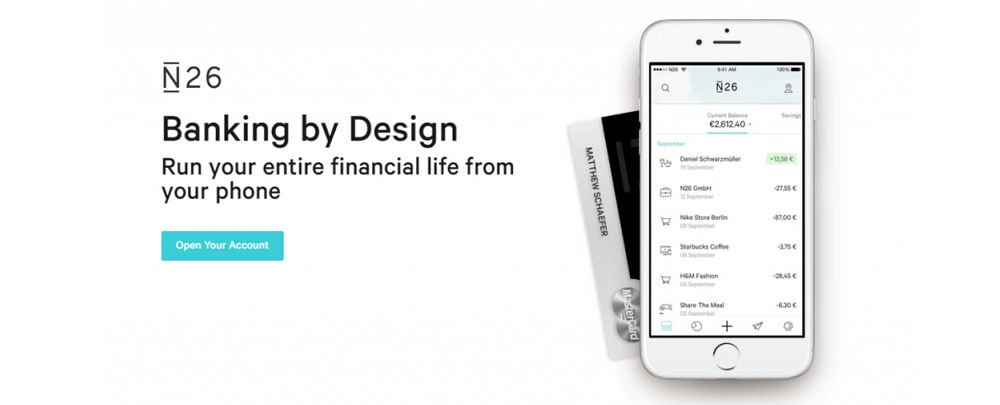

German smartphone bank N26 counts 5 million customers

German smartphone bank N26 now has 5 million customers, the founder of Berlin’s leading fintech startup said to Reuters, representing an increase from the 3.5 million users it reported last summer.

Berlin-based N26 is adding up 10,000 clients a day.

N26, last valued by investors at $3.5 billion, is growing fastest in its main European markets while the United States – where it launched last year – is making a positive contribution, co-founder and Chief Executive Valentin Stalf told Reuters.

“We added more customers in 2019 than we did in all the prior years put together,” Stalf, 34, added in an interview.

He declined to share financials or give a market breakdown, but said growth at N26 was strongest in Germany, France and Austria, while Italy and Spain had a chance to achieve a similar rate of expansion.

N26, founded in 2013, has raised a total of $683 million in investment. Its last funding round in July 2019 gathered $170 million backers including Valar, Tencent and Insight Partners.

The German challenger bank views a stock market listing as an attractive option, but rather in 4-5 years than in the short-term, its Germany head told Reuters.

“We have no pressure, not even from our investors,” Georg Hauer said, the Germany Head of N26, adding that an IPO would be a possibility if the company came to the conclusion that a such deal would be the best way to finance its expansion.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: