Fujitsu, JCB, and Mizuho Bank to test digital identity interoperability

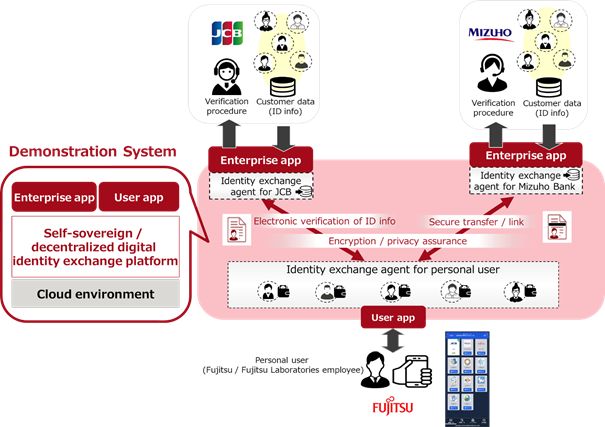

Fujitsu, JCB and Mizuho Bank to jointly test a system that enables secure transactions involving sensitive user ID information between companies and industries. The system is based on Fujitsu’s self-sovereign and decentralized digital identity exchange technology. The initial trial participants will be Fujitsu Group employees.

Fujitsu Limited, JCB Co., Ltd. and Mizuho Bank, Limited. today announced a joint demonstration trial aimed at further advancing a digital society in which digitally managed information attributable to individuals (i.e. ID information) can be safely and securely transacted online, distributed and linked between different industries.

In the demonstration, JCB and Mizuho Bank will verify mechanisms to securely exchange and link participant ID information, such as names, addresses, and employers, on a cloud platform built by Fujitsu. Approximately 100 Fujitsu Group employees in Japan will participate in the program, which is scheduled to last for approximately four months. Fujitsu has built a self-sovereign and decentralized digital identity exchange technology(1), which utilizes a blockchain solution from Fujitsu Laboratories.

Through this demonstration trial, Fujitsu, JCB, and Mizuho Bank will confirm the accuracy of ID information held by multiple business operators and verify the mechanism by which customers can safely and securely control the distribution of ID information. Going forward, JCB, Mizuho Bank, and Fujitsu will consider innovative service models best suited to ID information management, regardless of the industry or sector.

[Background]

In recent years, much thought has been given to how individual data – which is acquired and managed by one service provider – can be utilized and distributed among other service providers to enable more convenient services. However, the importance of identity verification has been demonstrated many times over, as misappropriation of personal data, privacy risks, and damage caused by the unauthorized use of such data has become widespread. There is also a growing demand for business operators to be able to definitively prove the reliability of their business partners.

With the continued proliferation of digitization and circulation of personal ID information, it is essential to manage data with greater security and reliability, while also increasing the convenience of its shared usage.

„JCB and Fujitsu have been conducting a joint research project on digital identity since 2019. From the viewpoint of improving the management and reliability of information held by multiple parties, we are conducting a demonstration trial on an interoperability model of identity information together with Mizuho Bank,” the company said.

[Outline of the demonstration trial]

1. Details of implementation

(1) Verification of self-sovereign and decentralized digital identity exchange technology via the demonstration system

– JCB and Mizuho Bank will automatically issue the participants’ ID information as electronic certificates.

– Participants will freely combine or encrypt the electronic certificates they receive from JCB and Mizuho Bank, in order to link their own identities online in a secure and reliable method to other businesses (JCB or Mizuho Bank).

The usefulness of ID information distribution technology will be verified by experiencing the mechanism described above.

(2) Verification of platform requirements and operational practices for self-sovereign and decentralized digital identity

The demonstration system will be used to verify the requirements for building the system and show how to operate it to implement the identity platform.

2. When: Four months from October 2020 to January 2021 (Scheduled)

3. Role of the three companies

(1) JCB and Mizuho Bank

Through the demonstration system, information on participants held by JCB and Mizuho Bank will be disclosed to the participants from each company. At the same time, the system will receive personal information disclosed by participants through the system. The companies will also examine the service requirements, operational practices, and new service models for self-sovereign and decentralized digital identities.

(2) Fujitsu Group

Developing and providing the demonstration system and applications used by participants and operating the demonstration and the system.

Fujitsu will also design and evaluate the functions of the system for a self-sovereign and decentralized digital identity exchange platform.

[Future Developments]

JCB, Mizuho Bank, and Fujitsu are considering a new service model that will make utilization of customer ID information more convenient for both business operators and customers.

„This new service model will enable each company to mutually cooperate, authenticate and update customer ID information held by each company under customer sovereignty. The aim is to build a safe, secure and customer-centric digital ecosystem in order to contribute to the realization of a society that uses data with greater convenience,” JCB said.

###

Note

(1) Identity exchange: A proprietary, decentralized identity technology developed by Fujitsu Laboratories that enables the safe and voluntary distribution of identity information provided by businesses and other third parties. Used for the distribution of identity information to a service provider and a user related to online transactions and capable of judging the authenticity of personal information of the transaction partner. For details, please refer to the Fujitsu Laboratories Press Release, „Fujitsu Develops Digital Identity Technology to Evaluate Trustworthiness in Online Transactions” dated July 4, 2019: https://bit.ly/2FdhSpJ

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: