Finastra’s annual global survey reveals that, despite economic constraints, financial institutions globally continue to invest in artificial intelligence (AI), Banking as a Service (BaaS) and embedded finance.

The ‘Financial Services: State of the Nation Survey 2023’ finds that decision-makers in financial institutions worldwide are excited about the opportunities presented by fast technological and cultural change within the industry today. Nearly nine in ten respondents (87%) are personally excited about the pace of change, while 83% are excited for the opportunities it will bring for their financial institution and 81% for the wider financial services industry.

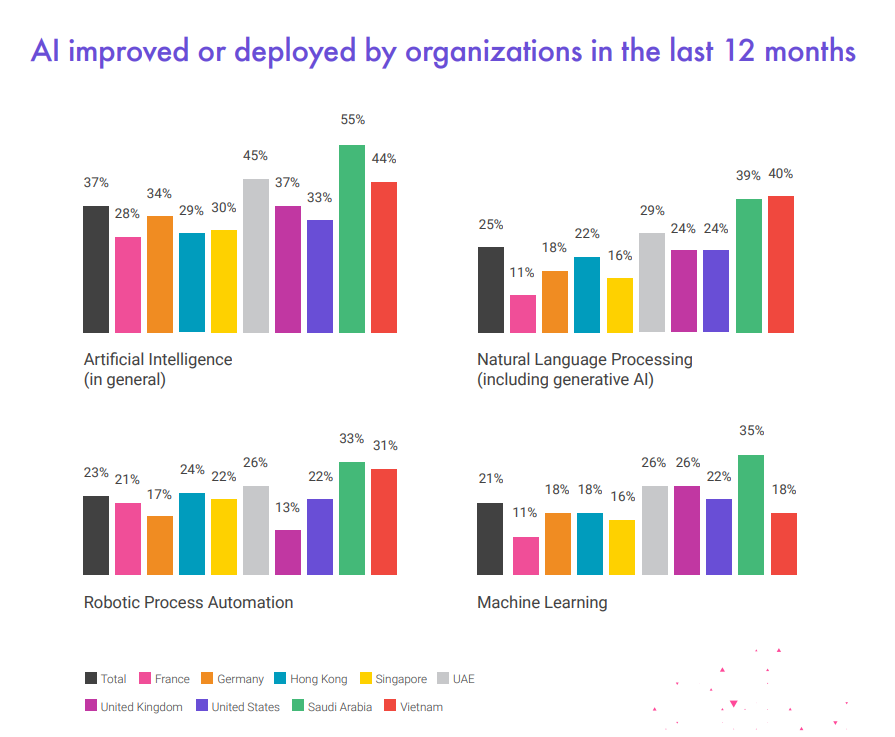

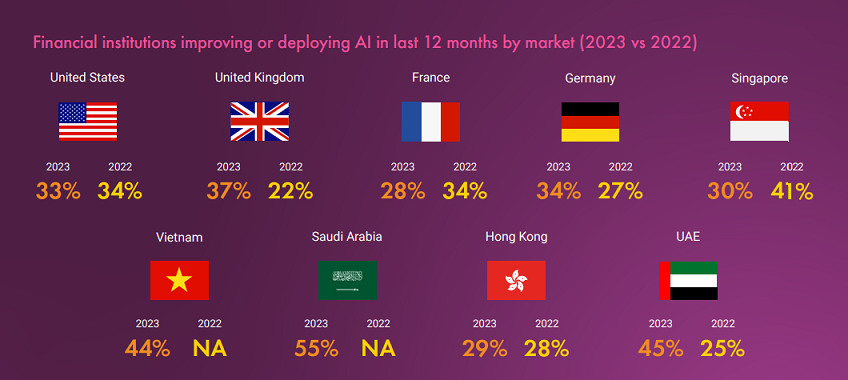

The survey found that financial institutions are rapidly exploring the benefits of AI, with deployment of AI and improvements in AI capabilities increasing notably year-on-year. Globally, 37% of respondents stated that their financial institution had improved or deployed AI technology in the last 12 months, rising from 30% in 2022. The growing importance of generative AI also stands out. More than four fifths (83%) of decision-makers say their institution is interested in the technology, with 26% having already incorporated generative AI in some form. Only 6% of respondents globally say that their financial institution is not interested in adopting the technology.

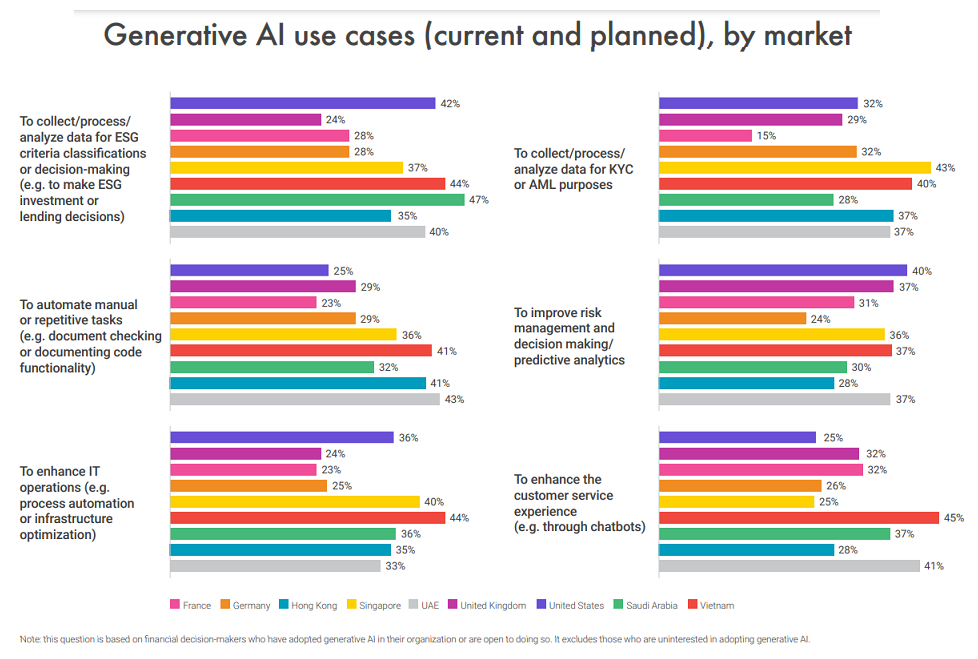

Respondents perceive generative AI as a key means to meet increased customer expectations for tailored, personalized services, with 32% of those interested in the technology saying they will use it in this way.

When asked about specific business areas, the most common use case for generative AI is collecting, processing, and analyzing data for ESG criteria classifications and decision-making. Other widely cited use cases include: automating manual or repetitive tasks; collecting, processing, and analyzing data for KYC or AML purposes; and improving risk management and decision-making processes.

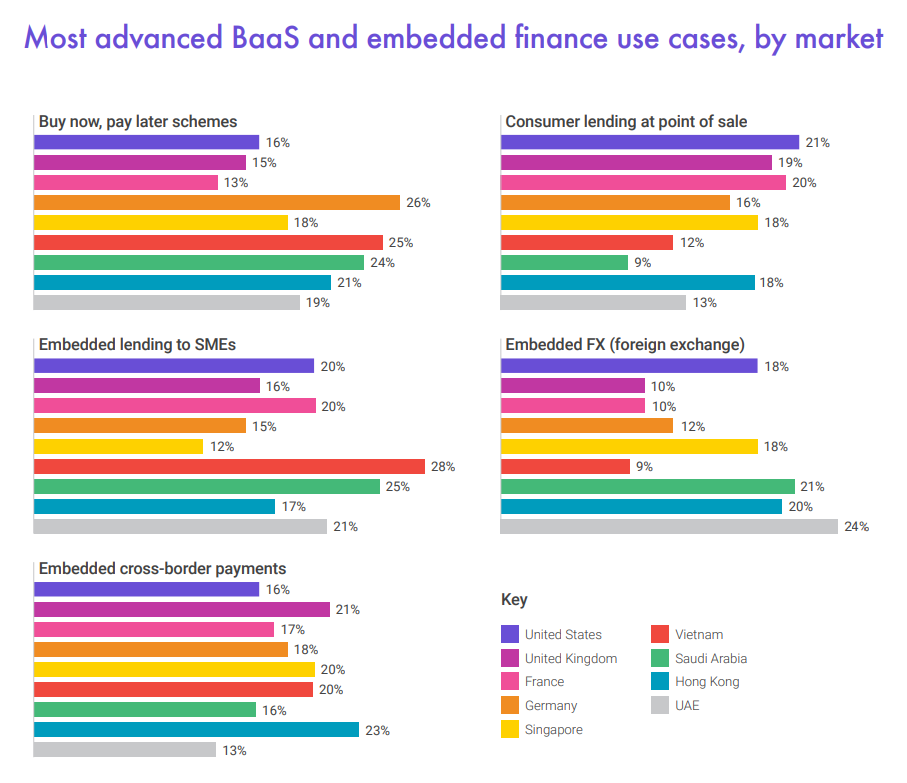

The research, conducted from August to September 2023, canvassed the opinions of 956 professionals at financial institutions and banks across France, Germany, Hong Kong, Singapore, Saudi Arabia, the UAE, UK, US and Vietnam.

Other insights include:

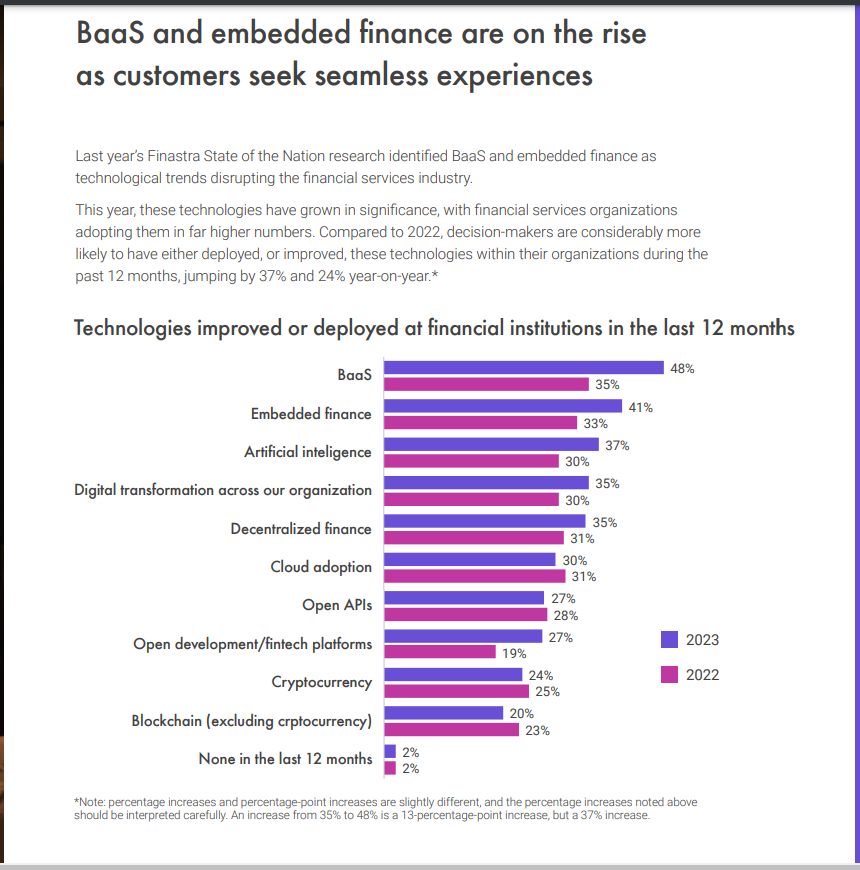

Increased uptake of Banking as a Service: 48% of financial institutions surveyed have either deployed BaaS or improved their capabilities in this area in the last year. This is a sizeable increase from the 35% recorded in 2022. Key use cases globally include buy now pay later schemes, embedded lending and embedded cross-border payments.

Optimism about outlook for tech investment despite current constraints: While 78% of financial institutions surveyed say the current economic climate has constrained their investment in technology, 69% expect their investments to resume in full before the end of H1, 2024.

Agreement that Open Finance is making financial services more collaborative: The vast majority of financial institutions (85%) believe Open Finance is having a positive impact on the industry. In addition, 85% say that at least a quarter of their customers are using Open Banking-enabled services. 46% say that over half of their customers are using them.

Financial institutions are not turning inwards during challenging economic conditions: Instead, decision-makers still believe it is as important as ever to maintain a strong commitment to their communities. 86% of decision-makers believe financial services and the banking sector are about more than just finance and that they have a duty to support the communities they serve.

“Despite the challenging economic climate, it’s clear from our research that investment in AI, BaaS, and embedded finance remain key priorities for financial services organizations over the next 12 months, particularly as they seek to further enhance and personalize the customer experience,” said Simon Paris, Chief Executive Officer at Finastra. “We share the industry’s ongoing commitment to ESG initiatives, to collaboration around Open Finance, and excitement in using advanced technologies like AI to help deliver on the opportunities ahead.”

Access the full report and findings here.

Survey Methodology

A total of 956 professionals (at managerial level) in financial institutions and banks across the US, UK, France, Germany, Hong Kong, Singapore, Saudi Arabia, Vietnam and the UAE were surveyed. These financial institutions represent a gross total of around USD$33 billion in turnover over the last 12 months, employ approximately 2.4 million staff and have approximately 240 million client / customer / member relationships.

As a result of rounding up percentage results, the answers to some questions might not always add up exactly to 100%. Respondents were also able to select more than one answer for some questions.

Comparative analysis was made from results of a similar survey run by Finastra in August 2022 which was also conducted online amongst financial institutions and banks across the same markets, except for Saudi Arabia and Vietnam.

The research was conducted by Savanta via an online panel (August to September 2023).

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: