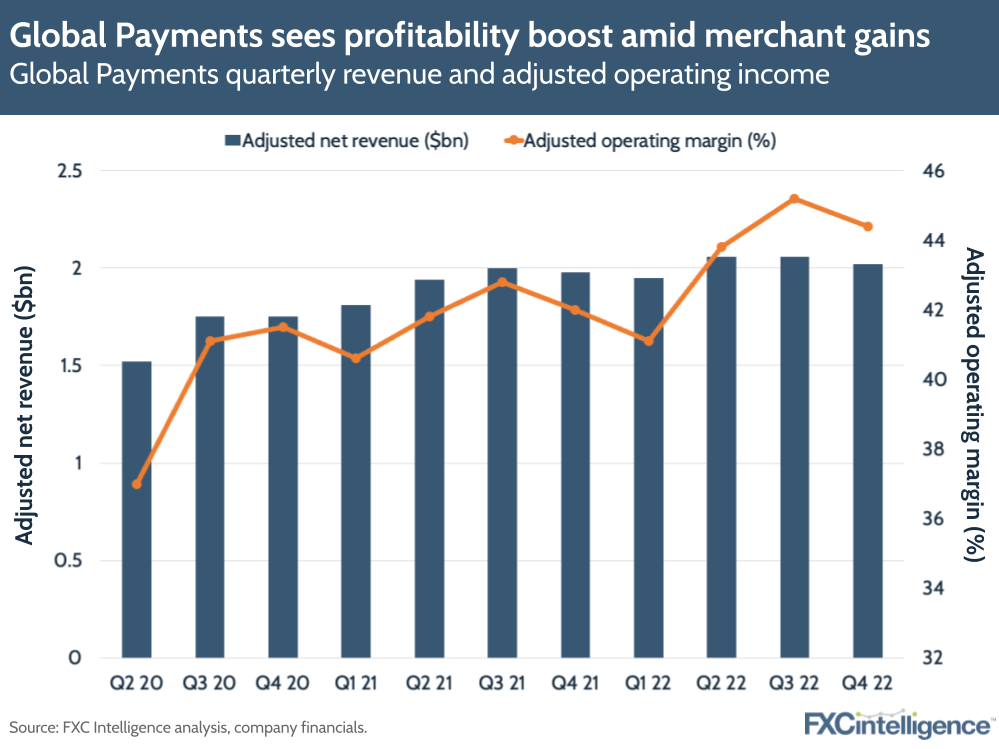

Payment processor Global Payments saw muted growth in 2022 compared to previous years, with adjusted net revenues increasing 5% to $8.09bn over the year as a whole, and just 2% to $2.02bn in Q4. The company announced it was now selling its gaming business for $415m as part of a shift to corporate over consumer-centric customers.

Jeff Sloan, Chief Executive Officer of Global Payments: „We entered into a definitive agreement to sell our Gaming Solutions business to Parthenon Capital Partners for $415 million, which is consistent with our efforts to refine our portfolio to focus on our corporate clients and away from consumer centric businesses.”

Merchant solutions drove revenues during Q4, with 5.2% growth in the quarter, partly fuelled by 20% growth for Xenial, the company’s payments brand focused on restaurants. However, as we’ve seen with other ecommerce players, growth in this segment was notably lower in Q4 2022 than the same period in Q4 2021.

Jeff Sloan explains: “For calendar 2022, our Merchant business delivered 13% adjusted net revenue growth (excluding dispositions) and our Issuer business delivered 5% adjusted net revenue growth, each on a FXN basis. For the year, we produced 10% adjusted net revenue growth and delivered 17% adjusted earnings per share growth.„

For its 2023 outlook, Global Payments projects adjusted net revenue to grow 6-7% this year. This guidance considers the closing of its EVO Payments acquisition, the divestiture of Netspend’s consumer business and the sale of Gaming Solutions, in each case by the end of the first quarter.

Sloan continued: “We also made great progress on our strategy in 2022. First, we look forward to closing our acquisition of EVO Payments no later than the end of March as anticipated. The transaction will significantly increase our target addressable markets, enhance our leadership in integrated payments worldwide, expand our presence in new and provide further scale in existing faster growth geographies, and augment our business-to-business software and payment solutions.

Looking ahead, the company expects adjusted net revenue to be in a range of $8.575 billion to $8.675 billion, reflecting growth of 6% to 7% over 2022 (…) Our 2023 outlook reflects the closings of the acquisition of EVO Payments, the divestiture of Netspend’s consumer business and the sale of Gaming Solutions in each case by the end of the first quarter.”

Fourth Quarter 2022 Summary

GAAP revenues were $2.25 billion, compared to $2.19 billion in the fourth quarter of 2021; diluted earnings per share were $0.94 compared to $0.72 in the prior year; and operating margin was 18.1% compared to 14.6% in the prior year.

Adjusted net revenues increased 2% (4% constant currency) to $2.02 billion, compared to $1.98 billion in the fourth quarter of 2021; excluding the impact of dispositions, adjusted net revenue increased 7% on a constant currency basis.

Adjusted earnings per share increased 14% (17% constant currency) to $2.42, compared to $2.13 in the fourth quarter of 2021.

Adjusted operating margin expanded 240 basis points to 44.4%.

Full Year 2022 Summary

GAAP revenues were $8.98 billion, compared to $8.52 billion in 2021; diluted earnings per share were $0.40 compared to $3.29 in the prior year; and operating margin was 7.1% compared to 15.9% in the prior year.

Adjusted net revenues increased 5% (7% constant currency) to $8.09 billion, compared to $7.74 billion in 2021; excluding the impact of dispositions, adjusted net revenue increased 10% on a constant currency basis.

Adjusted earnings per share increased 14% (17% constant currency) to $9.32, compared to $8.16 in 2021.

Adjusted operating margin expanded 190 basis points to 43.7%.

___________

Global Payments Inc. is a leading payments technology company. Headquartered in Georgia with approximately 25,000 team members worldwide, Global Payments is a Fortune 500® company and a member of the S&P 500 with worldwide reach spanning over 170 countries throughout North America, Europe, Asia Pacific and Latin America.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: