Global Fintech lending, or the alternative loans industry will hit a $312.6bn transaction value this year, growing by 17% year-on-year, according to data gathered by LearnBonds.com. The rising trend, highlighted by peer-to-peer firms Lending club in the US or Funding Circle in the UK, is set to continue, with the entire market reaching $390.5bn value by 2023.

Fintech Lending in Emerging Markets

Consumer and business loans in the Fintech space are mostly offered through lending platforms, connecting borrowers to lenders, without the need for a high street bank. Sophisticated computer algorithms make lending decisions in minutes instead of days, and the lean company structure of fintechs mean they can offer lower rates to borrowers as well as higher rates to lenders.

These platforms have grown in popularity in developed countries. However, emerging markets with low access to formal financial services are also expected to experience rising demand for business and consumer peer-to-peer loans.

Around 1.7bn people from all over the world still don`t have access to the bank account, according to the World Bank, with many living in developing countries such as India, Mexico, and Bangladesh. The lack of traditional banking products in these countries also brings enormous problems for businesses. India, for example, has nearly 50 million small and medium-sized companies that have no access to formal credit, according to a World Bank survey.

The growing number of fintech firms in emerging countries is expected to drive market competition, by forcing traditional banks to adapt their services and meet the needs of tech-savvy consumers.

Volume of Fintech Loans to hit 87 Million by 2023

In 2017, the global Fintech lending was worth $181.2bn, revealed the Statista Alternative Lending Market Outlook. This had jumped in market value by more than 30% to $267.1bn in 2019. The overall market is forecast to grow at a steady 7.7% over the next three years.

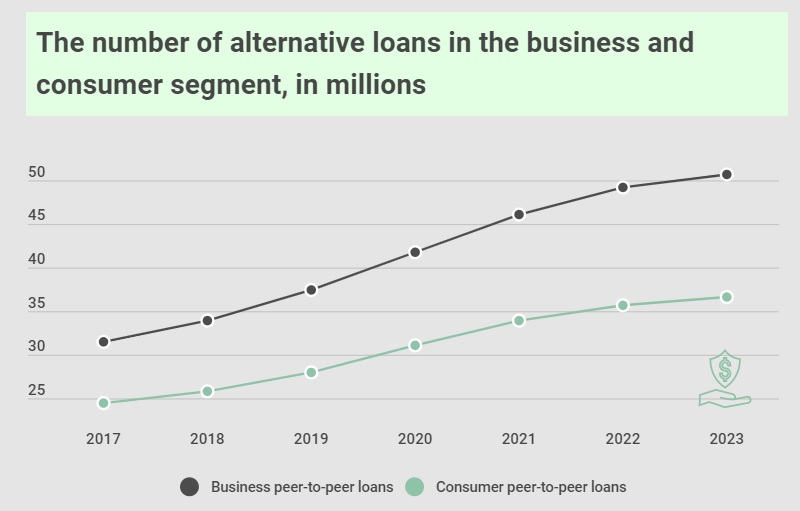

The volume of business and consumer peer-to-peer loans increased by 30% since 2017 and is expected to hit 72.8 million in 2020, growing by 11.2 % year-on-year. In the next three years, it is forecast to peak at 87 million globally.

Business peer-to-peer lending is the most significant part of the market, with a 70% market share expected to be worth $219.1bn in 2020. The number of loans to small and medium-sized companies is forecast to jump to $290.1bn by 2023.

Consumer peer-to-peer lending lags behind business loans, with $93.5bn a transaction value expected this year. By 2023, consumer peer-to-peer loans are set to edge up to $100.4bn worth, almost three times less than business lending.

China and the US make up 95% of the Fintech Lending Market

Regionally, China is the largest alternative lending market globally with a 90% market share and a $265.7bn transaction value expected in 2020. The country has been hugely affected by increased government regulation in recent years, which led to an enormous drop in the number of landing platforms and loans. However, the Statista survey shows the Chinese market will top $341.2bn over the next three years.

With a $33.5bn market value in 2020, the US is the second-largest alternative lending market in the world, home to large players such as Lending Club, Prosper and SoFi. Together, China and the US hold 95% of the overall market. However, the consumer lending model in China is different from the US model.

Chinese companies typically operate an online-to-offline model. This means investors are found online, but borrowers are served offline through partnerships with the non-bank financial institutions or their agents. In the US and across Europe, alternative lending is almost entirely based on an online model.

Far behind the two leading markets, the UK ranked as the third-largest alternative lending market, expected to peak at a value of $4.8bn this year. However, Switzerland, Denmark, and Spain are expected to see the highest growth rates over the coming years, rising by 27.4%, 23.7%, and 22.9% respectively year-on-year. Canada is forecast to show the lowest negative growth with a compound annual growth rate of -5.1% by 2023.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: