The digital bank is dead. Or better the discussion around it. It is simply outdated. And it is very fast being replaced by the AI bank.

an article written by Panagiotis Kriaris – Head of Business & Corporate Development at UNZER

For years banks’ strategic priorities and IT budgets focused on digital transformation. It basically meant integrating modern technology into banking operations & shifting from a traditional, legacy set-up to a flexible, cloud-based, infrastructure. Plus, billions of Euros and Dollars in budget and many years of implementation.

The problem with this approach is that it has always been a catch-up play. Meaning that it is an enabler for banks to compete in the digital era, but it doesn’t bring (alone) any competitive advantages over digital native fintechs or bigtechs.

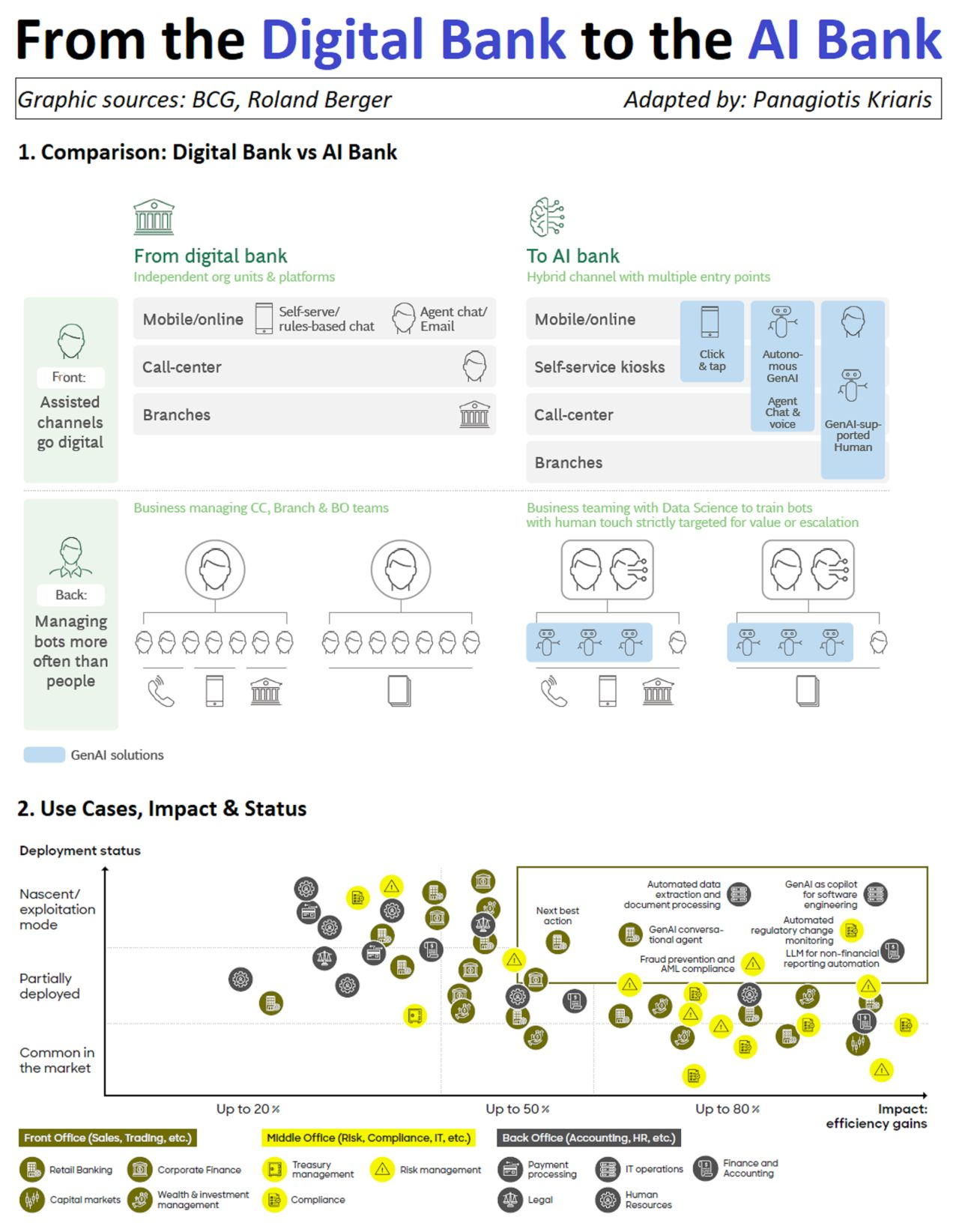

AI has brought this fact to the fore. AI is fundamentally changing banking (and banks), both from a front-end and from a bank-end perspective. It renders digital capabilities not a vague self-defined / driven exercise but a pre-condition for the AI transformation that is already re-writing competition tools and re-defining customer expectations.

Consider this:

According to Counterpoint Research Apple’s smartphone sales in China fell 19.1% in Q1 2024.

What is (one of) the main reason(s)? Artificial Intelligence. Or better the lack of it. Apple has been slow in integrating AI functionality and is lagging rivals such as Huawei.

If AI can trigger this for one of the mightiest and most tech-savvy companies on earth, will it not do the same for banks?

In fact:

— banking could see the biggest impact from GenAI as a % of revenues: between 2.8% and 4.7% or $200 bn and $340 bn annually (McKinsey)

— Deloitte goes even further and predicts +$ 1 tn in global banking revenues pools by 2030

— AI will bring down compliance, operations and customer service costs by 25% (Deloitte)

AI is redefining the banking business and operational model as these lines are being written. Not in the future, but now. Banks’ ability to integrate AI functionality will be much more critical than their ability to offer it in the first place.

Example: AI-powered chatbots will change front-end customer interaction. But at the same time, they will fundamentally modify the back-office set-up in terms of opening up hybrid channels, embedding new use cases, enhancing more added-value human interactions and even influencing sales outcomes.

Which brings me to my starting point: it’s not a “digital bank” discussion anymore but a “AI bank” or “AI-first bank” one. But unlike the transition from traditional to digital, this time transformation will move faster and will be a make-or-break factor.

Four things will be critical into the banks’ AI journey:

1) the challenge of integrating GenAI into existing IT infrastructure

2) retraining / upskilling the workforce

3) adjusting the entire business model

4) managing risks coming from data protection and regulatory compliance

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: