The app-based bank opened for business in the US in July 2019 and has amassed 500,000 customers, who must now find a new banking partner before the shutters come down on 11 January.

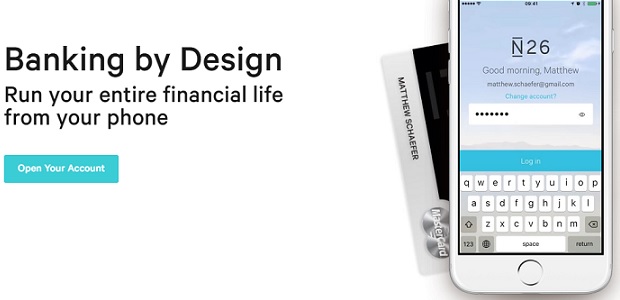

N26 announced that its digital banking experience will no longer be available to customers in the US after January 11, 2022. The announcement comes as the digital bank continues to sharpen its focus on its European business, with an emphasis on expanding its offer beyond its current accounts to cover additional financial products and services.

N26 will focus its strategy on broadening its digital banking experience into new verticals to include investment products in the coming year, with the goal to create an even more complete and compelling digital proposition. By bringing additional financial services and products into its experience, N26 aims to further empower customers to manage additional aspects of their financial lives simply and seamlessly.

On top of strengthening its core business operations in Europe, where digital banking adoption continues to be in its infancy, N26 is also assessing future expansion into additional markets in Eastern Europe in response to growing customer demand in the region.

„Learnings from N26’s two years of growth in the US market are being constantly applied as it further expands its product portfolio and scales its global business,” the bank said.

US customers will be able to use their accounts as usual until January 11, 2022, and will receive further instructions on how to withdraw their funds to ensure a smooth transition.

N26 was founded in 2013 and launched the initial product in early 2015. With a full European banking license and no branch network, N26 has welcomed more than 7 million customers in 25 markets. N26 has a 1,500-strong team of 80 nationalities based across the globe. It has 10 office locations: Amsterdam, Berlin, Barcelona, Belgrade, Madrid, Milan, Paris, Vienna, New York and São Paulo.

Valued at more than US$9 billion, N26 has raised close to US$ 1.8 billion from the world’s most established investors. N26 currently operates in: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland and the US, where it operates via its wholly-owned subsidiary, N26 Inc., based in New York. Banking services in the US are offered by N26 Inc. in partnership with Axos Bank®, Member FDIC.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: