Blockchain is transforming everything from payments transactions to how money is raised in the private market. Will the traditional banking industry embrace this technology or be replaced by it?

an analysis published by CBInsights

Blockchain technology has received a lot of attention over the last decade, propelling beyond the praise of niche Bitcoin fanatics and into the mainstream conversation of banking experts and investors.

In September 2017, JPMorgan Chase CEO Jamie Dimon derided Bitcoin: “It’s worse than tulip bulbs,” he said, referencing the 17th-century Dutch tulip market bubble. “It won’t end well. Someone is going to get killed.” Lloyd Blankfein, senior chairman of Goldman Sachs, echoed that thought, saying, “Something that moves 20% [overnight] does not feel like a currency. It is a vehicle to perpetrate fraud.”

Despite the skepticism, the question of whether blockchain and decentralized ledger technology (DLT) will replace or revolutionize elements of the banking system remains.

And this very loud and public backlash against cryptocurrencies from banks begs another question: What do banks have to be afraid of? The short answer is “a lot.”

Blockchain technology provides a way for untrusted parties to come to agreement on the state of a database, without using a middleman. By providing a ledger that nobody administers, a blockchain could provide specific financial services — like payments or securitization — without the need for a bank.

Further, blockchain allows for the use of tools like “smart contracts,” self-executing contracts based on the blockchain, which could potentially automate manual processes from compliance and claims processing to distributing the contents of a will.

For use cases that don’t need a high degree of decentralization — but could benefit from better coordination — blockchain’s cousin, “distributed ledger technology (DLT),” could help corporates establish better governance and standards around data sharing and collaboration.

Blockchain technology and DLT have a massive opportunity to disrupt the $5T+ banking industry by disintermediating the key services that banks provide, including: payments, clearance and settlements systems, loans and credit, customer KYC and fraud prevention.

Today, trillions of dollars slosh around the world via an antiquated system of slow payments and added fees.

If you work in San Francisco and want to send part of your paycheck back to your family in London, you might have to pay a $25 flat fee for a wire transfer, and additional fees adding up to 7%. Your bank gets a cut, the receiving bank gets a cut, and you’re charged exchange rate fees. Your family’s bank might not even register the transaction until a week later.

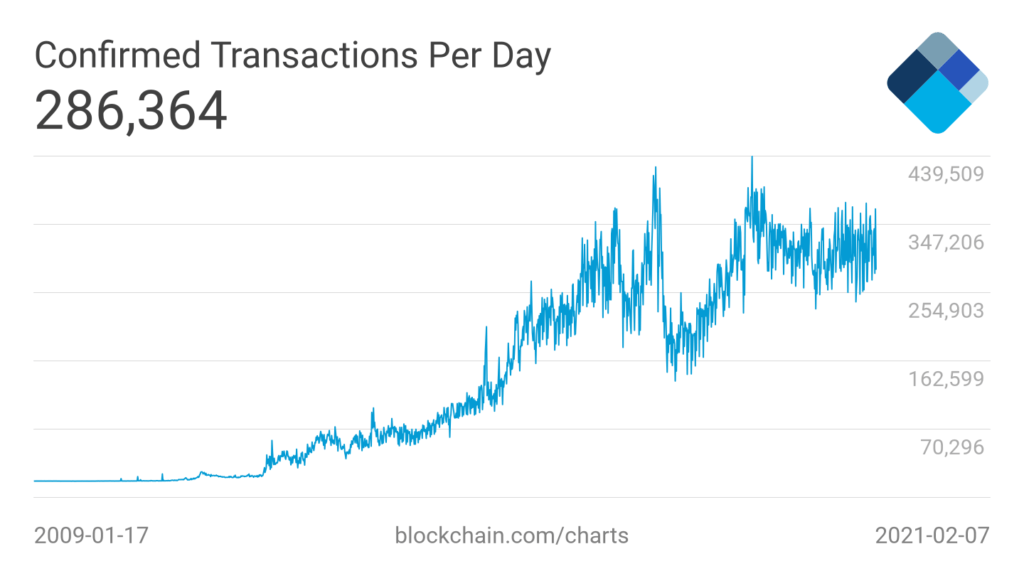

The number of confirmed Bitcoin transactions per day has grown 6x from just over 50,000 in 2014 to over 300,000 as of February 2021. Source: Blockchain

Facilitating payments is highly profitable for banks, providing them with little incentive to lower fees. For instance, cross-border transactions, from payments to letters of credit, generated $224B in payments revenues in 2019.

Cryptocurrencies like bitcoin and ether are built on public blockchains (Bitcoin and Ethereum, respectively) that anyone can use to send and receive money. In this way, public blockchains cut down on the need for trusted third parties to verify transactions and give people around the world access to fast, cheap, and borderless payments.

Bitcoin transactions take 10 minutes on average to settle, although this can lengthen to hours or even days in extreme cases. That’s still not perfect, but it represents a leg up from the average 3-day processing time for bank transfers. And due to their decentralized and complex nature, crypto-based transactions are difficult for governments and regulatory bodies to control, observe, and shut down.

Developers are also working on scaling cheaper solutions to process crypto transactions more quickly. Bitcoin Cash and TRON, for example, have relatively low-priced transactions.

While cryptocurrencies are a long way from completely replacing fiat currencies (like the US dollar) when it comes to payments, the last couple of years have seen mostly upward growth in transaction volume for cryptocurrencies like bitcoin and ether. In fact, the Ethereum network became the first to settle $1T in transactions in one calendar year in 2020.

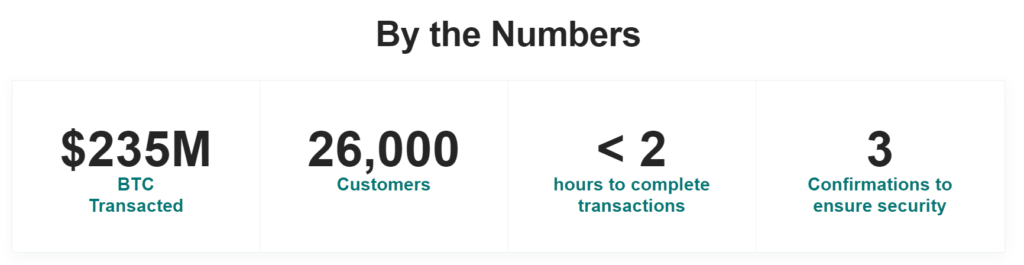

Some companies are using blockchain technology to improve B2B payments in developing economies. One example is BitPesa, which facilitates blockchain-based payments in countries like Kenya, Nigeria, and Uganda. The company has processed millions of dollars in transactions, reportedly growing 20% month-over-month.

Source: BitPesa

BitPesa is also widely used for remittances sent throughout sub-Saharan Africa, the most expensive region in the world for sending money. Crypto payments platforms such as BitPesa have led to a reduction of over 90% in transfer fees in the region.

Blockchain companies are also focusing on enabling businesses to be able to accept cryptocurrencies as payment. For example, BitPay, a payment service provider that helps merchants accept and store bitcoin payments, has a number of integrations with e-commerce platforms like Shopify and WooCommerce.

Ethereum-based payments platform Airfox, which was acquired by Brazil-based retailer Via Varejo in May 2020, has partnered with MasterCard to allow customers to pay using its banQi app at global points of sale, as well as at every Via Varejo location.

HUPAYX, a South Korea-based crypto payments startup, partnered with several South Korean businesses in 2019 to create a payments network. Consumers in the country can now pay using the HUPAYX mobile app and point-of-sale infrastructure at over 400,000 stores, including duty-free stores and shopping complexes.

Blockchain technology is also being used to facilitate micropayments, which represent amounts usually less than a dollar. For instance, SatoshiPay, an online cryptocurrency wallet, allows users to pay tiny amounts to access paid online content on a pay-per-view basis. Users can load their wallet with bitcoin, US dollars, or any other payment token supported by the app.

One big reason behind the coming disruption of the payments industry is the fact that the infrastructure supporting it is just as liable to disruption — the world of clearance and settlements.

The fact that an average bank transfer — as described above — takes 3 days to settle has a lot to do with the way our financial infrastructure was built.

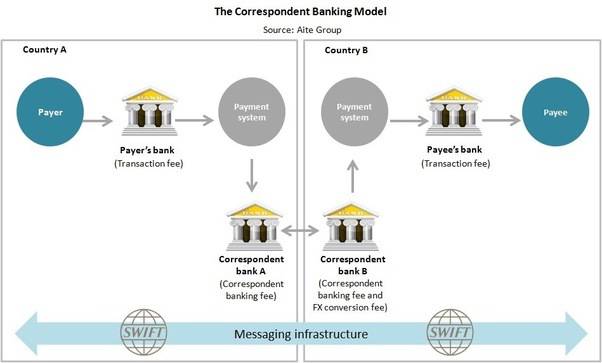

It’s not just a pain for the consumer. Moving money around the world is a logistical nightmare for the banks themselves. Today, a simple bank transfer — from one account to another — has to bypass a complicated system of intermediaries, from correspondent banks to custodial services, before it ever reaches any kind of destination. The two bank balances have to be reconciled across a global financial system, comprised of a wide network of traders, funds, asset managers, and more.

If you want to send money from a UniCredit Banca account in Italy to a Wells Fargo account in the US, the transfer will be executed through the Society for Worldwide Interbank Financial Communication (SWIFT), which sends 37.7M messages a day for more than 11,000 financial institutions.

Source: Aite Group

Because UniCredit Banca and Wells Fargo don’t have an established financial relationship, they have to search the SWIFT network for a correspondent bank that has a relationship with both banks and can settle the transaction — for a fee. Each correspondent bank maintains different ledgers, at the originating bank and the receiving bank, which means that these different ledgers have to be reconciled at the end of the day.

The centralized SWIFT protocol doesn’t actually send the funds, it simply sends the payment orders. The actual money is then processed through a system of intermediaries. Each intermediary adds additional cost to the transaction and creates a potential point of failure. Further, 60% of B2B payments require manual intervention, each taking between 15-20 minutes.

Blockchain technology, which serves as a decentralized “ledger” of transactions, could disrupt this state of play. Rather than using SWIFT to reconcile each financial institution’s ledger, an interbank blockchain could keep track of all transactions publicly and transparently. That means that instead of having to rely on a network of custodial services and correspondent banks, transactions could be settled directly on a public blockchain.

Further, blockchain technology allows for “atomic” transactions, or transactions that clear and settle as soon as a payment is made. This stands in contrast to current banking systems, which clear and settle a transaction days after a payment.

That might help alleviate the high costs of maintaining a global network of correspondent banks. An Accenture survey among 8 global banks found that blockchain technology could bring down the average cost of clearing and settling transactions by $10B annually.

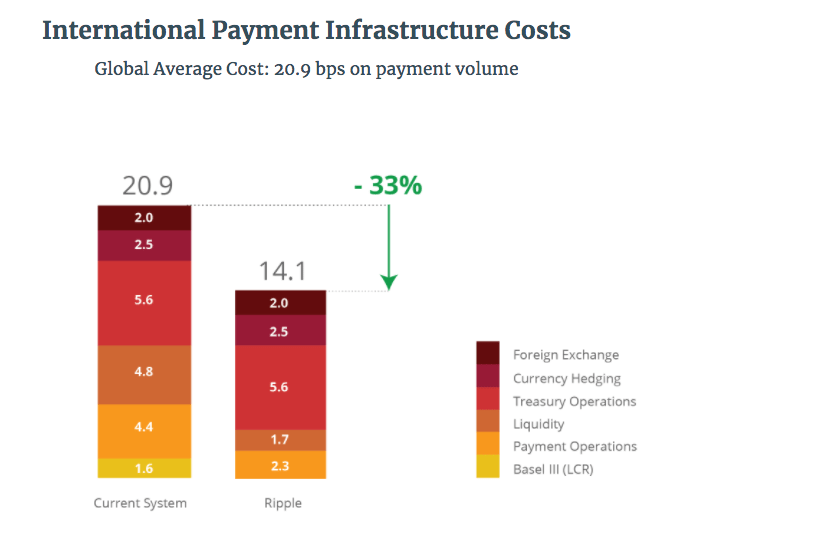

Ripple, an enterprise blockchain services provider, is the most prominent player working on clearance and settlement. While the company is best known for its associated cryptocurrency XRP, the venture-backed company itself is building out blockchain-based solutions for banks to use for clearance and settlement.

SWIFT messages are one-way, much like emails, which mean that transactions can’t be settled until each party has screened the transaction. By integrating directly with a bank’s existing databases and ledgers, Ripple’s xCurrent product provides banks with a faster, two-way communication protocol that permits real-time messaging and settlement. Ripple currently has over 300 customers in over 40 countries signed up to experiment with its blockchain network.

Source: Ripple

Another of Ripple’s products, xRapid, is helping settle cross-border transactions in a shorter period. If a trader in Mexico wants to send money to their counterpart in the US, a traditional bank transaction would require that both traders have local currency accounts in the countries they wish to receive their money in. xRapid removes this requirement. The trader in Mexico can simply use Mexican pesos to buy XRP tokens through the exchange to pay their American counterpart. The US trader can change these XRP tokens for dollars. And this entire transaction can happen in a fraction of a second, Ripple claims.

R3 is another major player working on distributed ledger technology for banks. It aims to be the “new operating system for financial markets.” It raised $107M in May 2017 from a consortium of banks like Bank of America Merrill Lynch and HSBC, although it has also lost some key members, such as Goldman Sachs, which departed because it wanted more operational control over the system.

R3’s technology was used by Switzerland’s central bank for a pilot to settle large transactions between financial institutions using digital currencies. The Swiss National Bank (SNB) said in December 2020 that the project, called Project Helvetia, was a success. While SNB plans to expand the trial to cross-border payments in 2021, it has not yet decided whether to issue its own central bank digital currency.

Projects like Ripple and R3 are working with traditional banks to bring greater efficiency to the sector. They’re looking to decentralize systems on a smaller scale than public blockchains by connecting financial institutions to the same ledger in order to increase efficiency of transactions.

Blockchain projects are doing more than just making existing processes more efficient, however. While still in their early days — and while we continue to see mostly experiments, pilots, and proofs-of-concepts (PoCs) take form — they’re creating entirely new types of financial activity. The fundraising space is a notable example of this.

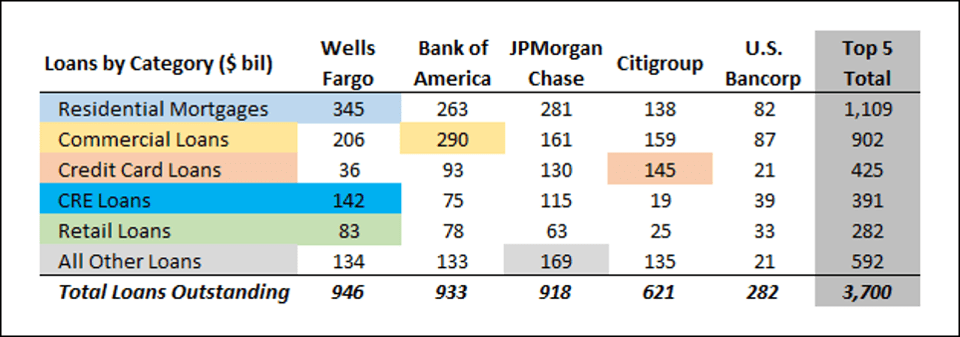

Traditional banks and lenders underwrite loans based on a system of credit reporting. Blockchain technology opens up the possibility of peer-to-peer (P2P) loans, complex programmed loans that can approximate a mortgage or syndicated loan structure, and a faster and more secure loan process in general.

When you fill out an application for a bank loan, the bank has to evaluate the risk that you won’t pay them back. They do this by looking at factors like your credit score, debt-to-income ratio, and home ownership status. To get this information, they have to access your credit report provided by one of three major credit agencies: Experian, TransUnion, and Equifax.

Based on that information, banks price the risk of a default into the fees and interest collected on loans.

The 5 biggest US banks control $3.7T worth of commercial lending.

This centralized system can be hostile to consumers. The Federal Trade Commission (FTC) estimates that one in five Americans have a “potentially material error” in their credit score that negatively impacts their ability to get a loan. Further, concentrating this sensitive information within three institutions creates a lot of vulnerability. The September 2017 Equifax hack exposed the credit information of nearly 150M Americans.

Alternative lending using blockchain technology offers a cheaper, more efficient, and more secure way of making personal loans to a broader pool of consumers. With a cryptographically secure, decentralized registry of historical payments, consumers could apply for loans based on a global credit score.

While blockchain projects in the lending space are still in their infancy, there are a couple of interesting projects out there around P2P loans, credit, and infrastructure.

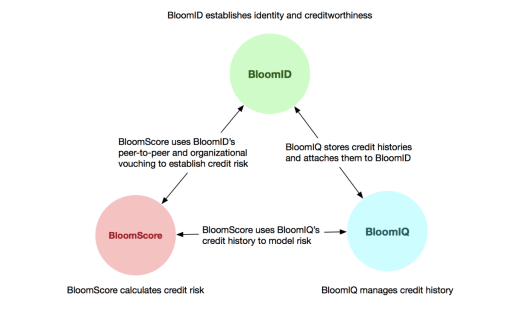

The Bloom protocol seeks to issue credit based on a track record of successful identity attestation on the network, without trusted third parties. Source: Bloom

One company, SALT Lending, lends cash using a blockchain. Users of SALT Lending’s platform can borrow money against any bitcoin, ether, or blockchain asset as collateral. Loans are approved based not on a borrower’s credit score but on the value of the collateral. To use this platform, a user must buy the platform’s cryptocurrency, SALT. This grants a user membership to be able to take out loans.

Another example of improved lending using blockchain comes from Dharma Labs, a protocol for tokenized debt. It aims to provide developers with the tools and standards necessary for building online debt marketplaces.

Meanwhile, Bloom wants to bring credit scoring to the blockchain, and is building a protocol for managing identity, risk, and credit scoring using blockchain technology.

While most of these projects focus on creating liquidity through loans around people’s existing crypto assets, they’re also jumpstarting the infrastructure that will enable bigger disruption in loans via blockchain.

Apart from the day-to-day activities of clearing transactions, processing payments, and trading, a bank also needs to onboard customers, verify their identity, and ensure their information is in order. This process is called “know your customer” (KYC).

Banks can spend up to 3 months executing all KYC proceedings, which include verification of photo IDs, documents such as address proofs, and biometrics. A delayed KYC process may cause some customers to terminate their relationship. According to a Thomson Reuters survey, 12% of companies said that they had changed their bank because of delays in the KYC process.

Apart from time and effort, complying with KYC rules also costs banks money. Banks end up spending up to $500M annually on KYC compliance and customer due diligence.

Blockchain tech can help reduce the human effort and cost involved in KYC compliance. With KYC customer information stored on a blockchain, the decentralized nature of the platform would allow all institutions that require KYC to access that information. Using blockchain for KYC purposes could reduce personnel requirements for banks by 10%, equating to cost savings of up to $160M annually.

Another security process where blockchain can help banks is detecting fraud and cyberattacks.

A rise in fraud and cyberattacks is one of the leading causes of concern for the banking industry, according to BNY Mellon Treasury Services. Since most banks have centralized ledger systems that store all customer information, it becomes easier for hackers to attack and access that information.

By decentralizing the storage of information, blockchain technology helps prevent a hacker from gaining easy access to all information at once.

Another way of ensuring safe transactions online is by using blockchain-based smart contracts. These contracts operate on an “if/then” basis, which means that the next step of the process won’t happen if the prior one hasn’t been completed, allowing for more failsafes in the process of transacting.

Blockchain-based credit scoring platform Bloom allows customers to create blockchain-based profiles using its mobile application. Bloom’s identity monitoring tool, meanwhile, continually scans the internet and the dark web to identify any potential leaks of a customer’s information.

Ripple’s xCurrent also stores customer details on blocks and passes on important information to different banks. This allows for real-time exchange of messages to authenticate customers and transactions, resulting in a quicker settlement of trades.

Similarly, HSBC, Deutsche Bank, and Mitsubishi UFJ Financial Group, in partnership with IBM, have tested a service to share KYC information via blockchain. The project was able to eliminate duplication of effort in collecting the same information by different financial institutions and digitize and store all customer information securely, among other things.

Disruption doesn’t happen overnight, and much of blockchain technology has yet to be perfected or widely tested.

Die-hard believers expect blockchain and cryptocurrencies to replace banks altogether. Others think that blockchain technology will supplement traditional financial infrastructure, making it more efficient.

It remains to be seen to what degree banks embrace the technology. One thing is clear, however: blockchain will indeed transform the industry.

More details here: How Blockchain Could Disrupt Banking

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: