacting together agree to use a stable coin, central bank digital currency or other digital asset as the bridge asset between any two fiat currencies. The digital asset facilitates the trade and supplies important settlement instructions. (For those preferring to avoid the use of digital currencies, IBM also provides alternative settlement methods.)

The institutions use their existing payment systems – seamlessly connected to World Wire’s APIs – to convert the first fiat currency into the digital asset.

World Wire then simultaneously converts the digital asset into the second fiat currency, completing the transaction. All transaction details are recorded onto an immutable blockchain for clearing.

Earlier in 2018, IBM has partnered with US-based settlement, processing and data solutions provider CLS to work on a proof of concept for a DLT financial platform.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: