How to avoid digital transformation failures in banking

By Jim Marous, Co-Publisher of The Financial Brand, Owner/CEO of the Digital Banking Report and host of the Banking Transformed podcast

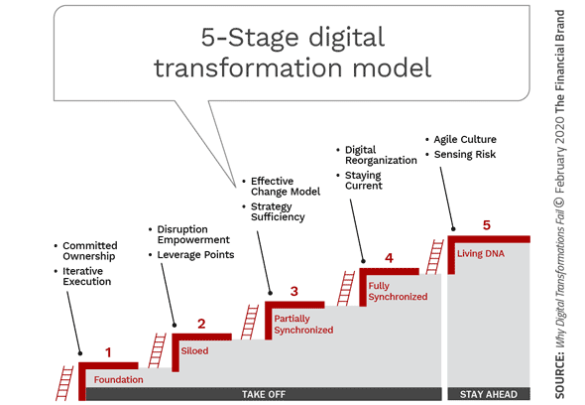

A lack of clear goals and a disciplined process for achieving them can lead to digital transformation failure. According to the author of the book, ‘Why Digital Transformations Fail’, there is a proven five-stage process that can ensure a successful digital transformation at any sized organization.

To understand the dynamics of how to avoid failure with digital transformation, Jim Marous talked with Tony Saldanha, previous head of operations and digital transformation at Procter & Gamble. Today he is President of Transformant, a Cincinnati-based agency focused on digital transformation.

As the author of the book, Why Digital Transformations Fail, Saldanha shares his 5-stage framework that any company can follow to successfully navigate its own digital transformation. In the interview he discusses why the ultimate proof of an organization’s success at digital transformation is its cultural, not technical, rewiring.

Why do digital transformations fail?

Saldanha: 70% of digital transformations fail for one simple reason – lack of discipline. There are two parts to this discipline. One is clarity in defining what you mean by digital transformation. The second is disciplined use of the right goals and the right processes to execute against these goals.

Unfortunately, most digital transformations are still run with IT project management methodology, which misses the need to completely change the culture of the organizations themselves. To address this, I used a checklist methodology that helps to mitigate the 70% failure rate.

Can you describe the 5-stage model?

Saldanha: The first stage is what most people think is digital transformation, but in reality, it is simple automation. The automation of existing work is stage one. It is the foundation of digital transformation, and where many institutions are stuck.

Stage two is what I call “siloed.” This is where parts of an enterprise decide, “Hey, let’s use blockchain for intra-company transfers in finance.” They say, “I’m going to change the way we work, not by 5% or 10%, but by 50% or 90%.” That’s silo change.

Stage three is “partially synchronized,” which is essentially the partial conversion of the entire company. The best example of that is General Electric under a Jeff Immelt, who set about with a vision and got the entire company kind of moving in that direction. The efforts are only partially synchronized because they were not able to execute across the whole company against that vision.

Stage four is what I call “fully synchronized.” That’s when the entire company is able to do a one-time transformation of the business model into the Fourth Industrial Revolution. A good example of that is MapQuest, which still exists. MapQuest was incredibly disruptive in the early 2000s. Today, thanks to GPS and directions being available on every smart phone, MapQuest pretty much became irrelevant. The issue with stage four is that a firm may be able to transform to the latest business model, but the next disruption still catches firms by surprise.

Finally, there is stage five, which is what I call “living DNA.” That’s when the DNA of the organization becomes one of disrupting your own business model over and over again. Netflix is an example of that. They went from mailing DVDs, to streaming media, to an original content model — all within a space of 20 years.

The ability to disrupt yourself has got to be part of the organizational DNA.

Where are most organizations today?

Saldanha: Let’s look at organizations that have a digital transformation agenda, which by the way, isn’t a whole lot of companies. Most are usually at stage two, which is siloed, or stage three, which is partially synchronized. That’s understandable in the sense that they’re just grappling with the fact that they have to do something.

The biggest challenge I see: Most organizations emphasize the digital part of digital transformation and not enough on the transformation itself – which is an organization change, management and HR process. That’s really what’s necessary for many of these companies to go past stage three into stage four and then stage five.

How engaged must top management be?

Saldanha: For CEOs, there is a big difference between leading and having skin in the game when it comes to digital transformation. Here’s what tends to happen, partly driven by the confusion on what exactly digital transformation is. Most CEOs will say, “Oh, we absolutely need to drive digital transformation, therefore I’m going to appoint a digital officer or transformation officer and they’re going to drive all of the change.”

The problem I have with that is that’s involvement, that’s sponsorship, but that’s not a skin in the game commitment. I went back and forth on trying to figure out what word to use along with leadership here, and then I chose “commitment” and then “ownership” and not just “leadership” or “empowerment.”

Is it tougher to transform when ‘times are good’?

Saldanha: Absolutely. It is so true that when there is a burning platform for the industry, nothing focuses the mind like an existential threat. In the financial and banking industry, there is clear awareness of potential disruption, but there isn’t that existential threat.

During the global economic crisis in 2008, banking was hit very, very hard and they made a lot of really good changes there to essentially recover. They recovered very quickly – in two or three years. That type of urgency is needed today, despite positive financial conditions.

What role does data play in the digital transformation process?

Saldanha: A huge, huge role. Many firms are finally understanding that every company is a data company. Wall Street is recognizing data companies, like Amazon, and the valuations of these companies reflects this advantage as it relates to digital transformation.

I define digital transformation in business outcome terms. You’re either creating completely new business models, like selling online instead of just brick and mortar, or you create disruptive business process capabilities like real time closing of books instead of having a mass of people to do that. The third digital transformation outcome is creating digital products like smart toothbrushes or smart cars.

In each of these, data is the common ingredient, because you need to understand data to be able to do smart toothbrushes. You need data to be able to connect the way books are closed in the company or you need data to be able to do electronic selling. Therefore, I think data and advanced analytics together make a commodity that is absolutely invaluable to transformation.

Why do companies fail midway through your 5-stage process?

Saldanha: There are many organizations that take their foot off the pedal. I think part of the reason is the reward mechanism of Wall Street and others that basically are more focused on short-term financial results change as opposed to long-term systemic organization culture change.

There are other companies that “double down” in the middle or later stages. For instance, Amazon declared that they were going to invest $700 million to digitally retrain their staff. That would be very hard for most companies. If Walmart had made that same reserve, they would be hit really, really hard in their stock price. That’s the challenge. I think the difference between the middle stages of digital transformation and the living DNA stage is essentially organizational culture change. That’s an investment that’s really, really hard to quantify for many companies.

How do companies deal with the current talent shortage?

Saldanha: That is a really, really good question. It’s actually one that’s getting a lot of thought and a lot of air time. I serve on MIT’s Work of the Future Task Force. One of the things that we’re trying to figure out is how do we sustainably source this talent? First and foremost, every organization needs to have a digital literacy and a digital change HR plan. Most organizations try and look at their technologists or digital officers to essentially own that strategy. I think there’s equal claim for it to be driven by HR, because it’s a culture change.

In terms of very specific skills like data science, the better strategy for most companies is a part buy and a part grow your own talent proposition. There is a case to be made for getting very, very long-term people development-oriented in this space. Then obviously, that’s not going to meet all the needs. Then you have to have a strategy of buying at retail price in the marketplace.

How do organizations get started?

Saldanha: The first step is for firms to acknowledge that we’re in the midst of the Fourth Industrial Revolution and that there is a need for a different set of strategies than what’s worked in the past. There needs to be an understanding from the very top of organizations that they need to have a disruptive innovation plan and a strategy. In my book, I talk about ten different disciplines and how to go about this one by one, but that’s really where I would start.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: