The 2023 McKinsey Global Payments Report shines a light on a changing industry and explains how banks and others can capitalize on new dynamics.

The payments industry’s 2022 performance shows ongoing change with opportunities for growth and margin improvement across geographies and products. A close look at revenues uncovers structural changes, including new developments in instant payments and digital wallets.

This 2023 edition of McKinsey’s Global Payments Report shares key findings from our proprietary market intelligence recorded in the Global Payments Map, which spans more than 25 payments products in 47 countries that together account for 90 percent of global GDP. Among this year’s findings are the following:

. Global payments revenue grew by double digits for the second year in a row.

. Sustained growth in India, fueled by cash displacement, moved it into the top five countries for payments revenues.

. For the first time in several years, interest-based revenue contributed nearly half of revenue growth.

. Cash usage declined by nearly four percentage points globally in 2022. Over the past five years, the growth rate for electronic transactions has been nearly triple the overall growth in payments revenue.

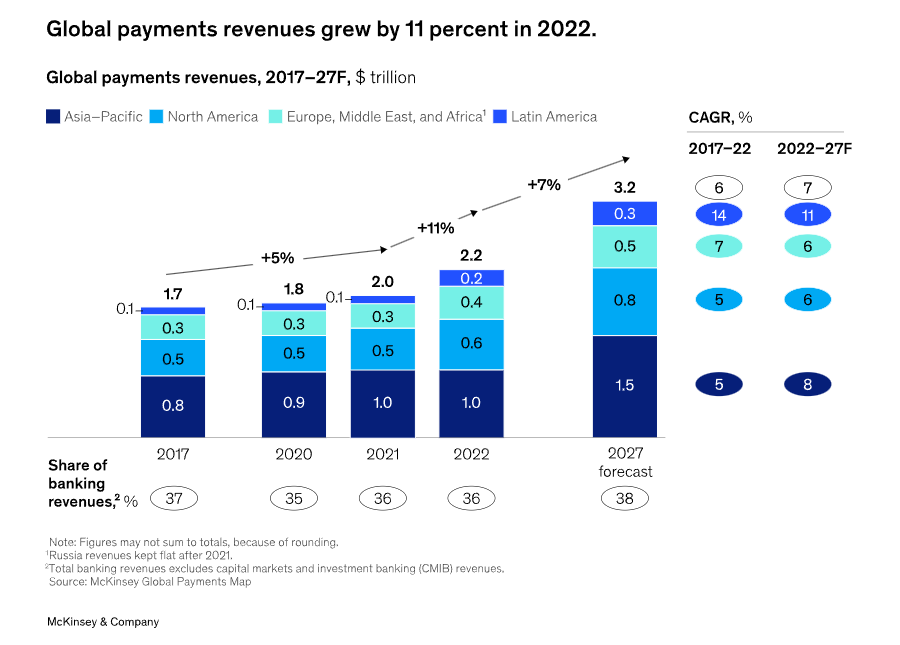

Globally, payments revenues proved remarkably resilient, overcoming a variety of regional headwinds to grow at rates well above the established long-term trend. Payments revenues grew at 11 percent in 2022—a double-digit rate for the second consecutive year—reaching more than $2.2 trillion, an all-time high.

Cross-border payments

Cross-border payment dynamics were particularly robust. Flows reached about $150 trillion in 2022, a 13 percent increase in a single year. This money movement generated an even greater increase in cross-border revenues, which rose 17 percent to $240 billion. Revenues from cross-border consumer payments—both C2B and C2C—increased at double-digit rates, accelerating from high single digits in 2021. Conversely, both forms of commercial payments (B2B and B2C) grew by 10 percent, somewhat slower than 2021’s postpandemic surge.

The US–Latin America corridor remains the largest for C2C remittances, representing 11 percent of the total value of such flows. Central America has been an increasingly relevant destination for remittances and humanitarian aid from the United States.

While B2B remains the primary driver of cross-border revenue (69 percent of the total), the consumer categories carry higher margins and are projected to grow more rapidly over the next five years. Much of the growth is expected to be in C2B, related to increased travel and e-commerce spending.

Future revenue growth: Instant payments and digital wallets on the rise

McKinsey’s analysis suggests that future revenue growth will likely be stimulated by instant-payments innovations and the rise in digital wallets in certain geographies. The increase in electronic payments transaction volumes has consistently outpaced payments revenue growth (17 percent versus 6 percent) over the past five years. This is indicative of the continuing evolution in payments preferences, a general migration toward lower-fee instruments, and the gradually declining margins that accompany scale.

These dynamics are also evident in cash displacement. Cash usage declined by nearly four percentage points globally in 2022. Worldwide, the decline in cash usage during the pandemic shows no evidence of being reversed, led downward by the cash-reliant economies of India and Brazil, where the share of cash transactions fell by seven to ten percentage points. Brazil’s cash declines are concurrent with the rapid uptake of the country’s PIX instant-payments network.

A similar transformation is taking place on a smaller scale in Nigeria, where instant-payments capabilities are being built into point-of-sale devices to facilitate merchant enablement. Nigeria’s share of cash transactions fell from 95 percent in 2019 to 80 percent in 2022. Over the same period, instant payments’ share quadrupled to 8 percent.

Instant payments are playing a key role in this transition out of cash. In Brazil, almost half of the transactional revenue growth through 2027 is expected to come from instant payments. Yet in other places, revenue growth from instant payments could be meager. Instant payments in India are expected to contribute less than 10 percent of future revenue growth because no fees are currently charged for the Unified Payments Interface (UPI). Conversely, in several European countries such as Germany, instant payments are perceived as a premium option, resulting in relatively strong potential for revenue growth.

By 2027, cash-heavy developing economies are likely to make further significant shifts toward instant payments, bringing these transactions’ share to roughly half of overall payment transactions—nearly two-and-a-half to three times greater than in 2022. By contrast, our analysis indicates that near-term impact in mature markets such as the US and UK will be nominal. Instant payments remain in a nascent stage in the US, where 2022’s cash decline was more muted following 2021’s reduction associated with pandemic restrictions. July 2023’s launch of the Federal Reserve’s FedNow real-time payment rails may prove to be an inflection point, but the effect will be gradual.

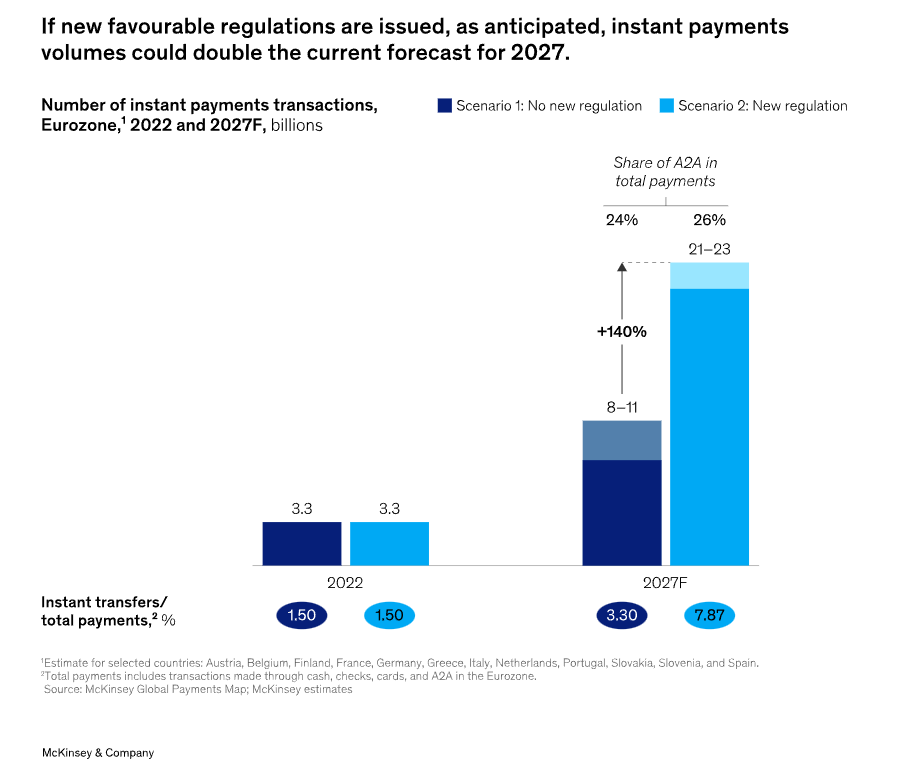

The story varies from country to country, but the developments in Europe are worth a second glance. Today, instant payments constitute 12 percent of the credit transfer volume in the Single Euro Payments Area (SEPA) (Exhibit 3). Absent regulatory intervention, this share could double by 2027, and if regulators proceed with anticipated actions to encourage adoption, this share could rise to 45 percent of SEPA’s 23 billion annual transactions and a far higher share of account-to-account (A2A) payments, including transfers done through Automated Clearing House (ACH), real-time gross settlement (RTGS), and instant payments.

Digital wallets, the source and destination of much of the flow in instant payments, are similarly booming. Several business models are taking shape in different parts of the world. In several African countries (Kenya, Ghana, and Tanzania, for instance), mobile-wallet infrastructure is ubiquitous and interoperable. Nigeria’s Central Bank spurred uptake by pushing a “cashless economy” during a note-change process in early 2023. Demand for digital payment solutions has spiked among Nigerian merchants of all sizes. One acquirer reports that 70 percent of the new merchant customers haven’t previously accepted digital payments—a clear indicator of expanding network effects.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: