an article written by Mouloukou Sanoh – CEO and Co-Founder of MANSA, a DeFi protocol that provides liquidity to remittance transactions in emerging markets. Largely neglected by traditional financial institutions, Sub-Saharan Africa now leads the world in the adoption of stablecoins, now accounting for over 50% of the region’s total cryptocurrency transaction volume.

The cross-border payments business continues to boom – and there’s no sign of a slowdown. The industry had a total market size of $190.1 trillion in 2023 and is expected to grow by 8.81% annually, reaching $290 trillion by 2030.

Yet despite these impressive figures, fundamental challenges remain that need to be addressed to help those who rely most heavily on cross-border payments: recipients in emerging markets.

As it stands, payment systems are still heavily skewed towards servicing those in richer nations, while businesses and individuals in emerging markets are faced with long transfer times, high costs or no service at all.

Shortfalls in Cross-Border Payments Systems

There are several reasons for this imbalance. First, traditional payments infrastructure, built before the advent of the internet, is not fit for purpose in the digital world. Dependency on legacy banking systems and intermediaries, such as correspondent banks and money transfer services, adds significant wait times for transactions to clear.

Differences in regional payments infrastructure also hamper payments in emerging markets; sending money internationally can take up to 7 days, and in many cases, it’s impossible to send money at all. This is caused by traditional banks largely avoiding emerging markets, owing to the complexity of ensuring compliance with international, regional, and national anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. Operating in these regions often means dealing with fragmented financial systems, high levels of political and economic instability, and a lack of regulatory clarity.

For banks, the compliance headache often outweighs any potential profits. Setting up the necessary infrastructure to verify the identity of customers, monitor transactions, and comply with other evolving regulations can be both costly and time-consuming. Besides, the risk of being fined for non-compliance is significant, pushing many financial institutions to limit or entirely abandon their involvement in cross-border transactions in emerging markets. As a result, billions of people in developing regions remain unbanked or underbanked, with little access to affordable financial services.

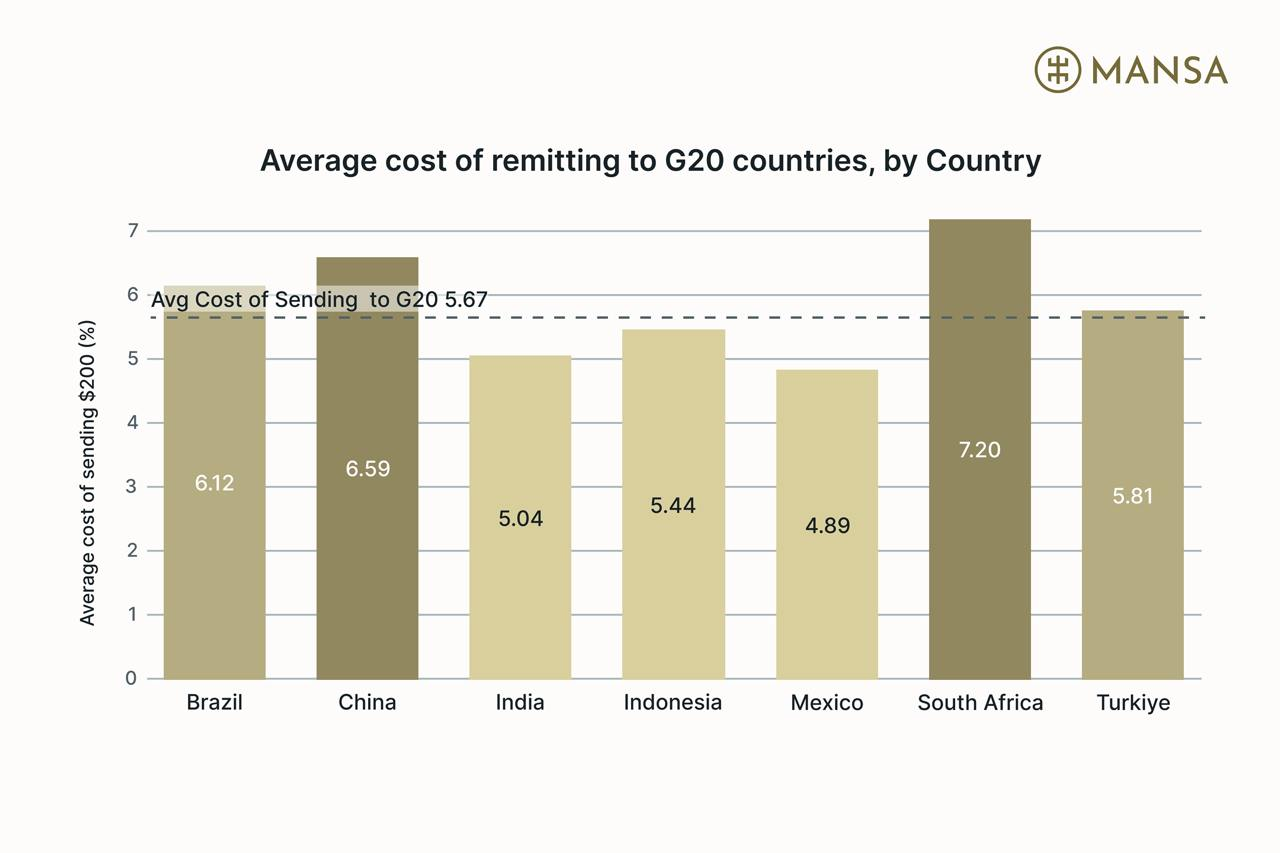

Then there are issues of cost – of which the poorest of regions end up paying the most. For example, on average, 8.2% of a cross-border payment to sub-Saharan Africa is surrendered to fees, making it the most expensive region in the world for remittances and other cross-border payments. Regulatory requirements and currency conversion fees push costs up, making it difficult for the most vulnerable to receive the full value of their money. The transaction fees extract money from local economies, causing a negative knock-on effect for individuals and businesses, stifling economic growth. As the graph below shows, sending $200 in remittances through traditional payment systems to a country in emerging markets, whether in South or North America, Asia or Africa, costs at least $8 (4% of the transaction), with some countries reaching as high as $14 (7% of the transaction).

Fortunately, there’s a solution to all of these hurdles, a solution that can truly democratise access to payments technology that’s fit for use in this century, irrespective of geography – and that’s the use of stablecoins. Leveraging blockchain technology, stablecoins offer a fast and cost-effective alternative that could solve the cross-border payments problem the world over.

The Rise of Stablecoins: A Revolutionary Solution

Stablecoins have become one of crypto’s most popular inventions by allowing fast and cheap global payments. Some have even suggested that stablecoins “could become the greatest experiment in financial empowerment humanity has ever undertaken.”

As cryptocurrencies pegged to stable assets like the US dollar, stablecoins have emerged as a game-changing solution for cross-border payments. Therefore, in contrast to volatile cryptocurrencies including Bitcoin or Ethereum, stablecoins are a dependable pegged store of value, making them ideal for transactions and remittances.

Many of the problems associated with traditional payment systems can be solved by stablecoins:

Transactions with stablecoins can be settled within seconds, not days, regardless of geographic location. This is particularly crucial for families and businesses in emerging markets who rely on daily or weekly payments.

Stablecoins significantly reduce the cost of cross-border transfers. By bypassing traditional intermediaries like banks and money transfer operators, users can send transactions directly from one wallet to another, for a fraction of the cost.

Stablecoins provide access to financial services for unbanked and underbanked populations. All that is required is a smartphone and an internet connection, enabling individuals in remote or underserved areas to participate in the global economy.

Many stablecoin platforms are working closely with regulators to ensure compliance with AML and CTF regulations, reassuring both users and governments that the technology is both secure and compliant.

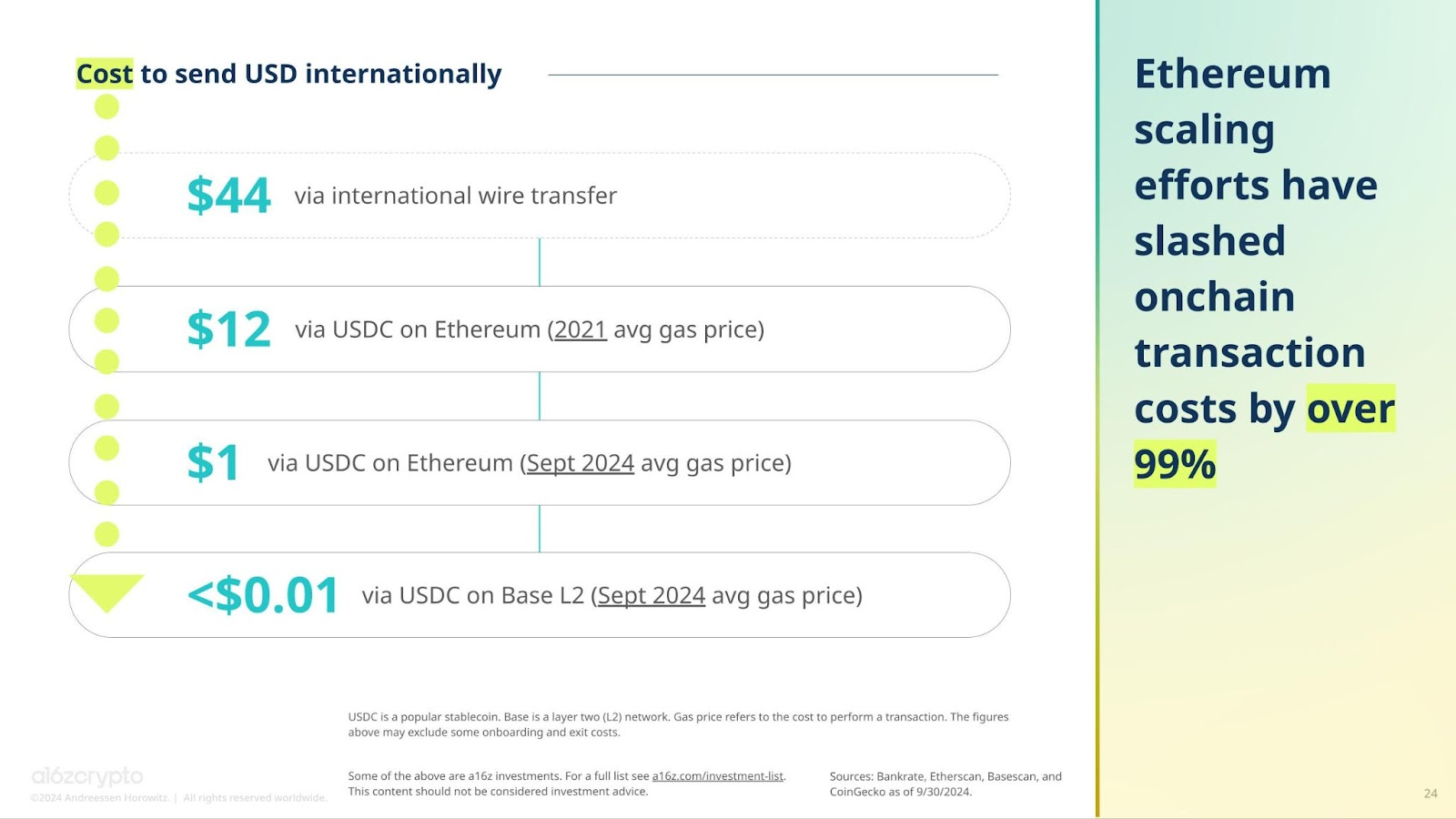

Recent blockchain infrastructure upgrades have further reduced the cost of cryptocurrency transactions by over 99%, making transfers significantly cheaper than traditional payments systems. When coupled with the value-storing attributes of stablecoins, adoption across the cross-border payments industry seems inevitable. For example, sending USDC with Ethereum now costs an average of $1, while the same transaction on Coinbase’s Base network costs under a cent; when compared to the typical $44 necessary for international wire transfers, stablecoins come out on top.

With $8.5 trillion in transaction volumes across 1.1 billion transactions in Q2 2024 alone, over double Visa in the same period, the growth in the stablecoins market speaks for itself. It is not just a temporary craze as stablecoin activity is completely uncorrelated to crypto’s volatile market cycles, proving that stablecoins have now found product-market fit. Overall, the stablecoin market has reached new valuation heights at over $168.5 billion, clearly highlighting growing popularity and increased institutional adoption. Further supporting this statement, stablecoins now represent nearly a third of daily crypto usage at 32% when measured by the share of daily active addresses. This exponential growth can be explained by the ecosystem’s underlying infrastructure advances where blockchains are now able to process over 50 times as many transactions per second as four years ago.

Read the article in full here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: