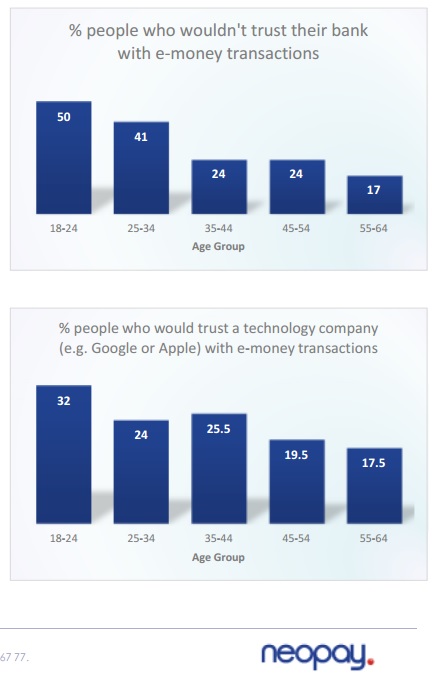

Half of millennial’s don’t trust their high street bank

50% of 18-24 year olds wouldn’t trust the traditional banking system with transactions, according to new research.

The report entitled ‘Are Banks Losing the Innovation Game?’ by financial regulatory framework compliance experts, Neopay, interviewed 2,000 UK adults on their experiences with high street banks and how they felt they fared up when handling money digitally through e-money channels.

Half of youngsters admitted they wouldn’t trust high street banks, while one in three said they would trust a technology company, such as Google or Apple, with their e-money transactions.

The research shows a difference in perceptions from younger to older generations in trusting their bank with e-money transactions. 41% of 25-34 year olds would not trust their bank with such activity, whilst only 24% of 35-44 year olds, 24% of 45-54 year olds, and only 17% of 55-64 year olds expressed concerns in this regard.

However, people who would trust a technology company (e.g. Google or Apple) with e-money transactions ranged from 32% at the younger end of the scale (18-24 year olds) to just 17.5% at the older end of the scale (55-64 year olds).

With processes becoming more automated, only 47% of customers had actually met someone from their bank in person in the last year. Now, consumers are no longer seeing banks as the only option when it comes to managing their financial needs.

Scott Dawson, commercial director at Neopay, commented: “Traditionally, banks have been synonymous with dependability and solidity. However, since the banking crisis, the sturdiness of banks has been cast into doubt. Also, the increasing frequency of scandals, combined with concerns about infrastructure and reliability, and the increase of automated processes have all served to erode trust and undermine the reputation of our banks.

“At the same time, we’ve seen the emergence of new technology companies that are rich with our personal data and are seen to be fueling much of the innovation and growth across the wider economy. Young people still trust banks, just to a much lesser extent than in previous generations. Other providers of financial services, such as apple pay or pre-paid cards are now very much seen as credible alternatives.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: