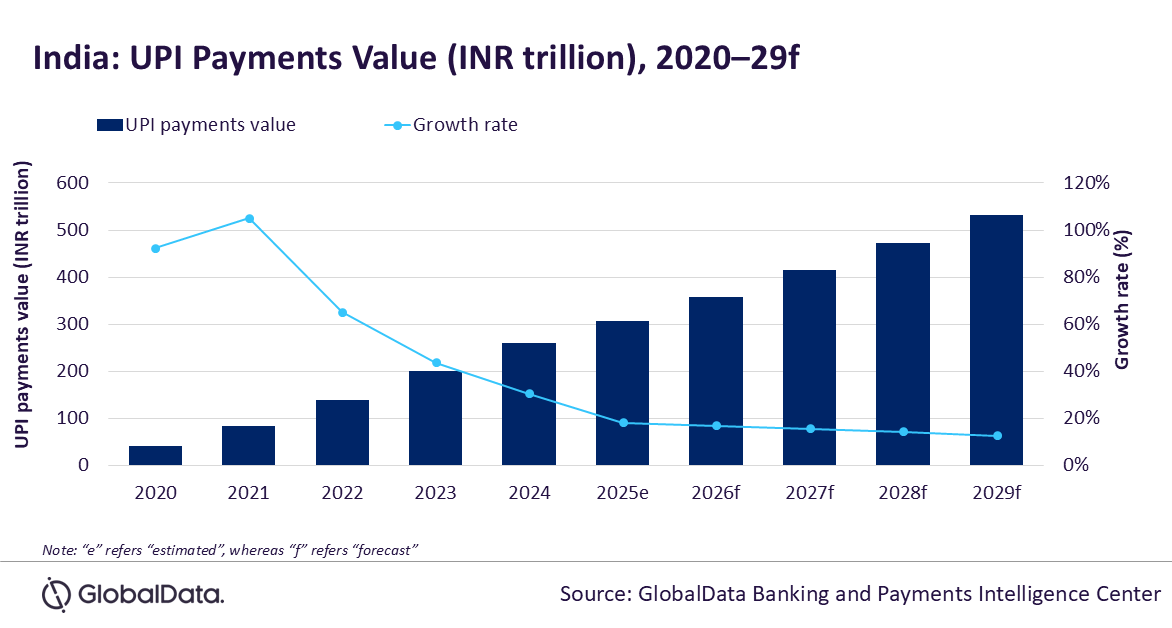

India has a well-developed instant payment infrastructure driven by Immediate Payment Service (IMPS) and Unified Payments Interface (UPI). While the former is primarily used for fund transfers, the latter is mostly preferred for day-to-day payments. Against the backdrop, the overall UPI payments value is projected to grow at a compound annual growth rate (CAGR) of 14.7% between 2025 and 2029 to reach INR532.6 trillion ($6.4 trillion) in 2029, forecasts GlobalData, a leading data and analytics company.

GlobalData’s Payment Instrument Analytics reveals that India UPI payments saw a significant growth of 30.4% in 2024, driven by the rise in consumer spending and increasing usage of mobile wallet payments.

UPI system allows customers to integrate bank account with mobile payment solution and enables instant transfers between bank accounts from mobile phone using virtual ID, mobile number or QR code, making transactions quicker. It is increasingly used for day-to-day transactions, a trend which is gaining momentum post COVID-19 pandemic as consumers prefer to use non-cash payment method.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “UPI has become a mainstream payment method in India, gradually displacing traditional cash payments. Launched in 2016, UPI has revolutionized the Indian payments space, enabling users to make digital payments at the convenience of their mobile phones and allowing merchants to accept digital payments just by using recipients’ mobile number or using a QR code.”

Rising banked population, high smartphone penetration, and proliferation of UPI-enabled mobile payment brands are some factors driving the growth. The UPI-based payments space is mainly dominated by third-party payment solution providers like Google Pay, PhonePe, and Paytm.

To further expand its coverage, UPI has partnered with international operators. For example, it has integrated with Singapore’s instant payment scheme – PayNow in February 2023. This helps users in the both countries to make low-cost cross-border fund transfers. Similar partnerships are in place with many other markets such as Nepal, the UAE and Bhutan.

Multiple features have been added over the years to expand the UPI functionality. For instance, the linkage with credit cards facilitates merchant payments with credit cards simply by scanning merchant QR codes without the need of high-cost POS terminals. Users can store their credit card details to UPI and make payments by scanning QR code.

The introduction of UPI Circle in August 2024 allowed primary users to delegate transactions within a family or group while maintaining control, further widening access to payments. Most recently in September 2025, Paytm has launched “Paytm Postpaid,” a credit line on UPI in partnership with Suryoday Small Finance Bank allowing users to “Spend Now, Pay Next Month” without requiring traditional credit cards.

Sharma concludes: “The rising mobile wallet adoption, coupled with high merchant acceptance and constant expansion of UPI features led to significant rise in UPI-based payments in the country. Improving payment infrastructure, high preference of QR code-based payments over traditional POS, and a consumer shift towards electronic payments remain major factors for their faster UPI adoption. Overall, UPI card payments market is expected to grow by 18% to reach INR307.4 trillion ($3.7 trillion) in 2025.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: