The European Fintech Alliance has fired another broadside in its tussle with the financial services establishment over PSD2, raising fears that banks will develop substandard APIs as a way to fend off competition.

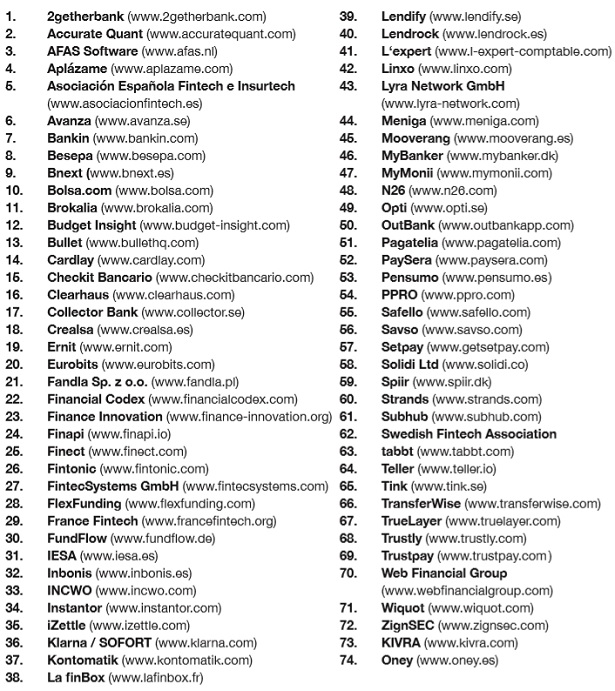

Future of European Fintech (FoEF), consisting of 74 European fintechs, challenger banks and fintech associations, notes that the final Regulatory Technical Standards on strong customer authentication and common and secure communication under PSD2 (the RTS) allow banks the possibility to be exempted by their National Competent Authority from having to accommodate licensed Third Party Payment Services Providers (TPP) to access accounts via the so called fallback option in case of malfunction of the dedicated interface (API).

This is indeed a novel approach – we are not aware of any other case when new competitors in an industry have been obliged to rely on a specific API controlled by the incumbents.

Europe has the opportunity to build the world’s most sophisticated API-enabled financial services sector. The European fintech industry shares and wants to contribute to this vision but the realisation of it is fully dependent on banks developing APIs that have the necessary functionalities, availability and performance. We sincerely hope that banks will take on the challenge and develop the best possible APIs, allowing themselves, as well as fintechs to build innovative products and services to the benefit of European consumers and businesses.

However we also recognise there is a real risk that banks for competition reasons rather than developing as good APIs as possible, will want to minimise the functionalities and information available in the API. As such, in order for the objectives of PSD2 to be realised, a heavy responsibility falls on the European Institutions to ensure that any API offered by banks has the adequate functionalities and performance, and works in practice.

The Future of European Fintech Alliance notes that the “API Evaluation Group”, an industry stakeholder group where inter alia the European Commission, the European Banking Authority and the European Central Bank have been given observer seats, has organised itself with the aim of providing market guidance to Competent Authorities ahead of the decision on whether banks’ APIs fulfill the requirements necessary for granting the banks an exemption from accommodating the fallback-option.

In order to provide concrete input on the market needs and expectations, the Future of European Fintech Alliance has identified what it believes to be the necessary key criteria that banks’ APIs must meet. All the Alliance’s members have been given the opportunity to suggest and comment on these criteria.

As such, the Future of European Fintech Alliance calls on the European Institutions, Competent Authorities, banks and all participants of the API Evaluation Group to ensure that APIs developed and offered by banks meet the criteria outlined in Annex A to this document. The Future of European Fintech Alliance also endorses the TPP members of the API Evaluation Group; Bankin, Klarna, PPRO and Trustly, as representatives of our interests in the European fintech and TPP sector.

The alliance has set out what it calls the key API requirements in four areas: authentication, information, performance, and consent management. You can read the detail here.

Future of European Fintech brings together European fintech companies and associations that are seeking fair regulation of their services under the Payment Services Directive 2 (PSD2).

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: