Despite a common perception to the contrary, open banking is one of the (incumbents) banks’ best bets to go on the offensive and find new monetization opportunities, says in a blog post, Panagiotis Kriaris, Head of Business Development at Unzer. He will deliver a keynote speech at the Banking 4.0 international conference.

Let’s take a look.

It’s true that open banking has created for banks new compliance requirements that are eating up resources and attention. What is sometimes not realized though, is that at the same time it opens up a much-needed window of opportunity in a world that is moving at break-neck speed:

— data and APIs are now the building blocks of the new economic model, in which innovation is customer rather than product-driven

— Banks that are not able to properly connect and consume data via APIs, are essentially banned from the innovation that is happening

— The traditional banking model of vertically integrating static products in a closed-loop set-up is no longer a viable option

— The fiercest competition is no longer coming from the inside of the industry but rather from adjacent segments or even from the outside

Adapting to this reality is a one-way street for banks. Here’s how:

— As a starting point, banks need to change their vertically integrated and product-focused approach to an open set-up that is built on integrating third-party and fintech offerings via APIs

— Despite clearly falling outside their comfort zone, the opportunity for banks lies in combining existing elements like trust and customer positioning with new ones like technology and data analytics

— As the ecosystem becomes more advanced and adapts to customer needs, it will become increasingly difficult for banks to go it alone with nothing more than their own apps

— As long as they keep their customers happy, banks do not necessarily have to own everything they offer

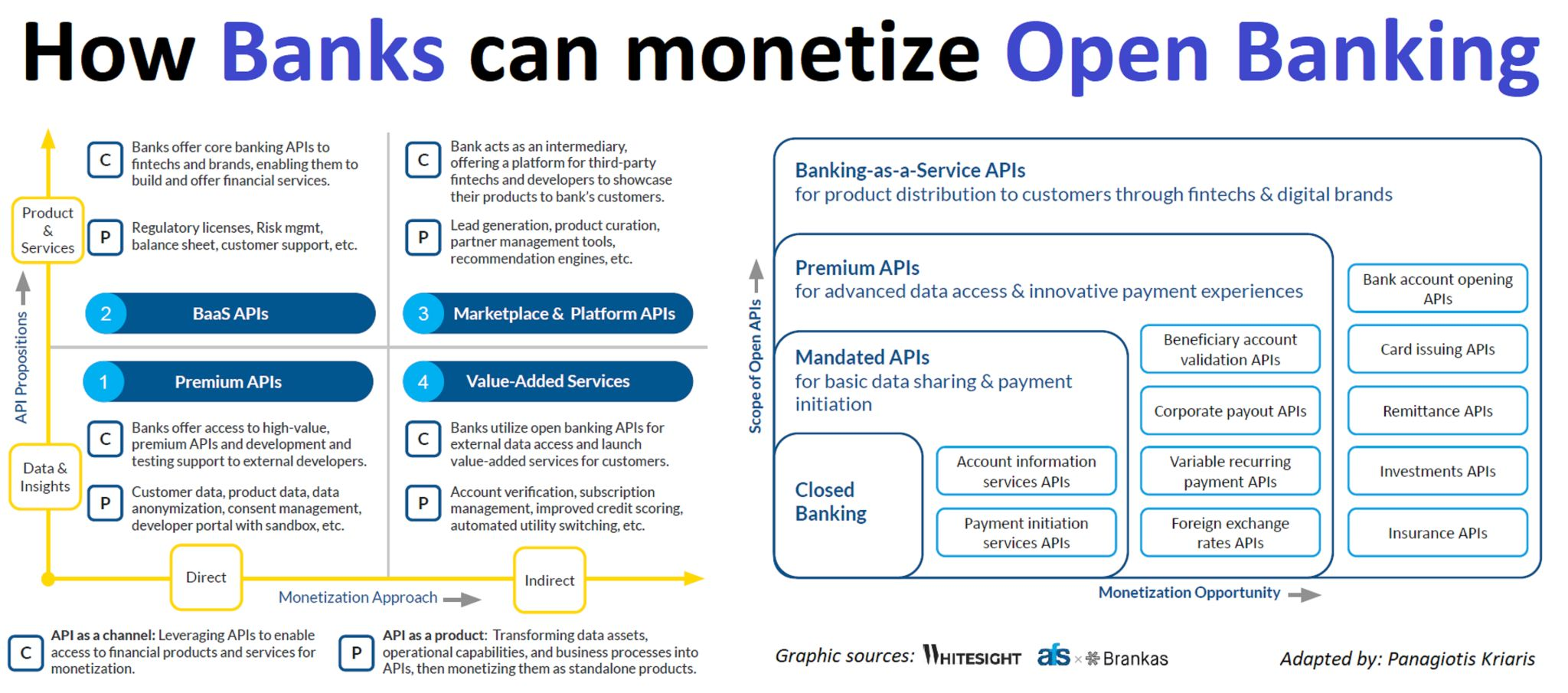

A recent paper from Whitesight, AFS + Brankas has summarized well banks’ monetization opportunities across 4 clusters:

1) Banks work with external developers and incentivize them to use their premium APIs to create innovative solutions while generating revenue from API subscriptions and usage.

2) Banks monetize their license and infrastructure by offering BaaS APIs and services to fintechs, merchants and other third parties.

3) Banks position themselves as intermediaries, offering a platform for third-party fintechs and developers. These marketplace and platform APIs encompass lead generation, product catalog management, partner relationship tools, and recommendation engines. Banks profit by facilitating valuable interactions between fintechs and customers.

4) Banks leverage open banking APIs themselves to build value-added services that improve the customer experience and generate additional revenue streams.

The more successful banks manage to perform in this strategy, the higher up they can move in the new value chain and subsequently the more new revenue sources they can generate.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: