Human bankers are losing to robots as Nordea sets a new standard

Something interesting happened in Swedish finance last quarter. The only big bank that managed to cut costs also happens to be behind one of the industry’s boldest plans to replace humans with automation.

Nordea Bank AB, whose Chief Executive Officer Casper von Koskull says his industry might only have half its current human workforce a decade from now, is cutting 6,000 of those jobs. Von Koskull says the adjustment is the only way to stay competitive in the future, with automation and robots taking over from people in everything from asset management to answering calls from retail clients, according to Bloomberg.

While many in the finance industry have struggled to digest that message, the latest set of bank results in Sweden suggests that executives in one of the planet’s most technologically advanced corners are drawing inspiration from Nordea.

At SEB AB, CEO Johan Torgeby now says that “whatever can be automated will be automated.”

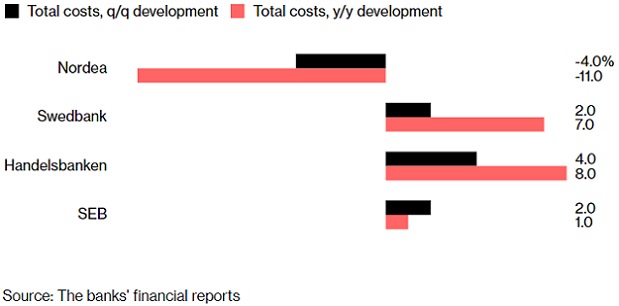

Standing Out

Nordea was the only Swedish bank to report a drop in second-quarter costs

Nordea, which is the only global systemically important bank in the Nordic region, saw total costs drop 11 percent in the second quarter from a year earlier as staff numbers fell 8 percent to about 29,300. By comparison, Barclays Plc, which has roughly the same market value as Nordea, had almost 80,000 employees at the end of 2017, according to the latest figures. (To be sure, Barclays’s assets are more than twice as big as Nordea’s.)

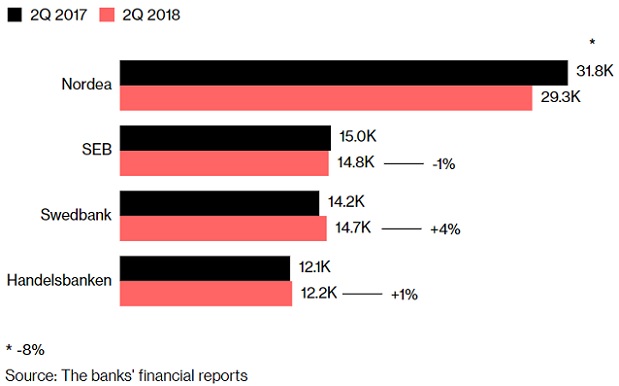

Less Staff

Nordea employee numbers have dropped to the lowest level in five years

SEB, Svenska Handelsbanken AB and Swedbank AB all acknowledge that adding technology is key. But they have different ideas about the extent to which humans need to be replaced by robots and they’ve been far more restrained with job cuts than Nordea. Some banks have even gone on a hiring spree to add technology specialists and computer scientists.

Profit Boost

Nordea had the biggest profit growth among Swedish banks in second quarter

Nordea’s lower costs helped it deliver a 31 percent annual increase in operating profit last quarter, the best performance of Sweden’s four main banks. And after waiting roughly a year for Nordea’s digital plan to pay off, investors were rewarded when the bank’s earnings report triggered the best share-price performance since early February.

Other Swedish banks are now trying to automate more and to do so faster. SEB’s Torgeby says there’s no question that new technology is “impacting customer behaviors and disrupting banks’ existing business models.”

And a bank that had previously stood out for its reluctance to replace branches with automation appears also to be adjusting its approach. Handelsbanken CEO Anders Bouvin now says going more digital will make the bank’s operations more efficient, and he wants management to push through “strategic initiatives for business development and efficiency improvement.”

Handelsbanken plans to unveil more details after the third quarter. Swedish media have reported that the bank’s automation plans may put about 2,000 employees out of work, though Bouvin has so far said he doesn’t want to fire people.

At Swedbank, CEO Birgitte Bonnesen has been looking for ways to automate more services since she took the helm in 2016. The bank, which for almost two years has had a separate digital unit, has also focused on automating mortgage applications.

Cutting Alone

Nordea is the only major Swedish bank that has instigated any big jobcuts

But to date, the only Swedish bank to have seen its headcount go down in any significant way is Nordea. There were about 2,500 fewer people working there at the end of the second quarter than there were a year earlier. Meanwhile, staff numbers at the other three banks were largely unchanged.

Von Koskull says it’s not just finance that has to go through this adjustment.

“We all need to understand that our industry, and many other industries and society, is going through a tremendous change,” he said in an interview earlier this month. And that’s something that “we need to be prepared for.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: