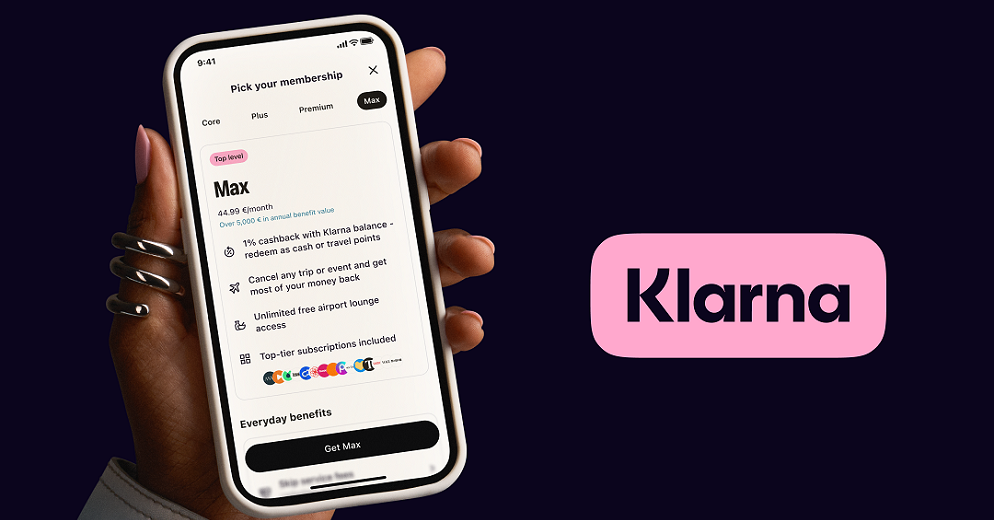

Klarna’s new Premium and Max memberships pack cashback (up to 1%), travel perks, and top subscriptions (lifestyle rewards) into one plan, delivering 10x the value with no spending targets. Premium and Max plans will be available to Klarna customers within the coming weeks.

Klarna, the global digital bank and payments provider, today unveiled its new global membership program, introducing Premium and Max. „The program delivers premium benefits like cashback, travel perks, and lifestyle rewards in a transparent, monthly plan, without the need to take on expensive credit.” – according to the press release.

„The launch marks a major step in Klarna’s evolution into a full-scale digital bank helping consumers manage their money with greater value and control.” – the company said.

“We believe consumers shouldn’t have to take on expensive credit to access premium benefits,” said David Sandström, Chief Marketing Officer at Klarna. “For decades, exclusive perks such as airport lounge access, concierge-style subscriptions, and premium travel insurance were only available to elite credit card holders. Klarna is changing that. Through Klarna memberships, consumers can enjoy travel, lifestyle, and digital experiences in one seamless plan, without the burden of credit-based rewards or hidden costs.”

Legacy credit cards make consumers spend more to earn rewards. Klarna’s new membership flips the model, giving users premium perks without overspending or taking on debt. Premium and Max members enjoy more than €400 in monthly benefits, including airport lounge access, travel insurance, ClassPass membership, and top subscriptions like Vogue, GQ, Headspace, The New York Times, and The Times and The Sunday Times.

Members can now convert their Klarna earned cashback directly to leading travel and hospitality partners, including top global airlines such Air France–KLM, British Airways, United Airlines, and Turkish Airlines; iconic hotel groups like Accor, IHG Hotels & Resorts, Radisson, Global Hotel Alliance, and Wyndham.

„With more than 1 million active membership customers to date, Klarna is redefining what consumers can expect from modern financial services. Premium and Max offer more than 10x their monthly value across lifestyle and travel benefits, making them among the most comprehensive subscription membership programs available today.” – the company explained.

Premium and Max Tier Offerings at a Glance

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: