Global survey: „attitudes towards open APIs are positive across banks in all regions and territories”

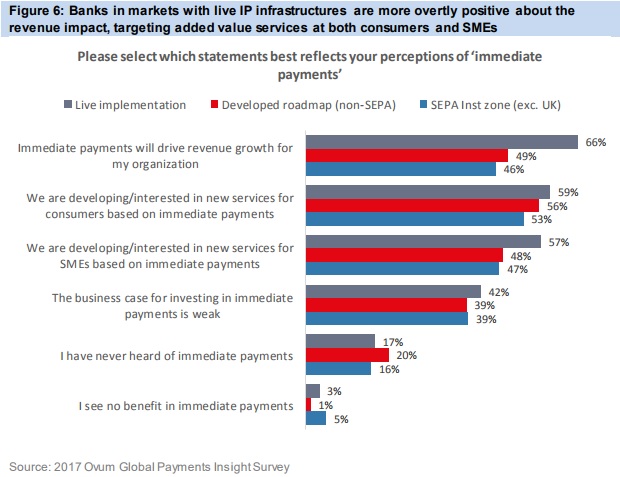

Immediate payments is a key revenue driver for 66 percent of banks in markets with IP schemes, according to new benchmark data, “2017 Global Payments Insight Survey: Retail Banking,” from ACI Worldwide and Ovum.

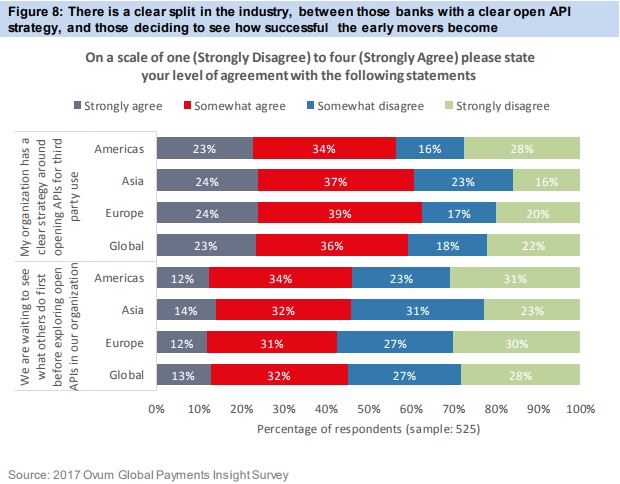

The benchmark report also notes that although open APIs will benefit customer satisfaction for 65 percent of banks, nearly half of respondents (45%) are taking a ‘wait and see’ approach to an open API strategy. Regardless of strategic focus, 57 percent of all banks are growing their IT investments in 2017, with a distinct emphasis on operational efficiency (91%) and fraud prevention (68%), as security issues remain an ongoing concern for the banking industry.

Principal study findings include:

Immediate Payments Driving Revenue

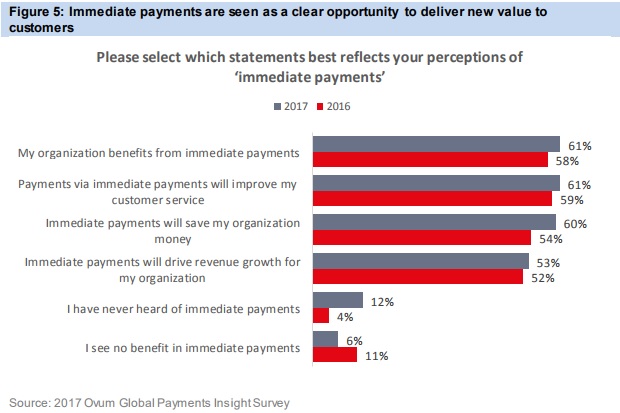

. 66 percent of banks in markets with live IP schemes view immediate payments as a revenue driver for their institutions

. 61 percent of banks believe that immediate payments will enhance their service and proposition to customers

. 60 percent of banks expect immediate payments to reduce costs, as the necessary investments in payment infrastructure and fraud systems ultimately deliver broader benefit to their institutions

Open APIs Benefits Customers—but there are Differences Over Strategy

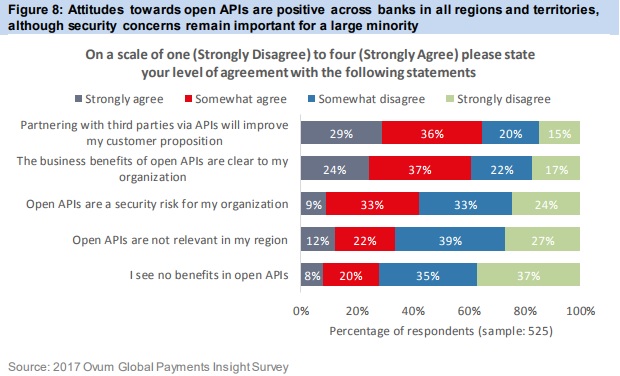

. 65 percent of institutions believe that open APIs will benefit their customer-facing proposition

. While 59 percent of banks have a clear strategy for creating open APIs and interfaces for developers, 45 percent of respondents report that they are taking a ‘wait and see’ approach

Overall IT Investment is Up and Fraud Prevention Remains a Priority

. 57 percent of all banks are growing their IT investments in 2017, up from 53 percent in 2016— particularly in Europe, where 62 percent are increasing budgets for payments-related projects

. 68 percent of banks have recently, or are currently, investing in fraud detection and prevention capabilities

. Delivering increased operational efficiency is a top three IT priority for 91 percent of banks

. 42 percent of banks are concerned about security issues, driven by risks around potential data breaches and fraudulent activity

“Immediate payments and open API capabilities are increasingly viewed by banks as key drivers of revenue, customer satisfaction and cost reduction,” said Mandy Killam, executive vice president, ACI Worldwide. “Developing an open API strategy is essential for banks to create a friction-free customer experience—and to compete in this quickly evolving retail payments market.”

“The market is rapidly changing—banks must invest wisely in core payments platforms and infrastructure to take advantage of relevant opportunities,” said Kieran Hines, head of industries, Ovum. “Financial institutions that proactively shape strategies around open APIs, fraud prevention and immediate payments will reap the benefits when it comes to both customer experience and revenue.”

The study is comprised of executives in retail banking and merchant acquiring organizations, based in countries in the Americas, Asia Pacific (APAC) and Europe, Middle East and Africa (EMEA).

Methodology and Demographics:

For the 2017 Ovum Global Payment Information Survey, which includes merchant, biller, and retail banking components, ACI and Ovum created a 23 point questionnaire, looking at the following criteria for key payments players: significant aspects of existing payments infrastructure; forecasts for spending; areas for investment and perceptions of where payments fit within their broader strategic objectives.

This survey was sent to payments decision makers globally in December, 2016—January, 2017. It provides a snapshot of payment perceptions among merchants, financial institutions, and scheduled billing and payment-taking organizations such as higher education, consumer finance and insurance. Overall, respondents totaled 1,475 executives across 15 industry sub verticals in 25 key global markets, resulting in more than 144,000 separate data points on perceptions and expectations of payments among critical payment enablers globally.

This paper focuses on the survey findings for retail payments organizations.

About ACI Worldwide

ACI Worldwide, the Universal Payments (UP) company, powers electronic payments for more than 5,100 organizations around the world. More than 1,000 of the largest financial institutions and intermediaries, as well as thousands of global merchants, rely on ACI to execute $14 trillion each day in payments and securities. In addition, myriad organizations utilize our electronic bill presentment and payment services. Through our comprehensive suite of software solutions delivered on customers’ premises or through ACI’s private cloud, we provide real-time, immediate payments capabilities and enable the industry’s most complete omni-channel payments experience.

Source: ACI Worldwide

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: