FSB warns of emerging risks from crypto-assets to global financial stability

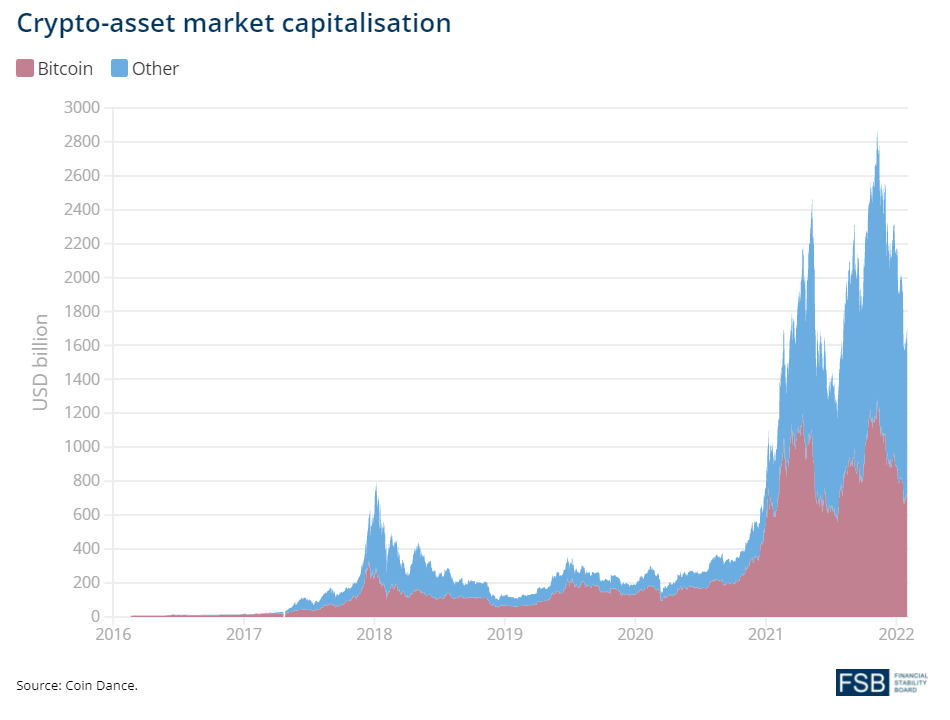

Crypto-asset markets are fast evolving and could reach a point where they represent a threat to global financial stability due to their scale, structural vulnerabilities and increasing interconnectedness with the traditional financial system. This is the Financial Stability Board’s (FSB’s) updated assessment of risks to financial stability from crypto-assets, published today.

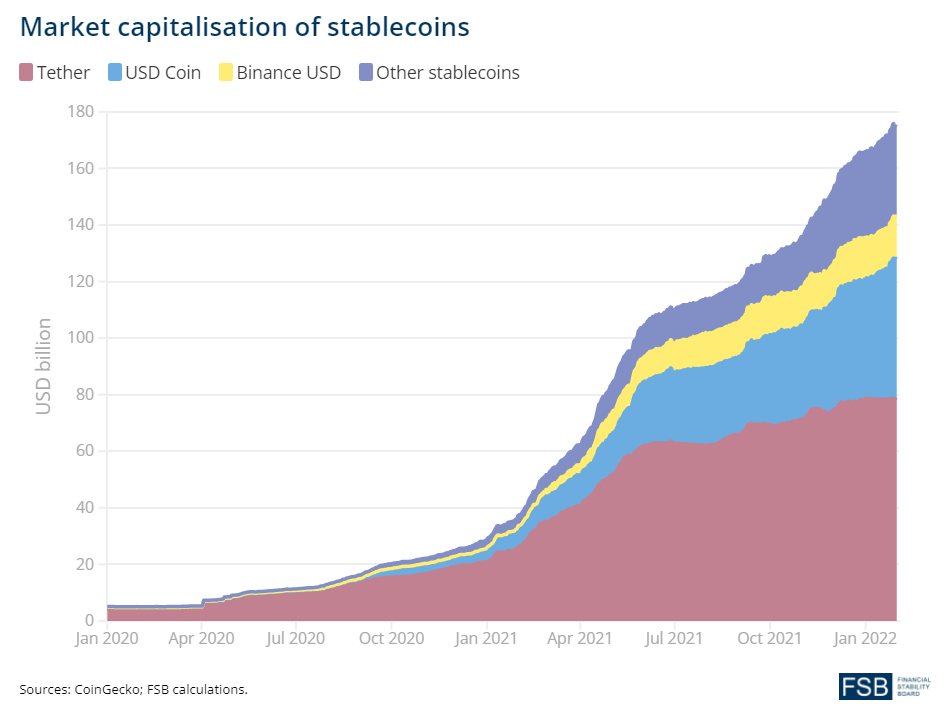

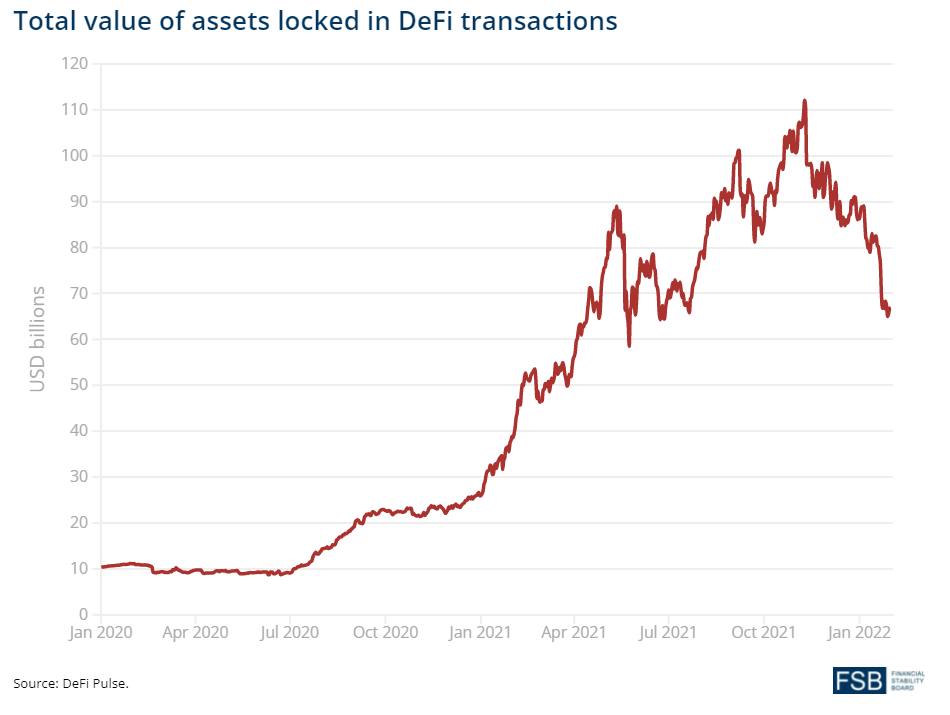

The report examines developments and associated vulnerabilities relating to three segments of crypto-asset markets: unbacked crypto-assets (such as Bitcoin); stablecoins; and decentralised finance (DeFi) and crypto-asset trading platforms. It notes the close, complex and constantly evolving interrelationship between these three segments, which need to be considered holistically when assessing related financial stability risks.

The report highlights a number of vulnerabilities associated with crypto-asset markets. These include increasing linkages between crypto-asset markets and the regulated financial system; liquidity mismatch, credit and operational risks that make stablecoins susceptible to sudden and disruptive runs on their reserves, with the potential to spill over to short-term funding markets; the increased use of leverage in investment strategies; concentration risk of trading platforms; and the opacity and lack of regulatory oversight of the sector. The report also notes wider public policy concerns related to crypto-assets, such as low levels of investor and consumer understanding of crypto-assets, money laundering, cyber-crime and ransomware.

The report notes that financial stability risks could escalate rapidly and calls for timely and pre-emptive evaluation of possible policy responses. Currently, crypto-assets remain a small portion of overall global financial system assets and direct connections between crypto-assets and systemically important financial institutions and core financial markets, while growing rapidly, also remain limited. Nevertheless, the rapid evolution and international nature of crypto-asset markets raise the potential for regulatory gaps, fragmentation or arbitrage.

The FSB will continue to monitor developments and risks in crypto-asset markets. It will explore potential regulatory and supervisory implications of unbacked crypto-assets, including the actions FSB jurisdictions have taken, or plan to take, to address associated financial stability threats.

The FSB will also continue to monitor and share information on regulatory and supervisory approaches to ensure effective implementation of its high-level recommendations for the regulation, supervision and oversight of so-called “global stablecoin” arrangements.

_________

In July 2018, the FSB published a monitoring framework which set out the transmission channels that the FSB would use to monitor the financial stability implications of crypto-asset markets as part of its ongoing assessment of vulnerabilities in the financial system. At that time, the FSB assessed that crypto-assets did not pose a material risk to global financial stability, but noted the need for vigilant monitoring in light of the speed of market developments.

In October 2020, the FSB published high-level recommendations for the effective regulation, supervision and oversight of “global stablecoin” arrangements. The recommendations were developed to support the implementation of a key building block of its roadmap to enhance cross-border payments. In October 2021, the FSB published a progress report which found that, overall, the implementation of the FSB high-level recommendations across jurisdictions is still at an early stage. The FSB will undertake a review of its recommendations in 2023, which will identify how any gaps could be addressed by existing frameworks and will lead to the update of the FSB’s recommendations if needed.

The FSB coordinates at the international level the work of national financial authorities and international standard-setting bodies and develops and promotes the implementation of effective regulatory, supervisory, and other financial sector policies in the interest of financial stability. It brings together national authorities responsible for financial stability in 24 countries and jurisdictions, international financial institutions, sector-specific international groupings of regulators and supervisors, and committees of central bank experts. The FSB also conducts outreach with approximately 70 other jurisdictions through its six Regional Consultative Groups.

The FSB is chaired by Klaas Knot, President of De Nederlandsche Bank. The FSB Secretariat is located in Basel, Switzerland, and hosted by the Bank for International Settlements.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: