GlobalData survey: mobile wallet has became a mainstream payment instrument in India – adoption among population of 55%

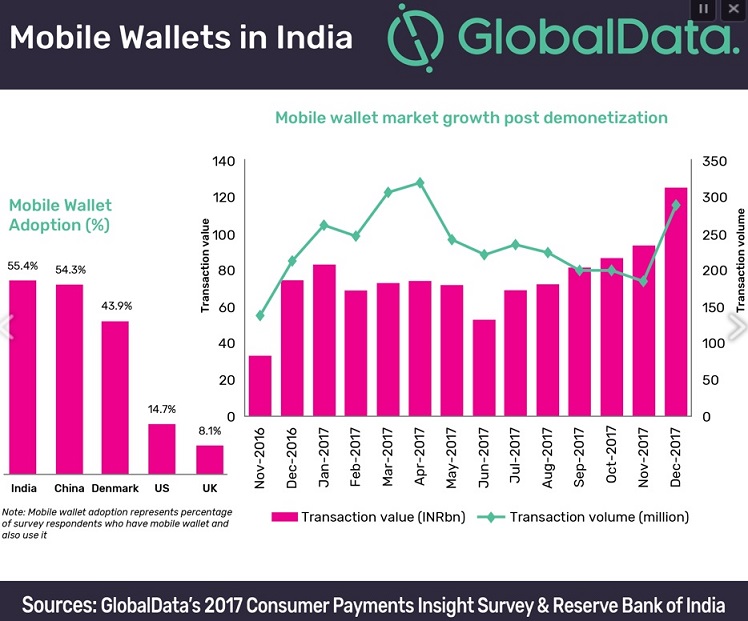

The mobile wallet market in India is poised for significant growth as Indian consumers are increasingly turning away from cash and card, says leading data and analytics company GlobalData. According to the 2017 Consumer Payments Insight Survey by the company, India is one of the top markets globally in terms of mobile wallet adoption with 55.4% survey respondents indicating that they have a mobile wallet and use it. India is followed by China and Denmark.

The adoption level in India is much higher compared to many of the developed markets such as the US and the UK, where consumers predominantly use cards. Mobile wallet transactions grew manifold in last five years, rising from INR24bn in 2013 to INR955bn in 2017, and will surpass INR1tn mark in early 2018.

Ravi Sharma, senior analyst at GlobalData’s Payments practice, comments: “The growth in mobile wallet market is fueled by the government’s policies to promote electronic payments, coupled with rise in smartphone penetration, and improved telecom and payment infrastructure.”

The government’s demonetization move in November 2016 was a game-changer as it had led to a massive cash-crunch in the country as most of the ATMs dried up, compelling people to switch to electronic-mode of payments. While medium to large-value transactions continue to be made through digital banking channels, the low-value day-to-day transactions are carried out through mobile wallets.

The total value of mobile wallet transactions grew two-and-half times between 2016 and 2017. Initially considered as e-commerce payment tool, post demonetization, these wallets are now widely used for day-to-day transactions at supermarkets, grocery stores, street vendors, tea stalls, fuel stations, and even inside taxis and auto-rickshaws.

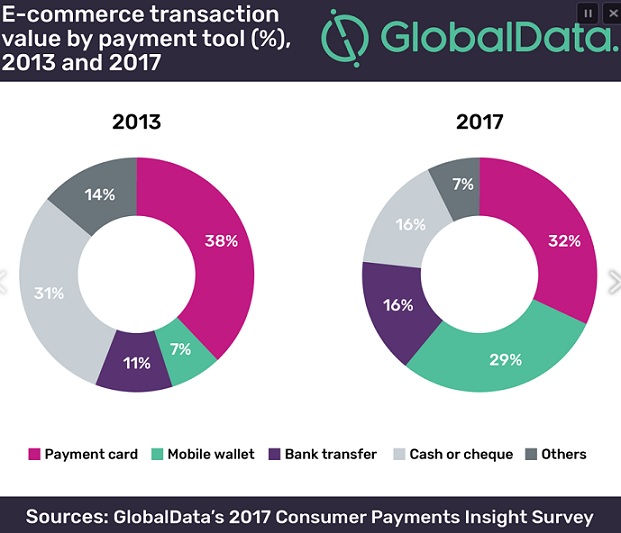

Mobile wallet has become a mainstream payment instrument in India. GlobalData’s survey shows that the share of cash or cheque (cash on delivery) in total e-commerce transaction value declined from 31% in 2013 to 16% in 2017, whereas the mobile wallet share jumped from just 7% to 29% during the same period. The usage of payment cards dropped from 38% to 32% during this period.

While consumers have benefited from convenient payment option and pricing benefits (cashback/discounts), it is the ‘cost-effectiveness’ that appeals to the merchants as the cost associated with mobile wallet acceptance including setting-up infrastructure and transaction fees is much lower compared to traditional card-based payment system.

Paytm, for instance, does not charge merchant any fees towards installation and annual maintenance. While it charges merchant service charges for online payments, no charges are applied on QR code based in-store transactions.

With intensifying competition in the Indian mobile wallet market, payment service providers (PSPs), banks, mobile network operators, and the government are all gearing up to get a piece of the mobile wallet pie. The significant growth in the market has led to the mushrooming of mobile wallet operators.

More recently, in September 2017, tech-giant Google launched its mobile payment solution–Tez–in India that enables users to link up their phones to their bank accounts to pay for goods in physical stores and online, as well as for P2P money transfers. Earlier, in March 2017, Samsung Pay entered the Indian market, though its use is now restricted to only offline payments.

While many payment solutions have forayed in the past few years, Paytm dominates the mobile wallet market and accounted for 9.9% share in total e-commerce transaction value in 2017, closely followed by PayPal with a 9.8% share. Other popular mobile wallets are MobiKwik and FreeCharge, which accounted for 2.8% and 2.7% of total e-commerce transaction value respectively.

To remain competitive, wallet providers are now looking beyond ‘just payments’ and focusing on value-added services. These wallets encompass additional services such as utility bill payments, mobile top-up, hotel/airlines bookings, buy entertainment tickets, and even gold purchases. Some of the wallet providers such as Paytm and Airtel have begun to move to other sectors to offer banking services, after receiving the approval from RBI.

Sharma concludes: “The provision of banking and value-added services is likely to further drive number of transactions via mobile wallet over the next five years.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: