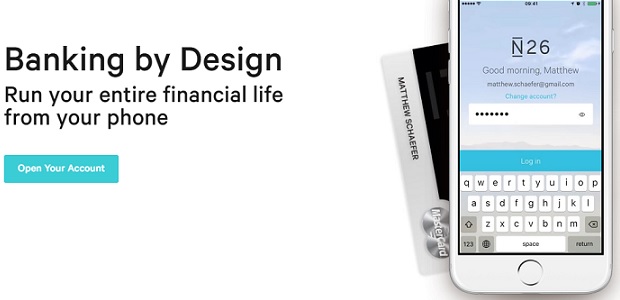

Germany’s N26 aims to become Europe’s leading mobile-only bank

Berlin-based N26 has laid claim to becoming Europe’s leading mobile-only bank, growing its user base to 300,000 and recording a seven-fold growth in transaction volumes over the past year. Operating in 17 markets across the EU, the two-year old bank has processed more than EUR3 billion in transaction volumes since inception, with 60% of the total logged in the past year.

„January and February 2017 were the strongest months in terms of customer growth in our company’s history,” says Valentin Stalf, founder and CEO of N26. „We are on track to grow to a couple of million customers over the next years,”

Launched in Germany and Austria in January 2015, N26 began as a current account with a Mastercard. It now operates as a fully-featured bank with instant overdraft, international transfers into 19 currencies through a tie-up with TransferWise, investment options via Vaamo and real-time consumer credits up to EUR25,000.

Last December N26 expanded its coverage to raft of new markets, picking up 30,000 customers in France and 10,000 users in each of Spain and Ireland. The startup says it is currently racking up 1000 new users every day.

Stalf says the bank, which operates an in-app marketplace model for access to third-party products and services from fintech providers plans to add further savings and insurance products over the next month as part of a programme that will see coverage extended to all EU citizens.

Source: finextra.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: