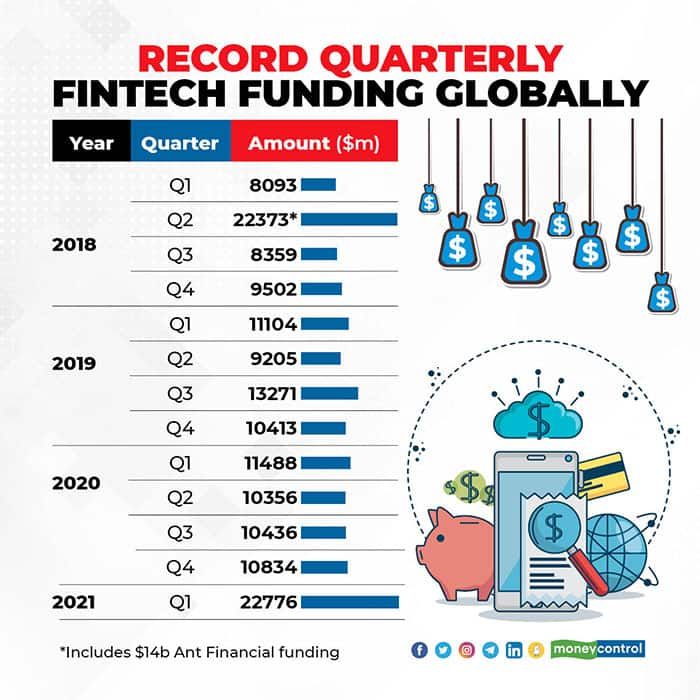

Fintech startups raised record $22.8 billion in Q1 2021, more than double the previous quarter

Fintechs firms globally raised $22.8 billion across 614 deals, compared to $10.8 billion across 560 deals in the last quarter of 2020, according to a report from CB Insights, a data platform. The record beats the $22.3 billion raised in the second quarter of 2018, which included Ant Financial’s historic $14 billion funding round in China.

Mega-rounds drove this quarter’s funding boom – There were 57 $100M+ mega-rounds this quarter, a new record, which together accounted for 69% of total funding in the quarter. As a result, the average deal size this quarter nearly doubled vs. Q4’20, from $19.3M to $37M.

Investing app Robinhood, payments firm Stripe, short term loan provider Klarna and Chinese financial security firm Paradigm raised the biggest rounds of the quarter- aggregating to $5.7 billion.

Deal growth was global – Every continent except for Africa saw QoQ growth in deal activity. Europe’s deal activity surpassed that of Asia last quarter, and this continued into Q1’21 with 151 total fundraises to VC-backed companies.

Europe also saw funding growth of over 180% QoQ (from $1.8 billion in Q4 2020 to $5.04 billion in Q1 2021), primarily driven by mega-rounds which accounted for 68% of the continent’s total funding for the quarter.

In the same time, in the US, despite being the most mature market, it nearly doubled to $12.8 billion from $6.8 billion. Asia, the second largest market, raised $3.6 billion, compared to $1.9 billion the previous quarter.

Indian fintech also has been on a tear, with credit card payments firm Cred, payments gateway Razorpay and lender BharatPe being valued at $2 billion, $3 billion and $950 million- increases in a very short period.

Among sub-sectors of fintech, payments, digital lending, small and medium businesses and wealth management grew the fastest in terms of funding they received, while banking, capital markets and insurance saw investments slow down compared to the previous quarter, the report said.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: