Berlin-based digital bank Nuri filed for insolvency, two months after announcing layoffs as it struggled with the rout in cryptocurrency prices, economic uncertainty and a difficult funding environment.

In a statement, the company said: „We would like to inform you about an important development that does not affect our services, funds or investments with Nuri. Nevertheless it is of great importance to us to provide this update to you straight away: Due to the current challenging market developments and subsequent effects on financial markets on Nuri’s business development, we have filed for insolvency on Tuesday 9. August 2022. This step became necessary to ensure the safest path forward for all our customers.”

The digital banks says that „all funds in your Nuri accounts are safe due to our partnership with Solarisbank AG”.

„The temporary insolvency proceedings do not affect your deposits, cryptocurrency funds and Nuri Pot investments which have been done with us. Your Euro deposits in the Bank Account, Bitcoin and Ether deposits in Wallets & Vaults, and the Nuri Pot investments are not affected by this situation. You have guaranteed access and will be able to deposit and withdraw all funds freely at any time. For the time being, nothing will change and Nuri’s app, product and services will continue to run.”

„We proceeded with the filling in due time to stay ahead of a lasting strain on the liquidity of our business. 2022 has been a challenging year for the startup ecosystem globally, especially for fintechs. Due to the ongoing after-effects of the Corona pandemic and the economic and political uncertainties in the markets after Russia`s invasion of Ukraine, we have been facing significant macroeconomic headwinds and the cooling down of public and private capital markets.

Additionally, various negative developments in the crypto markets earlier this year, including major cryptocurrency sell-offs, the implosion of the Luna/Terra protocol, the insolvency of Celsius and other major Crypto funds have led to a crypto bear market.”

What’s next?

The company says: „We are confident that the temporary insolvency proceedings offer the best basis for developing a viable long-term restructuring concept in the company’s current situation.”

__________

Based in Berlin, Germany’s second-largest challenger bank, reported at the end of June 2021 over 250.000 customers across 32 European countries. At that time, Nuri was able to convince existing and new shareholders to expand its Series B round by €9 million, up to €24 million.

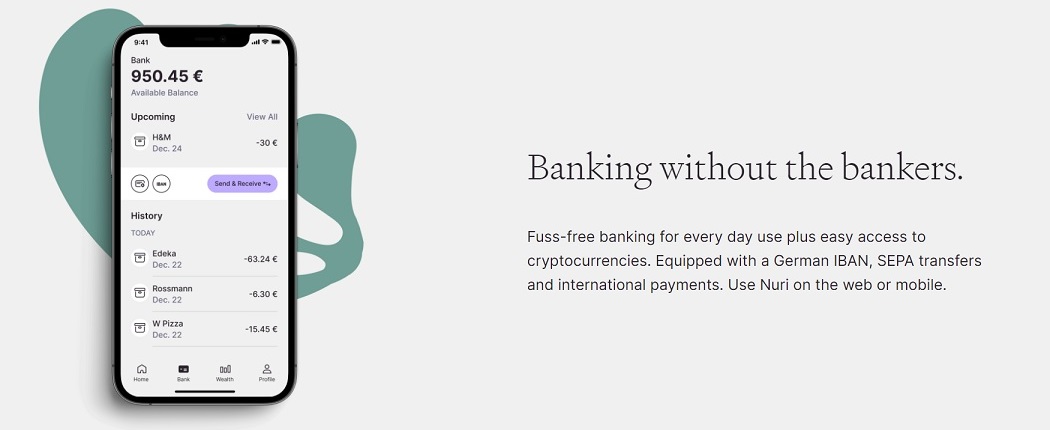

Nuri offers a full German bank account with access to cryptocurrencies, digital assets and blockchain-based financial services. The fintech company works with Solarisbank AG, which provides the banking infrastructure, and Solaris Digital Assets GmbH for cryptocurrency custody.

With Bitwala, customers can invest in cryptocurrency directly from a bank account and earn up to 5% annual return on Bitcoin, th digital bank said in a press release.

Nuri was founded in 2015 under the name Bitwala.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: