Granit Bank, the first digital bank in Hungary, launches its operations in Romania. Special offer to new customers by the end of March.

Gránit Bank is a bank licensed in Hungary, and is authorised to provide financial services within the territory of Romania as part of cross-border services. The launch of services in Romania marks the beginning of Granit Bank’s expansion abroad.

For those who want to be among the first customers to open a bank account with a selfie, Granit Bank says that they will receive a bonus amount of up to RON 400 if they open an account until 3/31/2025.

During the opening process, the customers have to accept the Consent to Marketing Purposes. „Until the end of the 3rd calendar month after the opening of the account, a minimum of RON 400 must be credited to your bank account in one sum every month for 3 months, and you must make at least 3 purchases with your bank card every month to be eligible for a bonus amount of up to RON 400.” – the bank explained. Unfortunately, if you want more details, alll you get is a 404 error: „this page could not be found.”

The bank is offering (AER) 3% interest without a fixed deposit. „You will now get 3% instant-access interest on the liquid amount on your Hello Gránit RON account.” The special offer is valid until 3/31/2025.

The instant-access interest rate shows the amount of the interest the bank will pay on the funds in your bank account over a period of one year, calculated daily based on the current (end-of-day) balance of your bank account. The AER stands for the Annual Effective Rate, an indicator of the actual yield on the deposit. The AER shows the amount of interest to be paid out on the deposit over the whole calendar year, i.e. the extent of the return on the investment. The indicator is calculated on the basis of the actual amount to be paid, less costs.

Also, customers can make a fixed deposit online in RON, EUR, HUF, USD, GBP or CHF until 5/15/2025 at what bank calls „favourable interest rates”. Pursuant to Hungarian tax legislation, at maturity, the Bank must deduct 15% as withholding tax both from the instant-access balance of the account and from the interest paid on fixed deposits. The Bank automatically deducts the relevant tax.

„Granit Bank is the first Hungarian bank to launch its cross-border services in Romania, the sixth largest country in the EU by population, where individual customers are characterized by a high degree of digital affinity and where we can offer digital banking services for individuals even without a physical presence. We are confident that the promptness, convenience, and innovative solutions will attract customers in Romania, as they do in Hungary,” said Éva Hegedüs, President and CEO of Gránit Bank.

In its existence of almost 15 years, the Hungarian bank has grown becoming the eighth largest universal bank in the country, with total assets of EUR 3.56 billion and 200,000 account holders. Granit Bank was founded by tycoon Sandor Demjan to support SMEs after the global financial crisis. In 2021, the real estate holding BDPST Zrt, owned by Istvan Tiborcz, acquired a majority stake (57%) in the bank. Istvan Tiborcz is one of the wealthiest businessmen in Hungary and also the son-in-law of prime minister Viktor Orban.

At the end of November 2024, Gránit Bank had deposits of more than HUF 1,114bn and lending stock of HUF 637.5bn. The bank’s market capitalisation is HUF 262.3bn and its shareholders’ equity is HUF 278.7bn.

____________

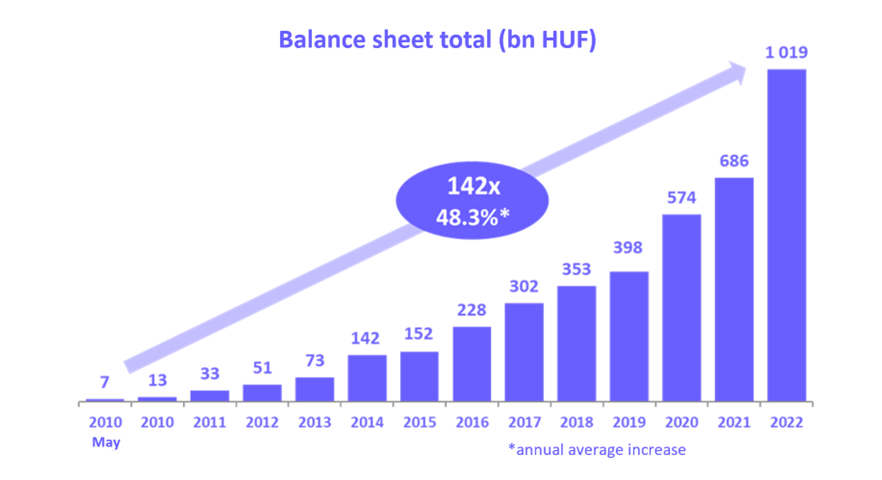

Gránit Bank, a wholly Hungarian-owned financial institution, started its activity as a greenfield bank in May 2010 and has now become the fastest growing and most cost-effective bank in Hungary, mainly due to the fact that it was the first to adopt a digital banking business model in Hungary.

In December 2024, Gránit Bank has completed the largest initial public offering in Hungary in the past 25 years.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: